How to Trade on XM in 2026: Beginner Step-by-Step Guide, Platforms, Order Types & Risk Management

By the end, you’ll have a solid understanding of how to trade on XM efficiently and confidently in today’s evolving market environment.

XM Trading Process Overview

XM is a globally established forex and CFD broker offering trading services to clients in more than 190 countries. Founded in 2009, XM is widely recognized for its easy-to-use trading platforms, competitive trading conditions, and a wide selection of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

Here’s a quick overview of the XM trading process.

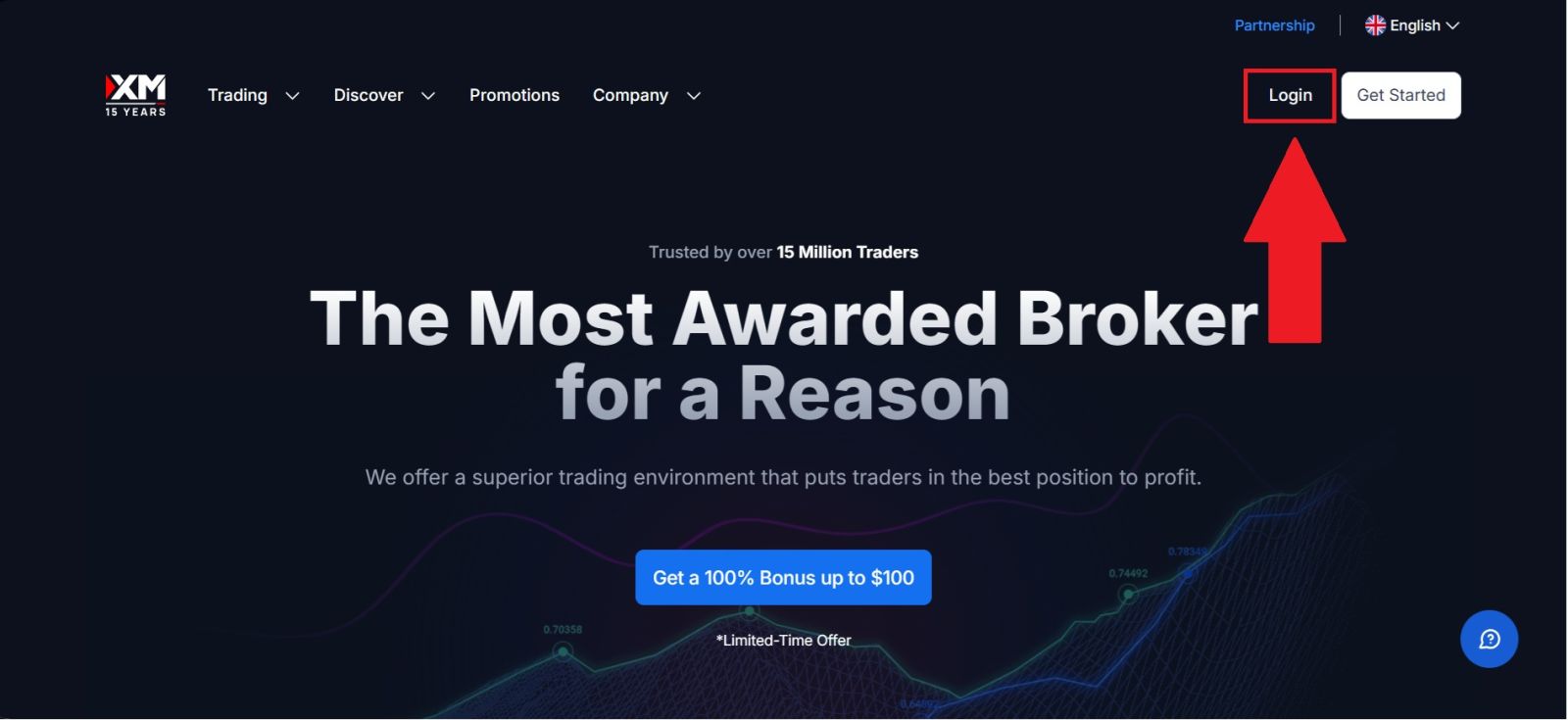

#1 Go To the Official XM Forex Website

Visit the official XM website and double-check that you are on the correct page for safety. With its clear and intuitive interface, XM makes it easy to get started. Simply click [Login] on the homepage to open the login form.

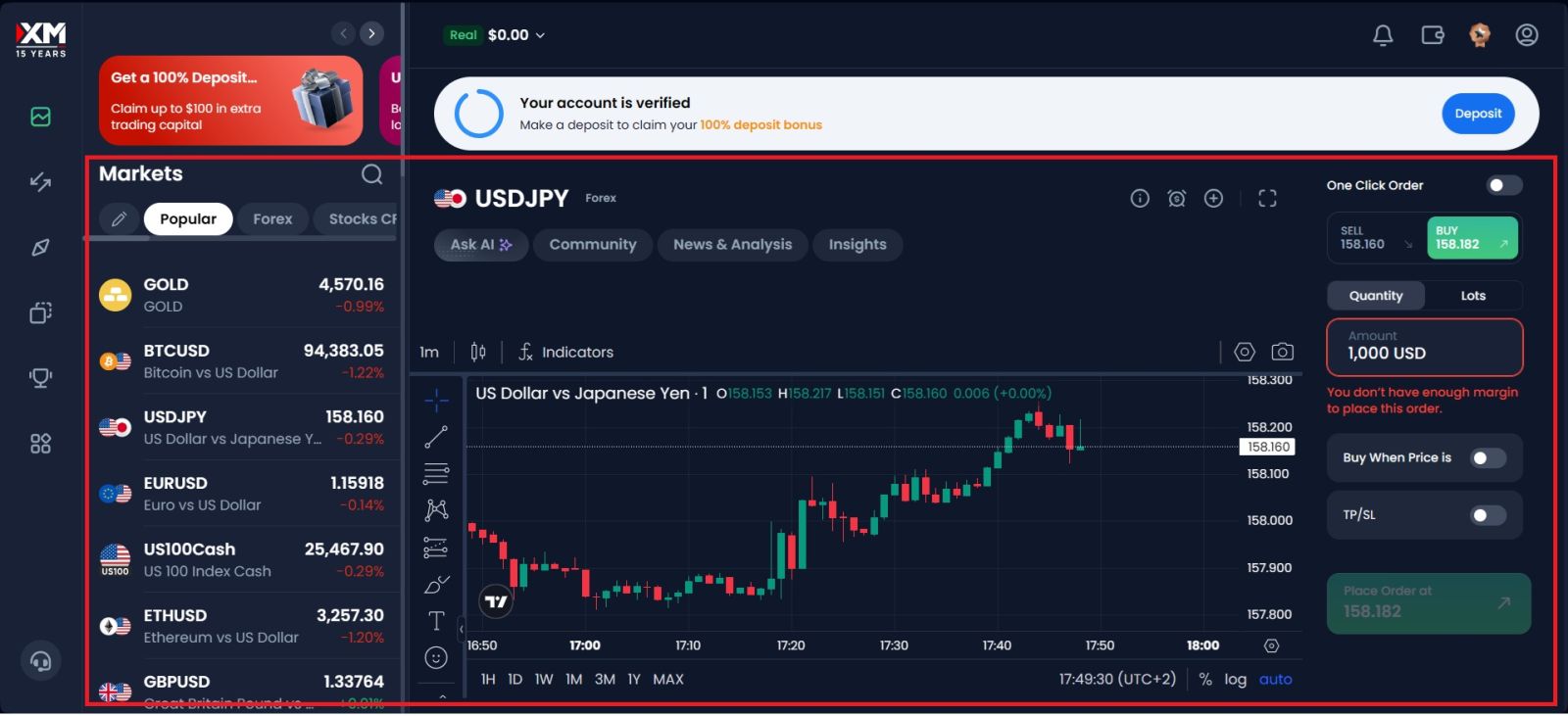

#2 Navigate to the Trading Section

After successfully logging in to your XM account, you will be taken directly to the main dashboard, where the trading interface is displayed on the homepage.

From this screen, you can easily access key trading features, view market prices in real time, monitor your open positions, manage orders, and navigate between different trading instruments, allowing you to start trading quickly and efficiently.

Congratulations! You are now all settled for trading as you have:

- An account with a reliable broker (the one that you use your email address to log in to);

- A trading account with deposited money (an account number and a password that you will use to log in to trade);

- A trading platform to open and close positions configured for your trading account.

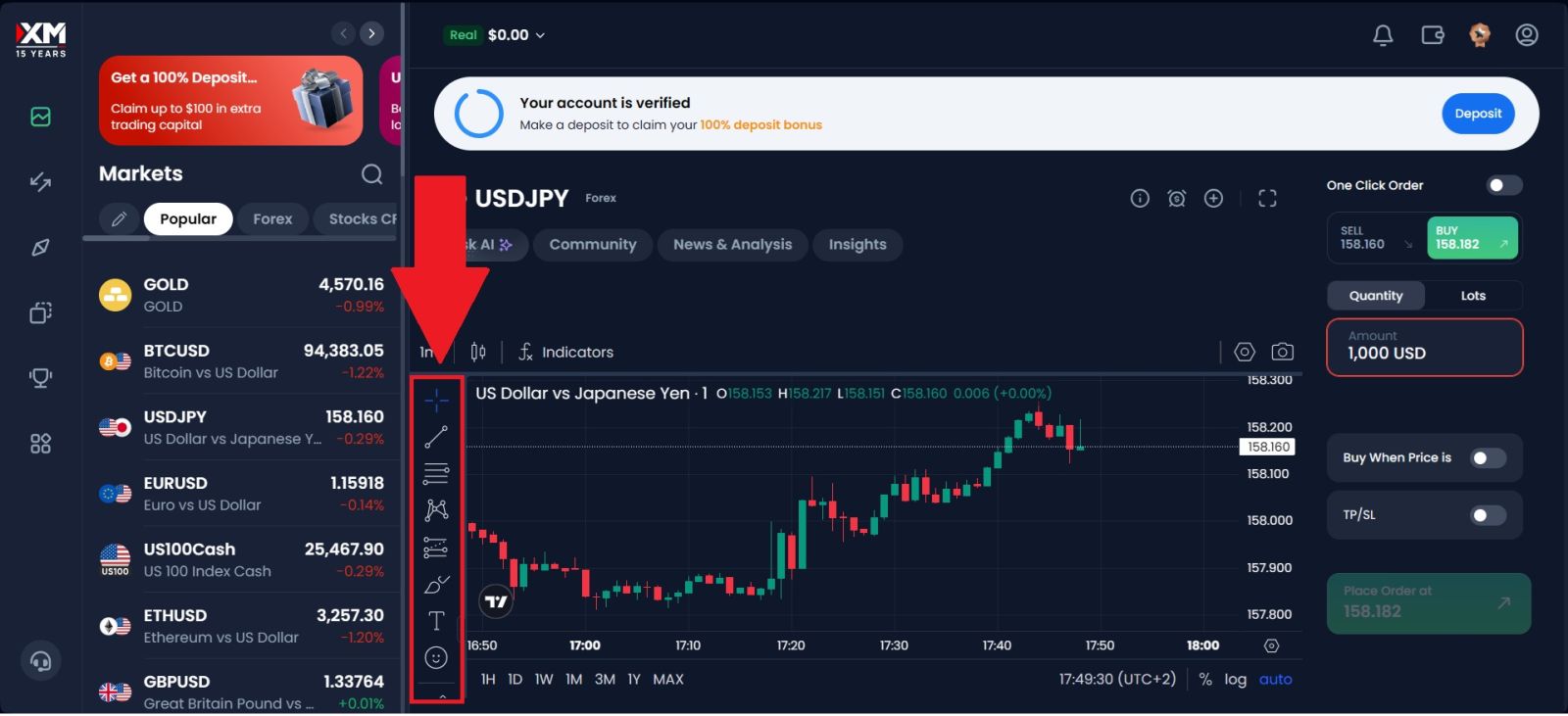

#3 Explore the XM Trading Interface

Before placing your first trade, it is important to become familiar with the XM trading interface, especially for beginners. XM provides a clean, intuitive, and well-structured platform that allows traders to navigate tools and features with confidence from the very start.

This part of the XM trading guide introduces key elements such as price charts, available trading instruments, order types, and trade execution controls in a clear and easy-to-understand way. Understanding these components helps reduce trading errors, improve execution accuracy, and support better trading decisions.

By gaining a solid understanding of the XM platform layout and functionality, your overall trading experience will be smoother, more efficient, and more professional.

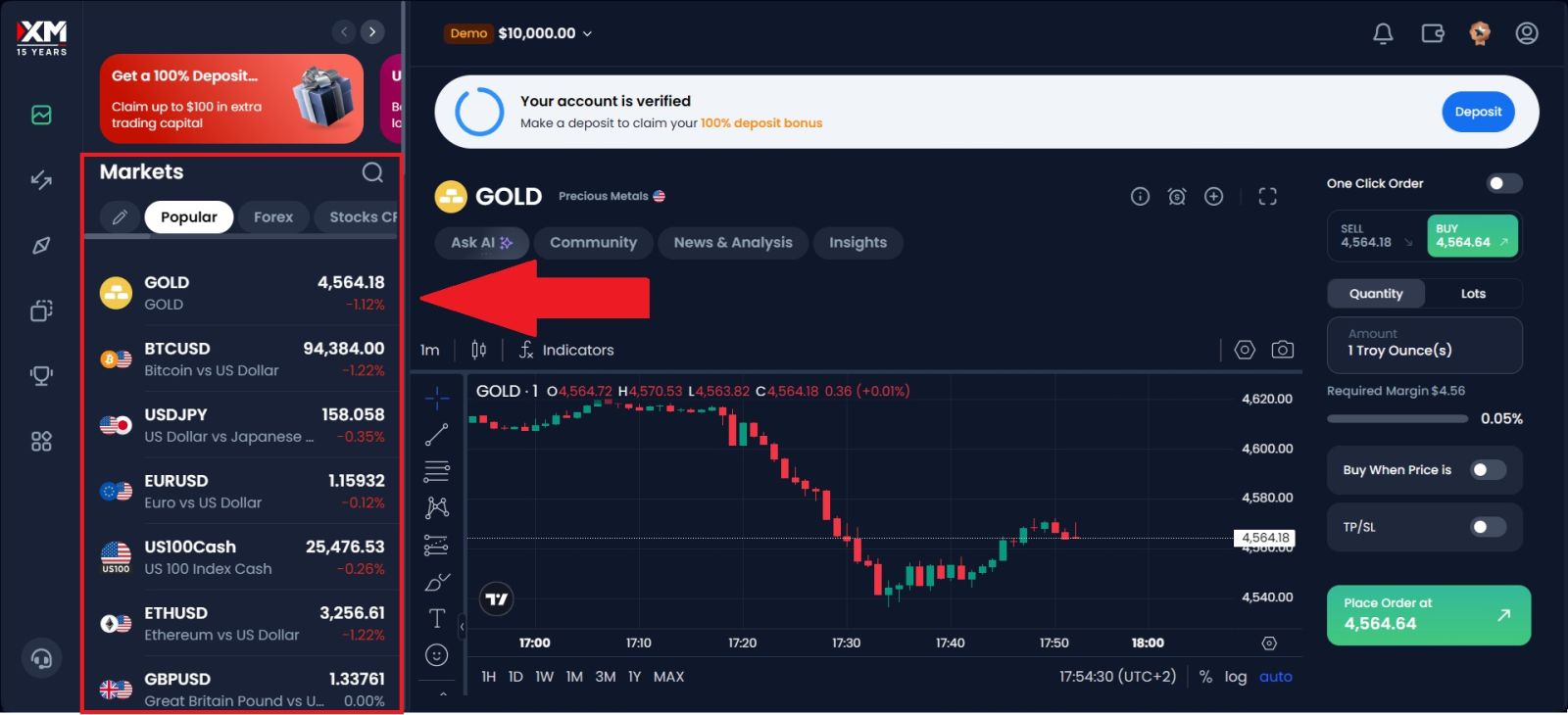

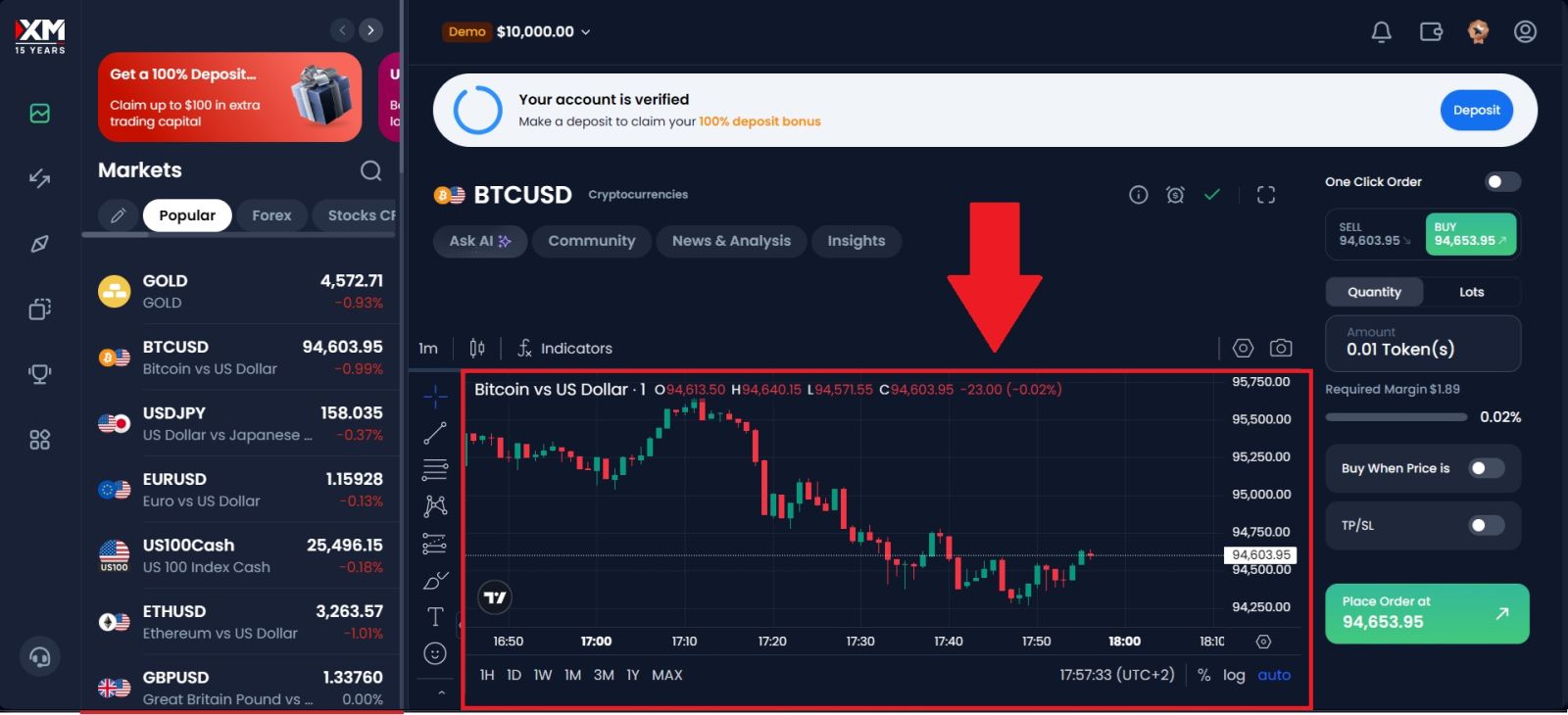

Here’s what the interface looks like:

1. Menu Panel: Use the toolbar to create an order, change time frames and access indicators.

2. Market Watch: which lists different currency pairs with their bid and ask prices.

2. Market Watch: which lists different currency pairs with their bid and ask prices.

3. The chart window: indicates the current state of the market and the ask and bid lines. To open an order, you need to press the New Order button in the toolbar or press the Market Watch pair and select New Order.

3. The chart window: indicates the current state of the market and the ask and bid lines. To open an order, you need to press the New Order button in the toolbar or press the Market Watch pair and select New Order.

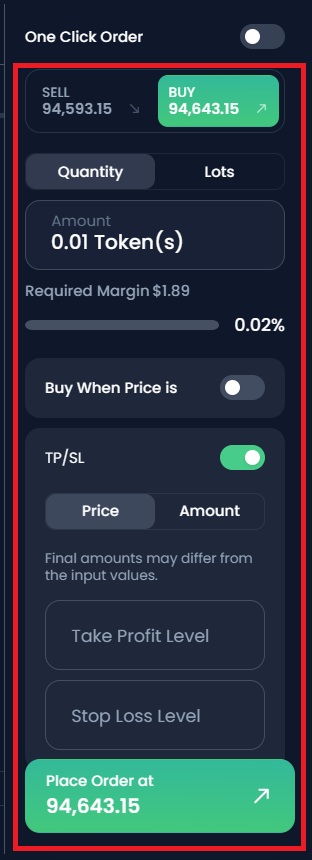

#4 Open Your First Trade

First, create a new order and select which one you would like to trade. Next, set your preferred Stop Loss and Take Profit levels to manage risk and potential profit.Notes on risk management:

-

We strongly recommend using risk management settings for every trade you open. These options will let you open a position, decide how much you want to make and how much you are willing to lose on this position, and forget about it. The trade will be closed automatically for you whenever the asset price reaches any of your specified values.

-

For both Stop Loss and Take Profit, the values should not be too close to the current price, or an error will be displayed.

-

When the value is 0.000, the order is not placed.

Click Place Order at... or Cancel, depending on your understanding of the market conditions.

Conclusion: Start Your Trading on XM with Confidence

XM provides a complete and beginner-friendly trading environment, making it easy to move from account setup to placing your first trade. By understanding the platform features, choosing the right account type, and applying sound risk management strategies, traders can navigate the markets more effectively.

With reliable execution, advanced tools, and strong account security, XM supports both new and experienced traders in building a disciplined trading approach. Once properly prepared, you can trade on XM with confidence and work toward your long-term trading goals and beyond.