How to Register and start Trading with a Demo Account on XM

This guide will walk you through the steps to register and begin trading with a demo account on XM, setting the stage for a successful trading journey.

How to Open an Account on XM

How to Open a Demo Account

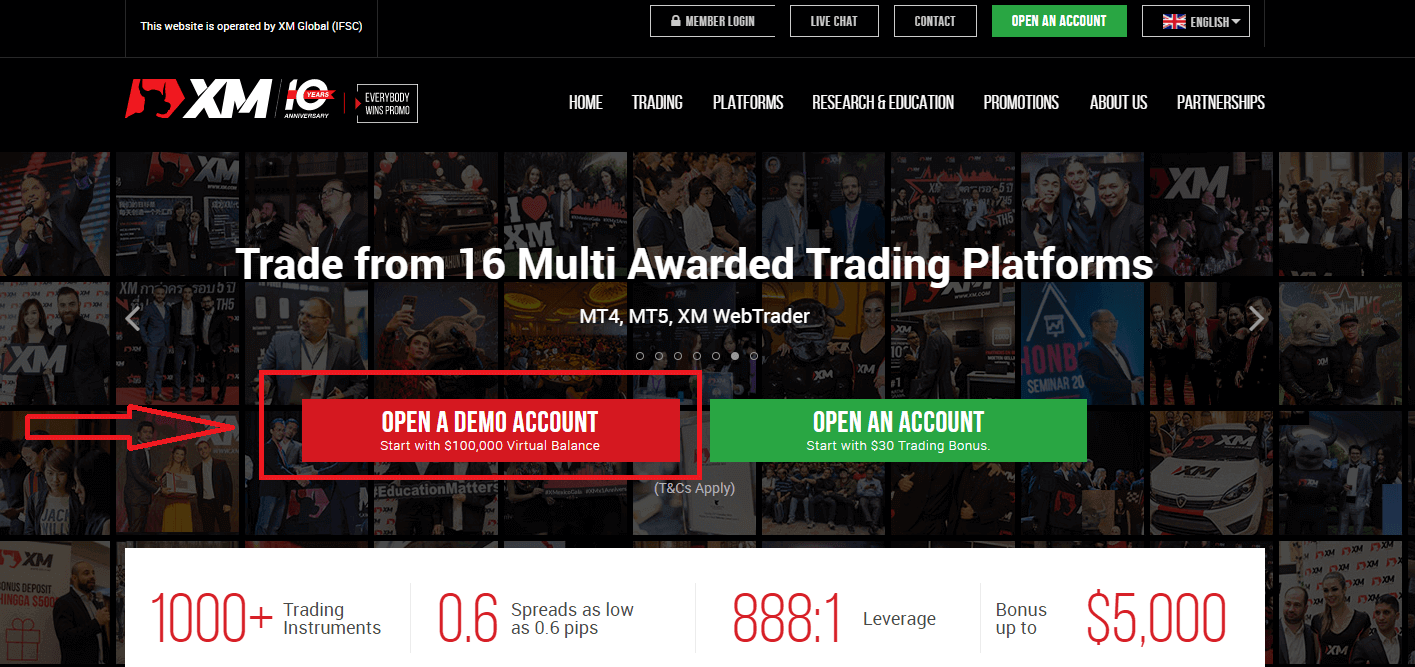

You must first access the XM broker portal, where you can find the button to create a demo account.

As you can see in the central part of the page there is the red button to create a free demo account.

Immediately next to it in green, you can see the button to create a real account.

For this guide, we proceed to create a demo account with the Metatrader4 platform, the main trading terminal of this broker.

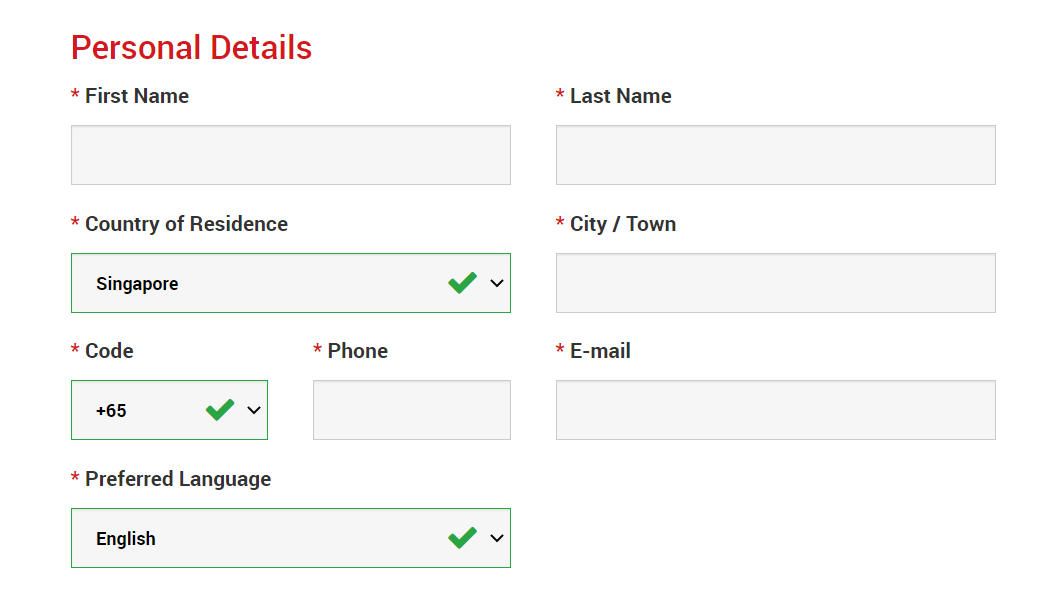

By clicking on the red button, you will be redirected to the demo account registration. There you will have to complete the form with the required information as below.

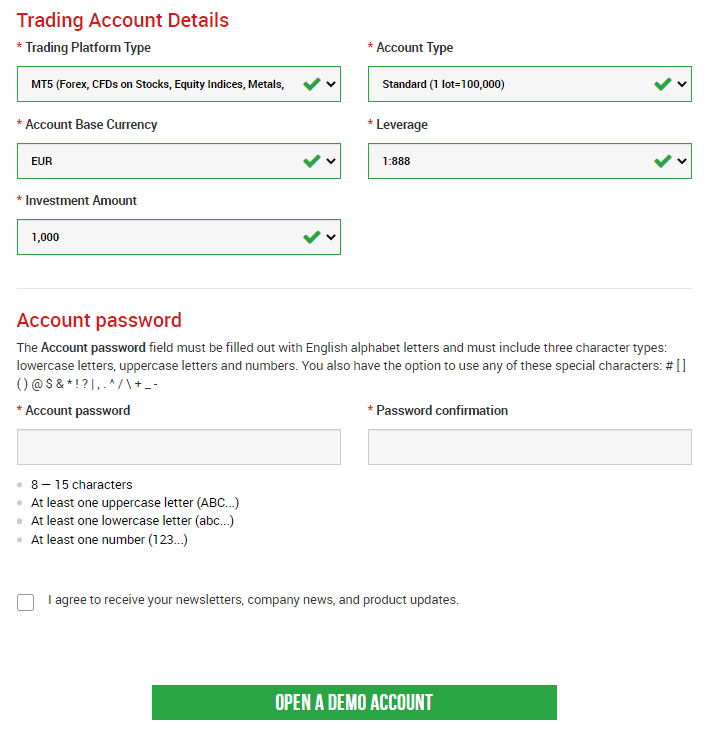

In addition, information on the trading account like the account type and maximum leverage are requested to create an account that suits the needs of the trader. Such data are:

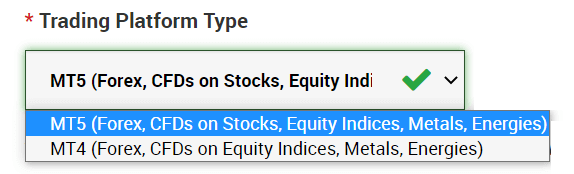

-Trading Patforms Type: The trading platforms Metatrader 4 and Metatrader 5 will be available here.

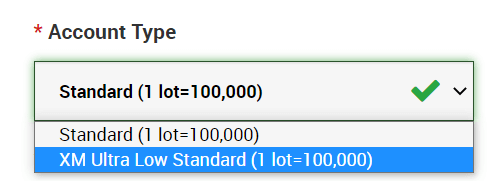

- Account Type: Here we can indicate if we want to open a standard account or an XM Ultra Low account.

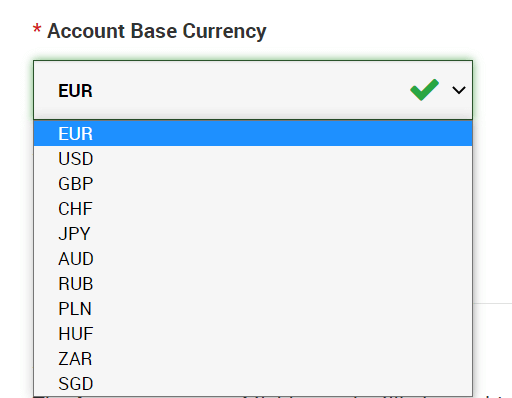

- Account Base currency: It is the base currency that will be used in transactions in the trading account.

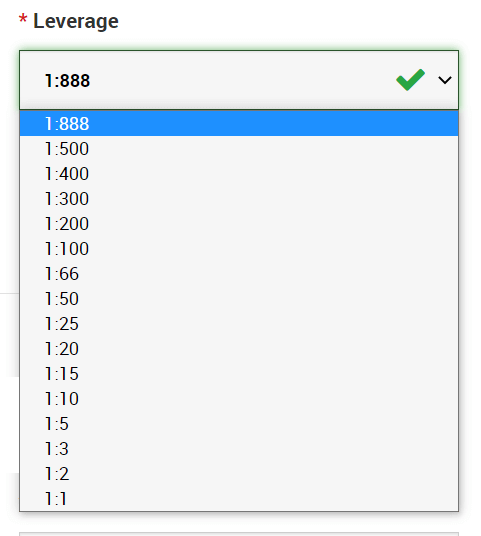

-Leverage: The leverage available in XM ranges from 1: 1 to 1: 888.

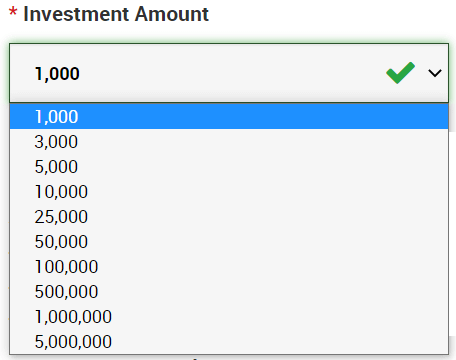

- Investment amount: This is the amount of virtual money available to practice in the demo account.

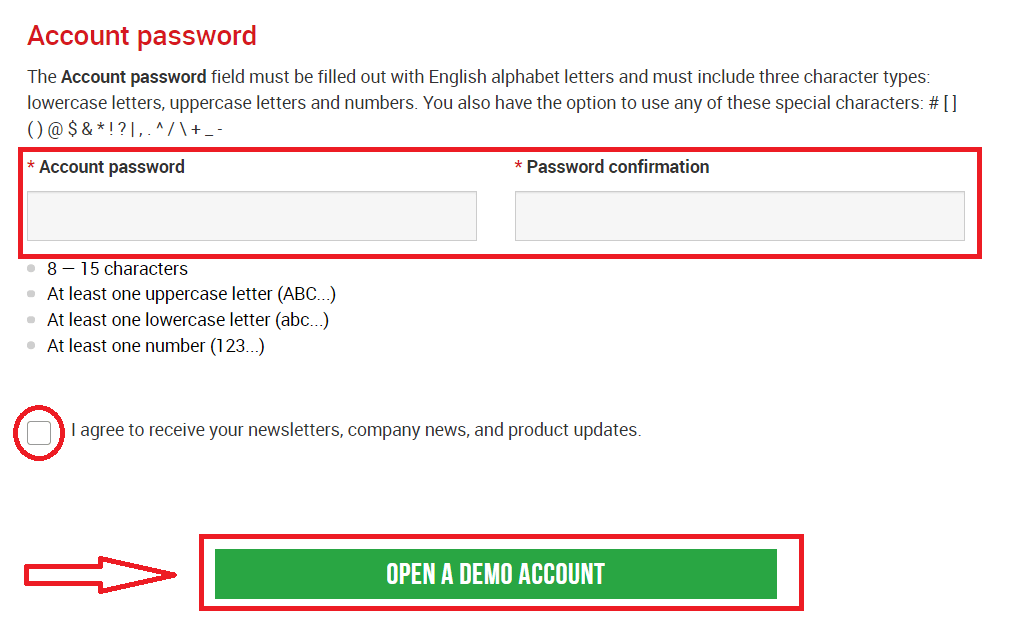

- Account Password:

The Account password field must be filled out with English alphabet letters and must include three character types: lowercase letters, uppercase letters and numbers. You also have the option to use any of these special characters: # [ ] ( ) @ $ * ! ? | , . ^ / \ + _ -

- 8 — 15 characters

- At least one uppercase letter (ABC...)

- At least one lowercase letter (abc...)

- At least one number (123...)

After completing the requested data, Check the checkbox and press the green button to open a free demo account with practice funds.

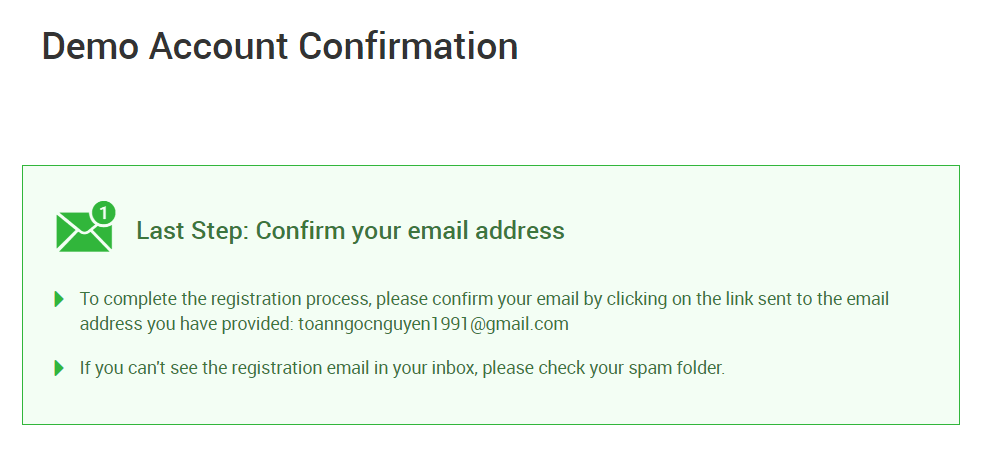

You will immediately go to the page where you are notified of the sending of a confirmation email.

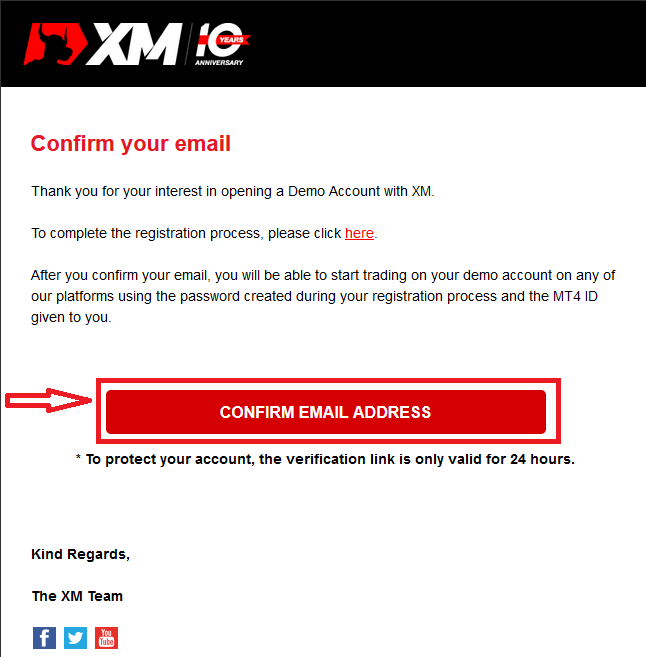

In your mailbox, you will receive an email like the one you can see in the following image. Here, you will have to activate the account by pressing where it says “Confirm email address“. With this, the demo account is finally activated.

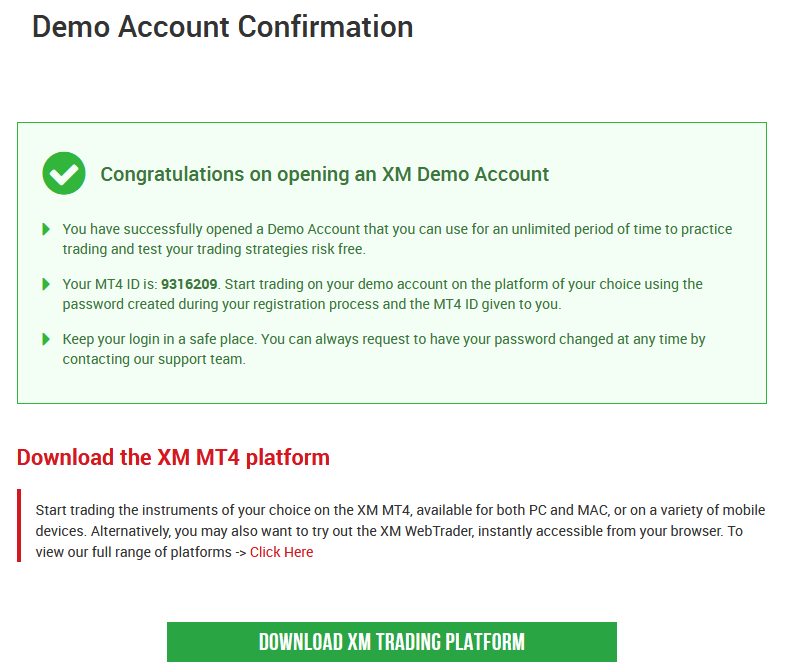

Upon confirmation of the email and account, a new browser tab will open with welcome information. The identification or user number that you can use on the MT4 or Webtrader platform is also provided.

Finally, the trader must press the green button where you can download or run the Metatrader 4 or MT4 Webtrader platform.

It should be remembered that for the version of Metatrader MT5 or Webtrader MT5, the account opening and verification process is exactly the same.

Who Should Choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, CFDs on stock indices, as well as CFDs on gold and oil, but it does not offer trading on stock CFDs. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.Access to the MT4 platform is available for Micro, Standard, or XM Ultra Low as per the table above.

Who Should Choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices CFDs, gold and oil CFDs, as well as stock CFDs.Your login details to the MT5 will also give you access to the XM WebTrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for Micro, Standard, or XM Ultra Low as shown in the table above.

What is the Main Difference Between MT4 Trading Accounts and MT5 Trading Accounts?

The main difference is that MT4 does not offer trading on stock CFDs.

What trading account types do you offer?

- MICRO: 1 micro lot is 1,000 units of the base currency

- STANDARD: 1 standard lot is 100,000 units of the base currency

- Ultra Low Micro: 1 micro lot is 1,000 units of the base currency

- Ultra Low Standard: 1 standard lot is 100,000 units of the base currency

- Swap Free Micro: 1 micro lot is 1,000 units of the base currency

- Swap Free Standard: 1 standard lot is 100,000 units of the base currency

What are the XM Swap Free trading accounts?

With the XM Swap Free accounts clients can trade without swaps or rollover charges for holding positions open overnight. XM Swap Free Micro and XM Swap Free Standard accounts provide swap-free trading, with spreads as low as 1 pip, in forex, gold, and silver, as well as in future CFDs on commodities, precious metals, energies, and indices.

How long can I use a demo account?

At XM demo accounts do not have an expiry date, and so you can use them as long as you want. Demo accounts that have been inactive for longer than 90 days from the last login will be closed. However, you can open a new demo account at any time. Please note that a maximum of 5 active demo accounts are allowed.

How to Trade Forex on XM

What is Forex Trading?

Forex trading, also known by the name of currency trading or FX trading, refers to buying a particular currency while selling another in exchange. Trading currencies always involves exchanging one currency for another.The ultimate aim can vary and can be any of the below but not limited to the below:

2. Exchanging currency A (e.g. USD) to currency B (e.g. EUR) for trading purposes;

3. Exchanging currency A (e.g. USD) to currency B (e.g. EUR) for speculative purposes, to make a profit.

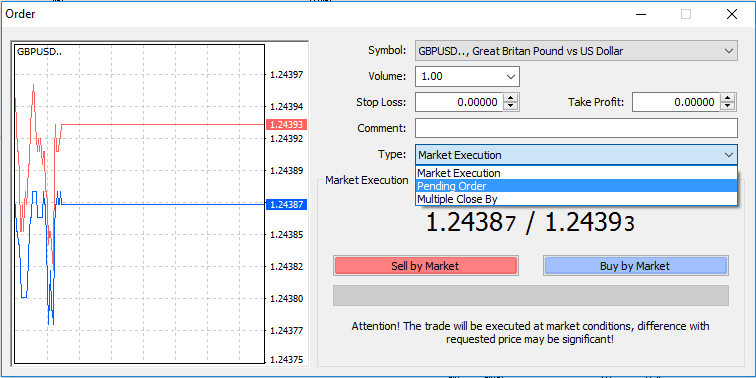

How to place a New Order in XM MT4

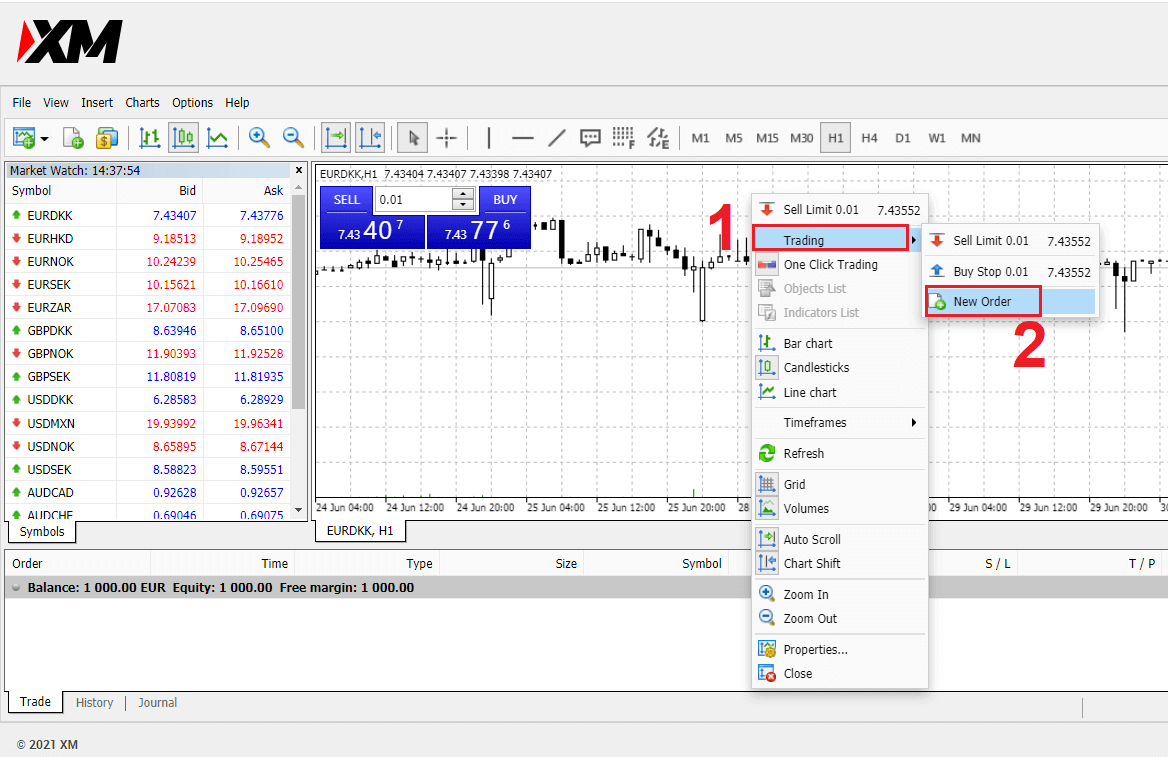

Right-click the chart, Then click “Trading" → select “New Order".Or

Double-click on the currency you want to place an order on MT4. The Order window will appear.

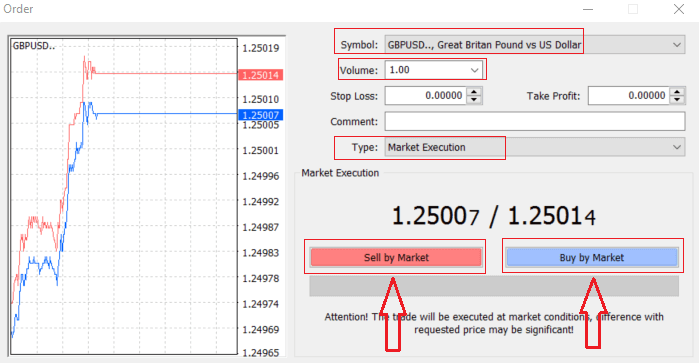

Symbol: check the Currency symbol you wish to trade is displayed in the symbol box

Volume: you must decide the size of your contract, you can click on the arrow and choose the volume from the listed options of the drop-down box or left-click in the volume box and type in the required value

- Micro Account: 1 Lot = 1,000 units

- Standard Account: 1 Lot = 100,000 units

- XM Ultra Account :

- Standard Ultra: 1 Lot = 100,000 units

- Micro Ultra: 1 Lot = 1,000 units

- Shares Account :1 share

- Micro Account: 0.1 Lots (MT4), 0.1 Lots (MT5)

- Standard Account: 0.01 Lots

- XM Ultra Account :

- Standard Ultra: 0.01 Lots

- Micro Ultra: 0.1 Lots

- Shares Account :1 Lot

Comment: this section is not obligatory but you can use it to identify your trades by adding comments

Type: which is set to market execution by default,

- Market Execution is the model of executing orders at the current market price

- A Pending Order is used to set a future price that you intend to open your trade.

Finally, you need to decide what order type to open, you can choose between a sell and a buy order.

Sell by Market is opened at the bid price and closed at the asking price, in this order type your trade may bring profit if the price goes down.

Buy by Market is opened at the ask price and closed at the bid price, in this order type your trade may bring profit It the price goes up.

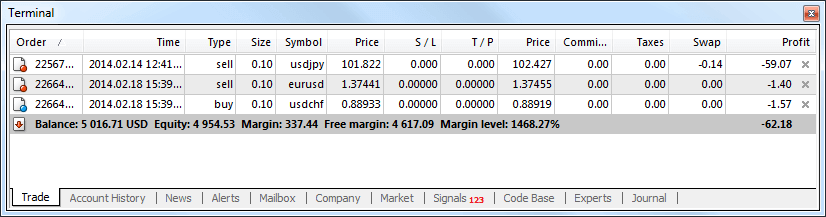

Once you click on either Buy or Sell, your order will be instantly processed, and you can check your order in the Trade Terminal.

How to place a Pending Orders

How Many Pending Orders in XM MT4

Unlike instant execution orders, where a trade is placed at the current market price, pending orders allow you to set orders that are opened once the price reaches a relevant level, chosen by you. There are four types of pending orders available, but we can group them into just two main types:- Orders expecting to break a certain market level

- Orders are expected to bounce back from a certain market level

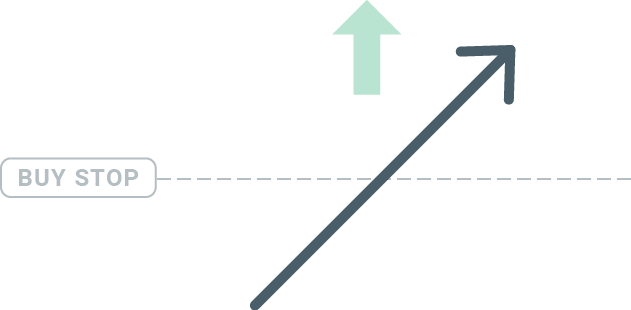

Buy Stop

The Buy Stop order allows you to set a buy order above the current market price. This means that if the current market price is $20 and your Buy Stop is $22, a buy or long position will be opened once the market reaches that price.

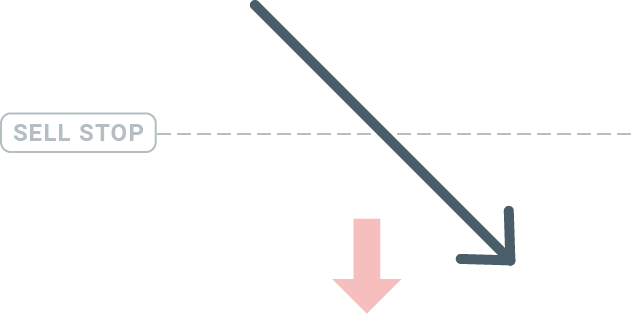

Sell Stop

The Sell Stop order allows you to set a sell order below the current market price. So if the current market price is $20 and your Sell Stop price is $18, a sell or ‘short’ position will be opened once the market reaches that price.

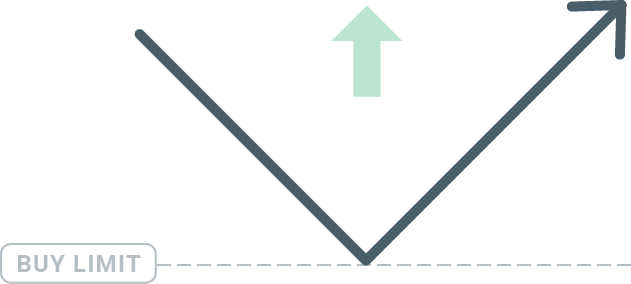

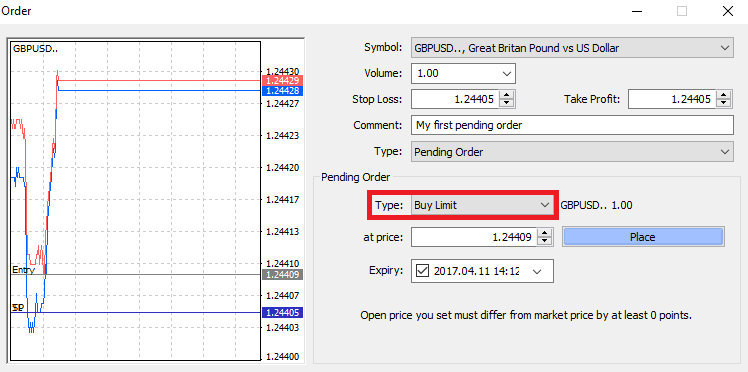

Buy Limit

The opposite of a buy stop, the Buy Limit order allows you to set a buy order below the current market price. This means that if the current market price is $20 and your Buy Limit price is $18, then once the market reaches the price level of $18, a buy position will be opened.

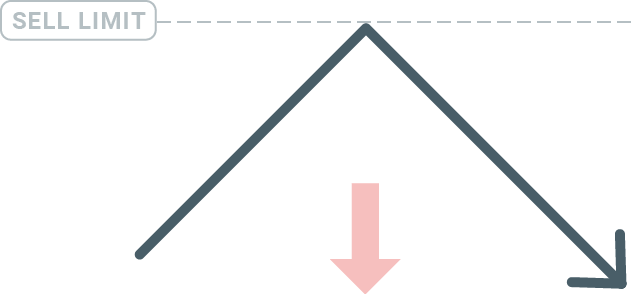

Sell Limit

Finally, the Sell Limit order allows you to set a sell order above the current market price. So if the current market price is $20 and the set Sell Limit price is $22, then once the market reaches the price level of $22, a sell position will be opened on this market.

Opening Pending Orders

You can open a new pending order simply by double-clicking on the name of the market on the Market Watch module. Once you do so, the new order window will open and you will be able to change the order type to Pending order.

Next, select the market level at which the pending order will be activated. You should also choose the size of the position based on the volume.

If necessary, you can set an expiration date (‘Expiry’). Once all these parameters are set, select a desirable order type depending on whether you would like to go long shortstop, or limit, and select the ‘Place’ button.

As you can see, pending orders are very powerful features of MT4. They are most useful when you’re not able to constantly watch the market for your entry point, or if the price of an instrument changes quickly, and you don’t want to miss the opportunity.

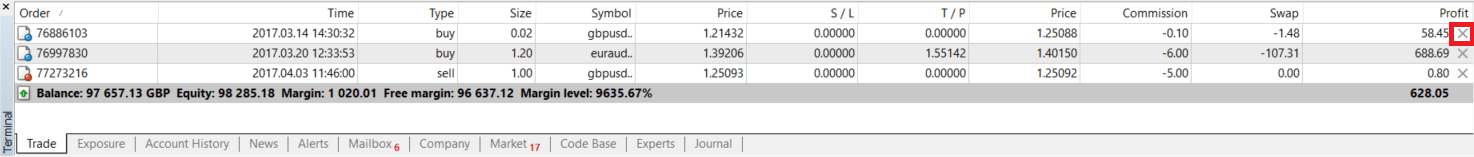

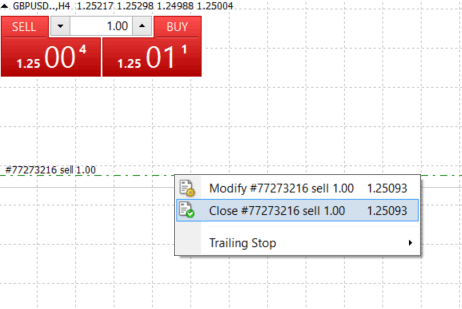

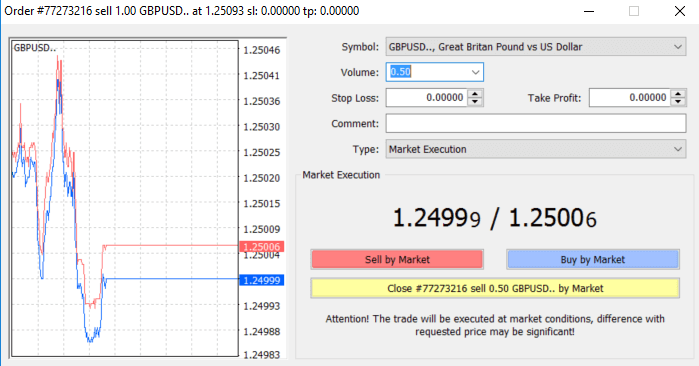

How to close Orders in XM MT4

To close an open position, click the ‘x’ in the Trade tab in the Terminal window.

Or right-click the line order on the chart and select ‘close’.

If you’d like to close only a part of the position, click right-click on the open order and select ‘Modify’. Then, in the Type field, select instant execution and choose what part of the position you want to close.

As you can see, opening and closing your trades on MT4 is very intuitive, and it literally takes just one click.

Using Stop Loss, Take Profit, and Trailing Stop in XM MT4

One of the keys to achieving success in financial markets over the long term is prudent risk management. That’s why stopping losses and taking profits should be an integral part of your trading.So let’s have a look at how to use them on our MT4 platform to ensure you know how to limit your risk and maximize your trading potential.

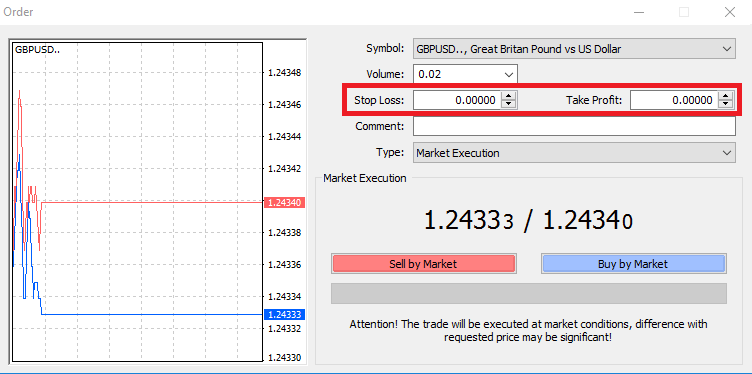

Setting Stop Loss and Take Profit

The first and the easiest way to add Stop Loss or Take Profit to your trade is by doing it right away when placing new orders.

To do this, simply enter your particular price level in the Stop Loss or Take Profit fields. Remember that Stop Loss will be executed automatically when the market moves against your position (hence the name: stop losses), and Take Profit levels will be executed automatically when the price reaches your specified profit target. This means that you’re able to set your Stop Loss level below the current market price and Take Profit level above the current market price.

It’s important to remember that a Stop Loss (SL) or a Take Profit (TP) is always connected to an open position or a pending order. You can adjust both once your trade has been opened and you’re monitoring the market. It’s a protective order to your market position, but of course, they are not necessary to open a new position. You always can add them later, but we highly recommend always protecting your positions*.

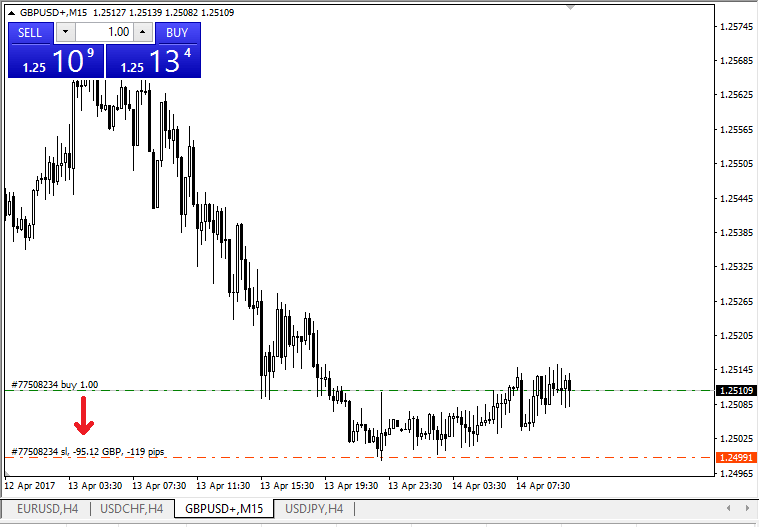

Adding Stop Loss and Take Profit Levels

The easiest way to add SL/TP levels to your already opened position is by a using trade line on the chart. To do so, simply drag and drop the trade line up or down to a specific level.

Once you’ve entered SL/TP levels, the SL/TP lines will appear on the chart. This way you can also modify SL/TP levels simply and quickly.

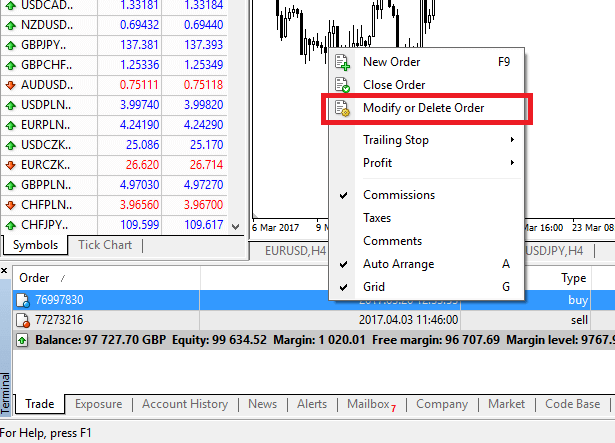

You can also do this from the bottom ‘Terminal’ module as well. To add or modify SL/TP levels, simply right-click on your open position or pending order, and choose ‘Modify or delete order’.

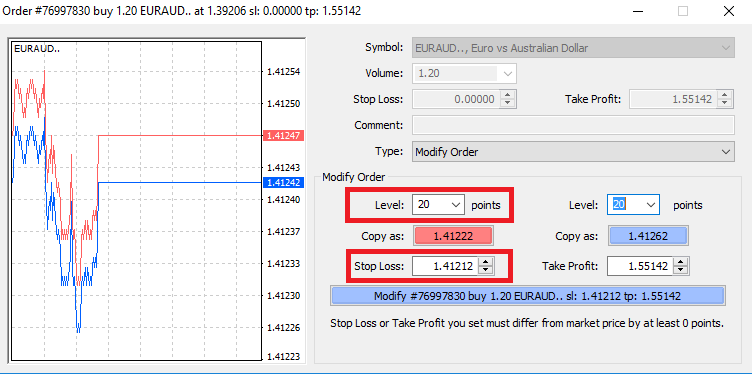

The order modification window will appear and now you’re able to enter/modify SL/TP by the exact market level, or by defining the points range from the current market price.

Trailing Stop

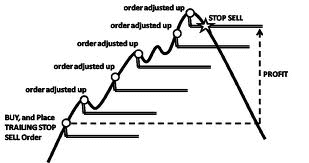

Stop Losses are intended for reducing losses when the market moves against your position, but they can help you lock in your profits as well.While that may sound a bit counterintuitive at first, it’s actually very easy to understand and master.

Let’s say you’ve opened a long position and the market moves in the right direction, making your trade a profitable one at present. Your original Stop Loss, which was placed at a level below your open price, can now be moved to your open price (so you can break even) or above the open price (so you are guaranteed a profit).

To make this process automatic, you can use a Trailing Stop. This can be a really useful tool for your risk management, particularly when price changes are rapid or when you’re unable to constantly monitor the market.

As soon as the position turns profitable, your Trailing Stop will follow the price automatically, maintaining the previously established distance.

Following the example above, please bear in mind, however, that your trade needs to be running a profit large enough for the Trailing Stop to move above your open price before your profit can be guaranteed.

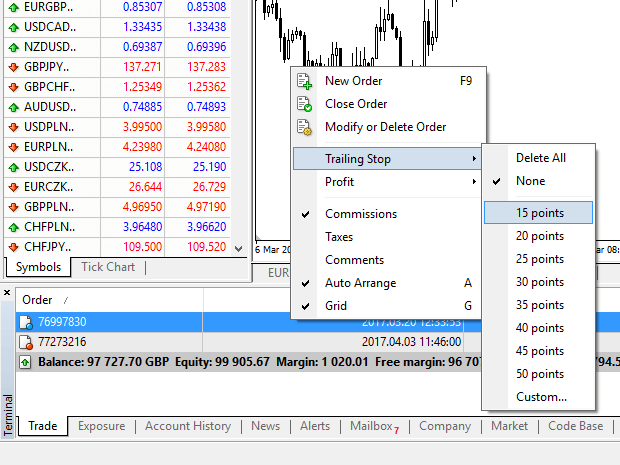

Trailing Stops (TS) are attached to your opened positions, but it’s important to remember that if you have a trailing stop on MT4, you need to have the platform open for it to be successfully executed.

To set a Trailing Stop, right-click the open position in the ‘Terminal’ window and specify your desired pip value of the distance between the TP level and the current price in the Trailing Stop menu.

Your Trailing Stop is now active. This means that if prices change to the profitable market side, TS will ensure the stop loss level follows the price automatically.

Your Trailing Stop can easily be disabled by setting ‘None’ in the Trailing Stop menu. If you want to quickly deactivate it in all opened positions, just select ‘Delete All’.

As you can see, MT4 provides you with plenty of ways to protect your positions in just a few moments.

*Whilst Stop Loss orders are one of the best ways to ensure your risk is managed and potential losses are kept to acceptable levels, they don’t provide 100% security.

Stop losses are free to use and they protect your account against adverse market moves, but please be aware that they cannot guarantee your position every time. If the market becomes suddenly volatile and gaps beyond your stop level (jumps from one price to the next without trading at the levels in between), it’s possible your position could be closed at a worse level than requested. This is known as price slippage.

Guaranteed stop losses, which have no risk of slippage and ensure the position is closed out at the Stop Loss level you requested even if a market moves against you, are available for free with a basic account.

Frequently Asked Questions

How Does Forex Trading Work?

Forex trading is in essence trading currencies for one another. As such, an XM client sells one currency against another at a current market rate.To be able to trade, it is required to open an account and hold currency A and then exchange currency A for currency B either for a long-term or a short-term trade, with the ultimate goal varying accordingly.

Since FX trading is performed on currency pairs (i.e., the quotation of the relative value of one currency unit against another currency unit), the first currency is the so-called base currency, while the second currency is called the quote currency.

For example, the quotation EUR/USD 1.2345 is the price of the euro expressed in US dollars, which means that 1 euro equals 1.2345 US dollars.

Currency trading can be carried out 24 hours a day, from 22.00 GMT on Sunday until 22.00 GMT on Friday, with currencies traded among the major financial centers of London, New York, Tokyo, Zürich, Frankfurt, Paris, Sydney, Singapore and Hong Kong.

What Influences Prices in Forex Trading?

There is an endless number of factors that all contribute to and influence the prices in forex trading (i.e. currency rates) daily, but it could be safe to say that there are 6 major factors that contribute the most and are more or less the main driving forces for forex trading price fluctuation:

2. Differentials in interest rates

3. Current account deficits

4. Public debt

5. Terms of trade

6. Political and economic stability

To best comprehend the above 6 factors, you will have to keep in mind that currencies are traded against one another. So when one falls, another one rises as the price denomination of any currency is always stated against another currency.

What is Forex Trading Software?

Forex trading software is an online trading platform provided to each XM client, which allows them to view, analyze, and trade currencies, or other asset classesIn simple terms, each XM client is provided access to a trading platform (i.e. software) that is directly connected to the global market price feed and allows them to perform transactions without the help of a third party.

Who are Forex Trading Market Participants?

Forex trading market participants can fall in any of the following categories:

1. Travellers or overseas consumers who exchange money to travel overseas or purchase goods from overseas.

2. Businesses that purchase raw materials or goods from overseas and need to exchange their local currency for the currency of the country of the seller.

3. Investors or speculators who exchange currencies, which either require a foreign currency, to perform trading in equities or other asset classes from overseas or are trading currencies to make a profit from market changes.

4. Banking institutions that exchange money to service their clients or to lend money to overseas clients.

5. Governments or central banks that either buy or sell currencies and try to adjust financial imbalances, or adjust economic conditions.

What is Important in Forex Trading?

As a retail foreign exchange trader, the most important factors that affect your trading are trade execution quality, speed,d, and spreads. One affects the other.A spread is the difference between the bid and the ask price of a currency pair (buy or sell price), and so to make it even easier it is the price at which your broker or bank is willing to sell or buy your requested trade order. Spreads, however, only matter with the correct execution.

In the forex trading marketplace, when we refer to execution we mean the speed at which a foreign exchange trader can actually buy or sell what they see on their screen or what they are quoted as bid/ask price over the phone. A good price makes no sense if your bank or broker cannot fill your order fast enough to get that bid/ask price.

What are Majors in Forex Trading?

In forex trading, some currency pairs are nicknamed majors (major pairs). This category includes the most traded currency pairs and they always include the USD on one side.Major pairs include: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, NZD/USD

What are Minors in Forex Trading?

In forex trading, minor currency pairs or crosses are all currency pairs that do not include the USD on one side.

What are Exotics in Forex Trading?

In forex trading, exotic pairs include the less traded currency pairs that include a major currency paired with the currency of a smaller or emerging economy. These pairs usually have less volatility, and less liquidity and do not present the dynamic behavior of major pairs and crosses.

Advantages of Forex Trading with XM

- 55+ currency pairs - majors, crosses, and exotics

- 24 hours a day, 5 days a week

- Leverage up to 888:1

- Tight spreads and NO re-quotes

- Trade the most liquid market in the world

- Trade with NO hidden charges

Conclusion: Unlock Your Trading Potential with an XM Demo Account

Opening a demo account with XM is a straightforward process that sets you on the path to becoming a confident trader. By practicing with virtual funds, you gain invaluable experience and knowledge of the trading platform and market dynamics.

Take advantage of XM’s demo account today and start your journey towards successful trading.