How to Start XM Trading 2025 : A Step-By-Step Guide for Beginners

Whether you're interested in Forex, stocks, commodities, or cryptocurrencies, XM provides an accessible environment for all types of trading. This step-by-step guide will walk you through how to start trading on XM, from creating an account to executing your first trade.

How to Sign up an Account on XM

How to Sign up an Account

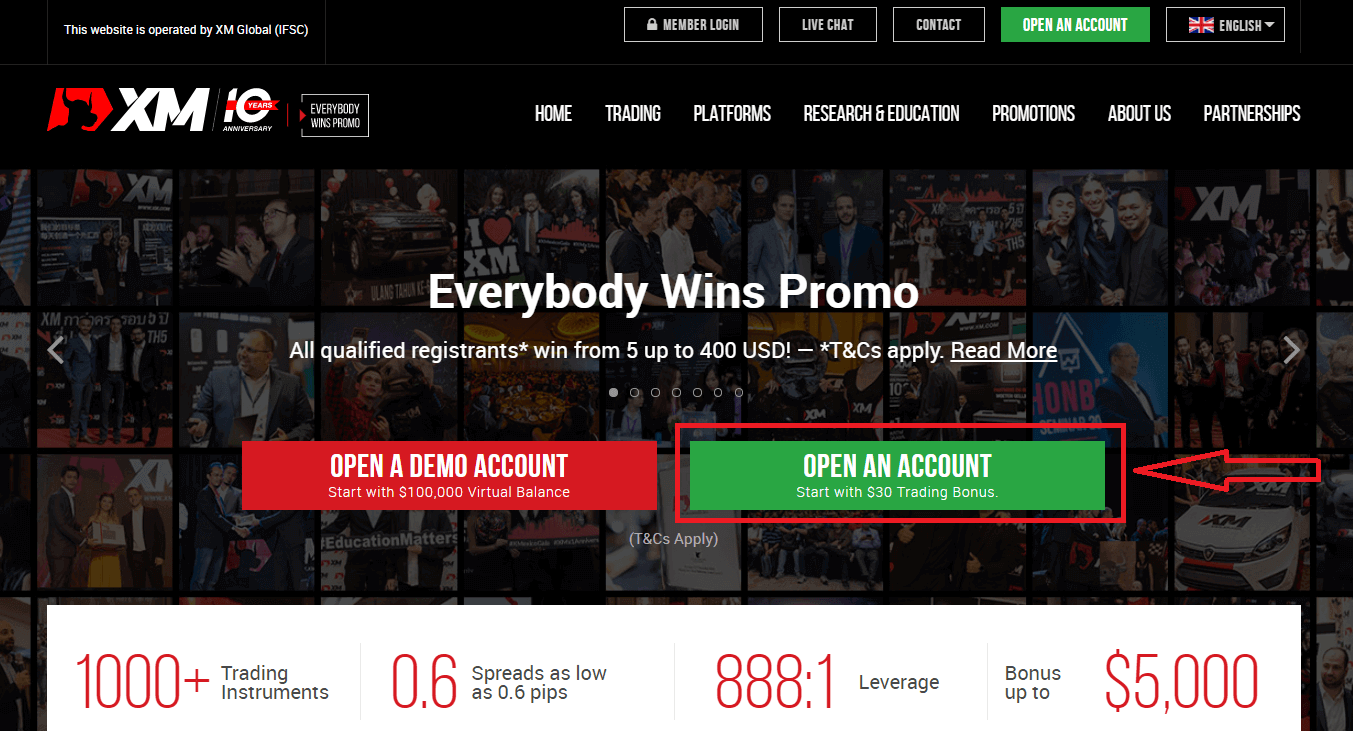

1. Go to the registration pageYou must first access the XM broker portal, where you can find the button to create an account.

As you can see in the central part of the page there is a green button to create an account.

The account opening is totally free.

It may take only 2 minutes to complete the online registration with XM.

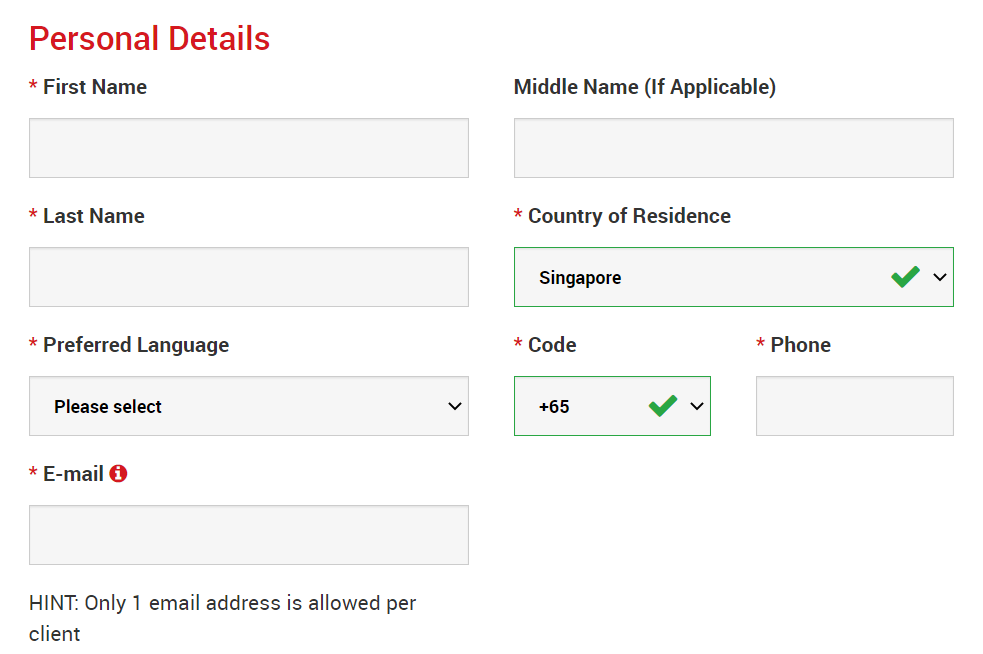

2. Fill in the required fields

There you will have to complete the form with the required information below.

- First Name and Last Name

- They are displayed in your identity document.

- Country of Residence

- The country you reside in may affect the account types, promotions, and other service details available to you. Here, you may select the country you currently reside in.

- Preferred Language

- The language preference can be changed later too. By selecting your native language, you will be contacted by support staff who speak your language.

- Phone Number

- You may not need to make a phone call to XM, but they may call in some cases.

- Email Address

- Make sure you type in the correct email address. After the completion of the registration, all communications and logins will require your email address.

Please Note: Only one email address per client is allowed.

At XM you can open multiple accounts using the same email address. Multiple email addresses per client are not allowed.

If you are an existing XM Real account holder and you wish to open an additional account you must use the same email address already registered with your other XM Real Account(s).

If you are a new XM client please ensure that you register with one email address as we do not allow different email address for every account you open.

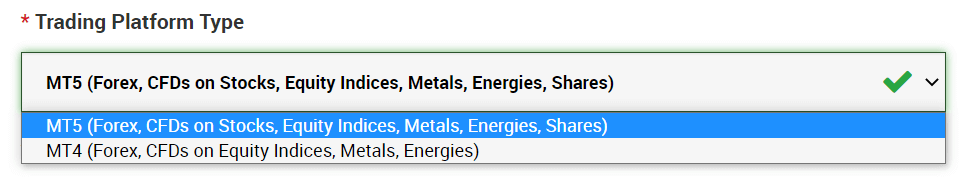

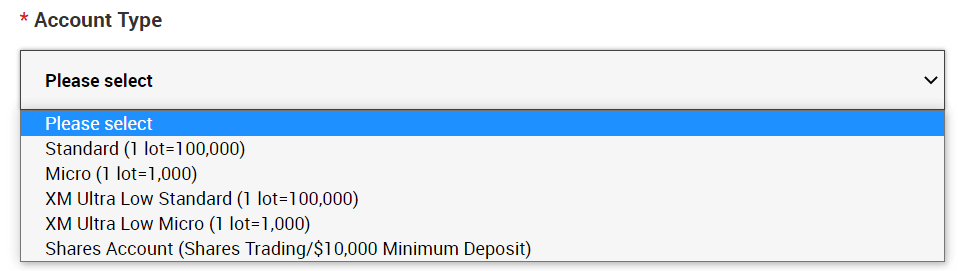

3. Choose your account type

Before proceeding to the next step, you must choose Trading Platform Type. You can also choose MT4 (MetaTrader4) or MT5 (MetaTrader5) platforms.

And the account type you like to use with XM. XM mainly offers Standard, Micro, XM Ultra Low Account, and Shares Account.

After the registration, you can also open multiple trading accounts of different account types.

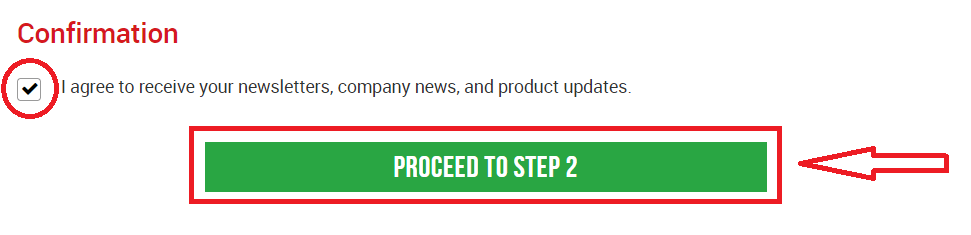

4. Agree to the Terms and Conditions

After filling in all the blanks, lastly, you need to click in the boxes and press "PROCEED TO STEP 2" as below

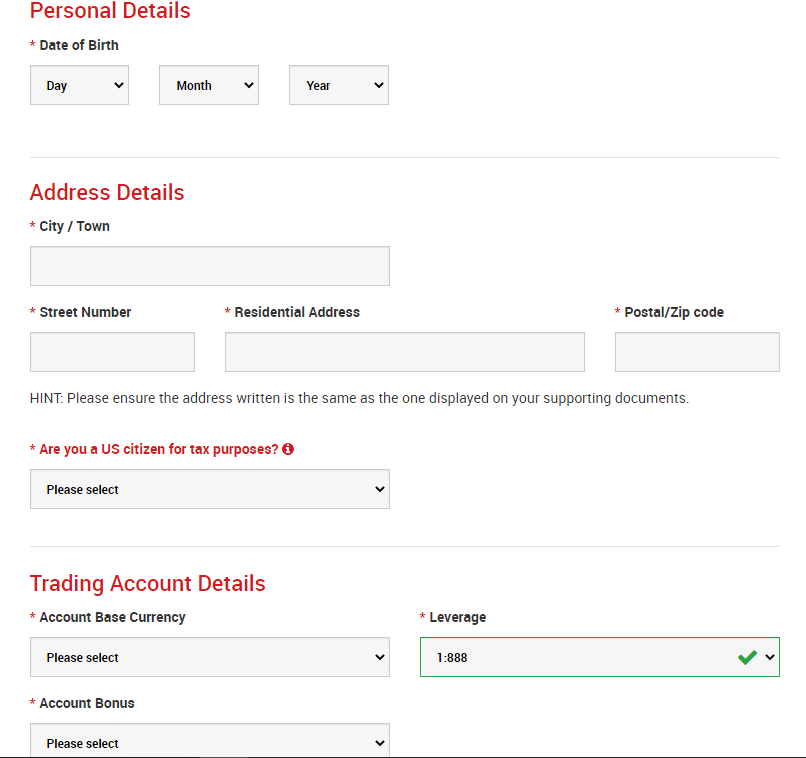

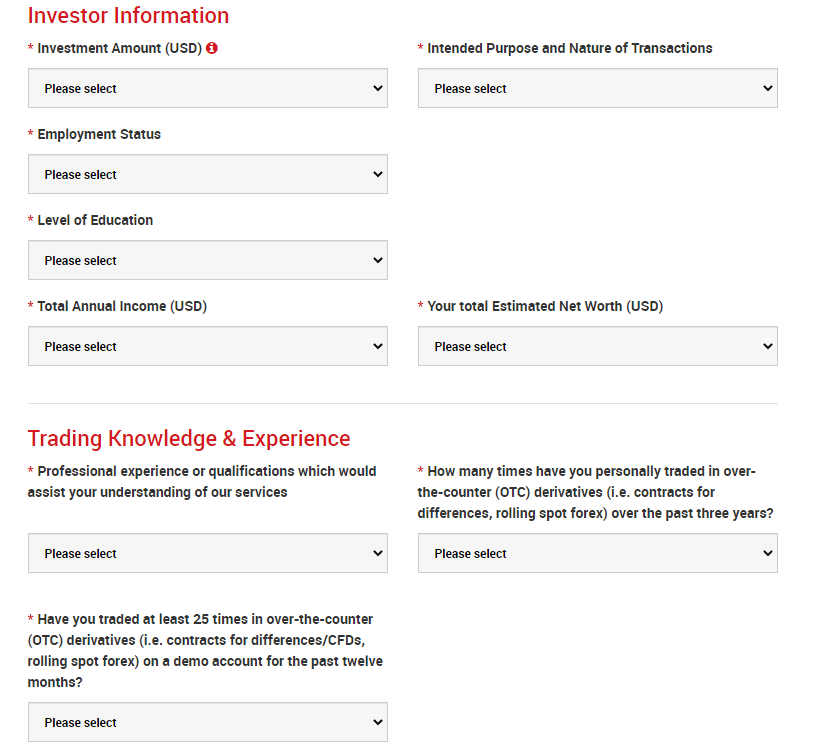

On the next page, you will need to fill in some more details about yourself and your investment knowledge.

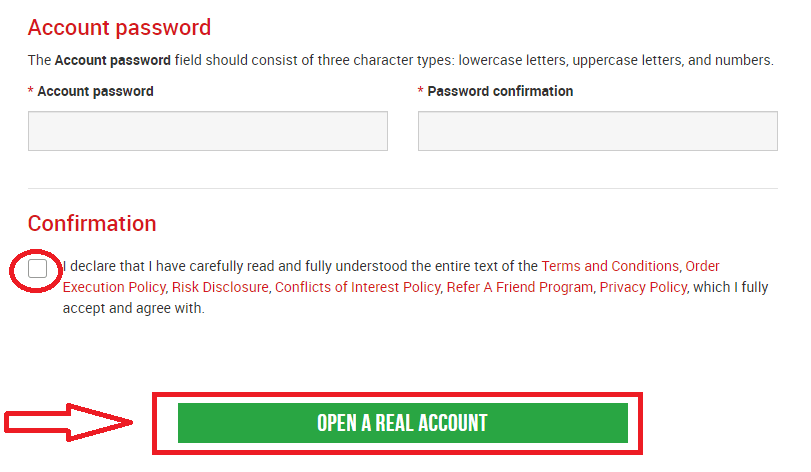

The Account password field should consist of three character types: lowercase letters, uppercase letters, and numbers.

After filling in all the blanks, lastly, you need to agree to the terms and conditions, click in the boxes, and press "OPEN A REAL ACCOUNT" as above

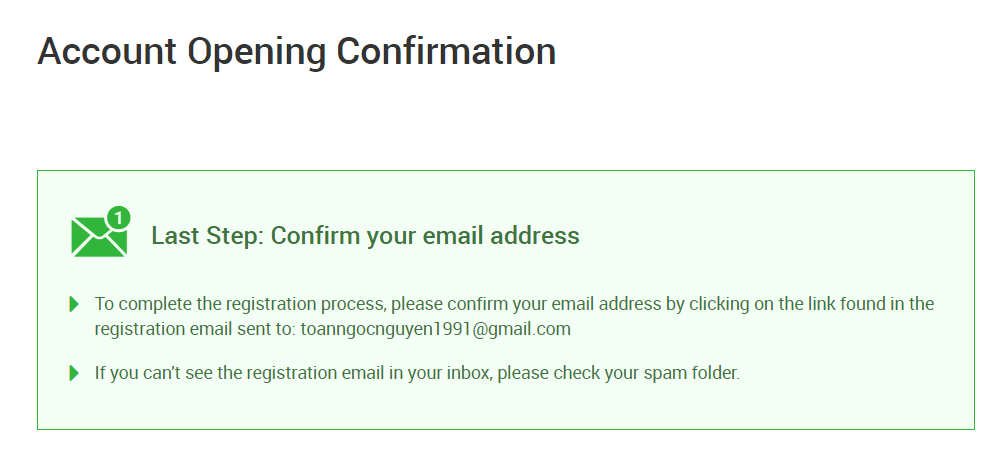

After this, you will receive an email from XM for email confirmation

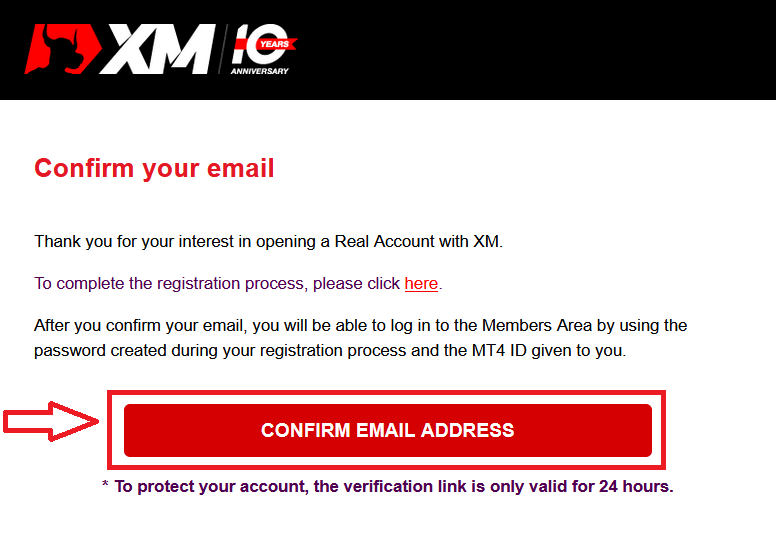

In your mailbox, you will receive an email like the one you can see in the following image. Here, you will have to activate the account by pressing where it says “Confirm email address“. With this, the demo account is finally activated.

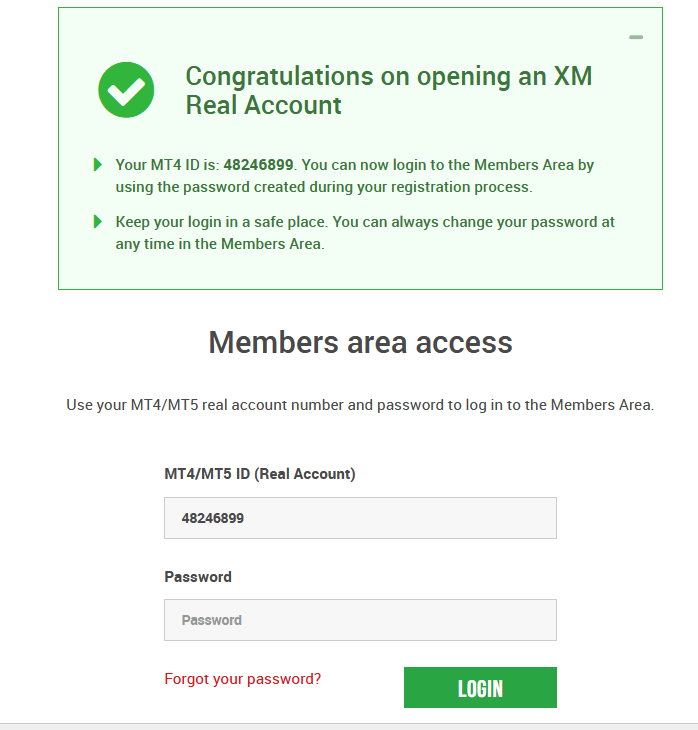

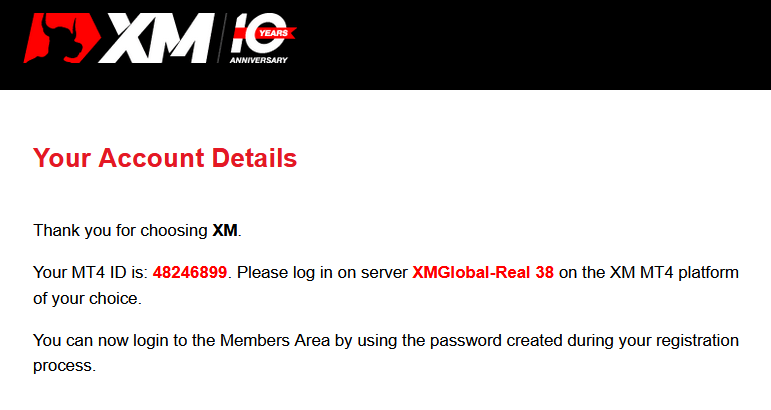

Upon confirmation of the email and account, a new browser tab will open with welcome information. The identification or user number that you can use on the MT4 or Webtrader platform is also provided.

Go back to your Mailbox, and you will receive login details for your account.

It should be remembered that for the version of Metatrader MT5 or Webtrader MT5, the account opening and verification process is exactly the same.

How to Deposit Money

What is a Multi-Asset Trading Account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices CFDs, stock CFDs, as well as CFDs on metals and energies.Multi-asset trading accounts at XM can be opened in Micro, Standard, or XM Ultra Low formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM WebTrader.

In summary, your multi-asset trading account includes

1. Access to the XM Members Area

2. Access to the corresponding platform(s)

3. Access to the XM WebTrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (Know your Customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM Account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details which will give you access to the XM Members Area.

The XM Members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support, and accessing the trading tools offered by XM.

Our offerings within the client’s Members Area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform that matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM Members Area will reflect on your corresponding trading platform.

Who Should Choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, CFDs on stock indices, as well as CFDs on gold and oil, but it does not offer trading on stock CFDs. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.Access to the MT4 platform is available for Micro, Standard, or XM Ultra Low as per the table above.

Who Should Choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices CFDs, gold and oil CFDs, as well as stock CFDs.Your login details to the MT5 will also give you access to the XM WebTrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for Micro, Standard, or XM Ultra Low as shown in the table above.

How to Verify your Account on XM

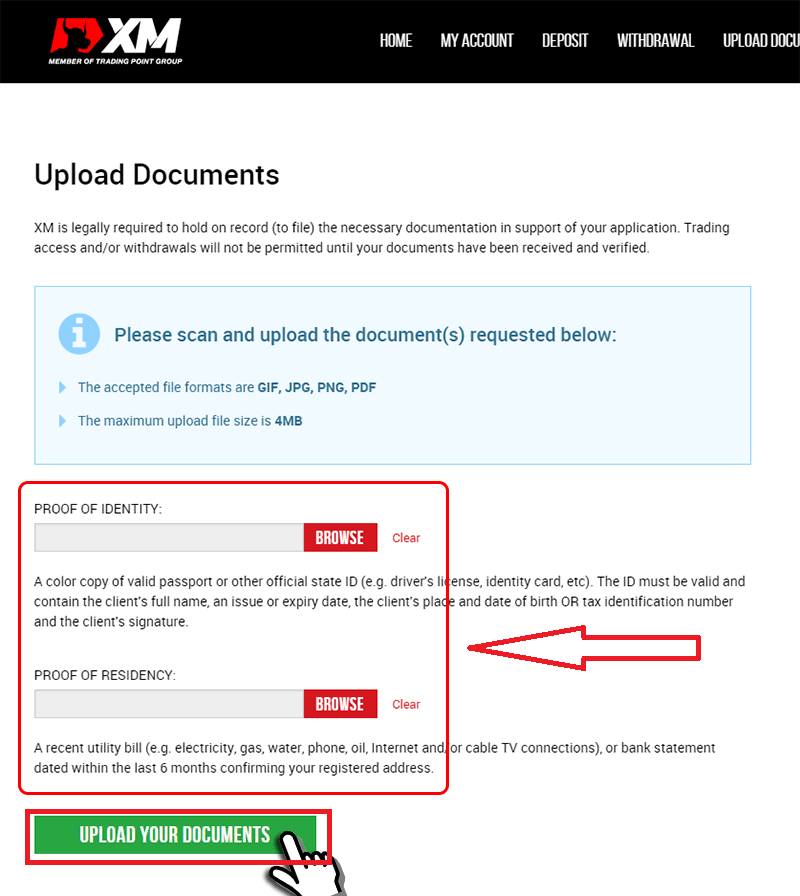

XM is legally required to hold on record (to file) the necessary documentation in support of your application. Trading access and/or withdrawals will not be permitted until your documents have been received and verified.

To validate your account, please provide us with the necessary Proof of ID and Proof of Residence documents.

Verify Account on XM [Web]

1/ Login to XM Account

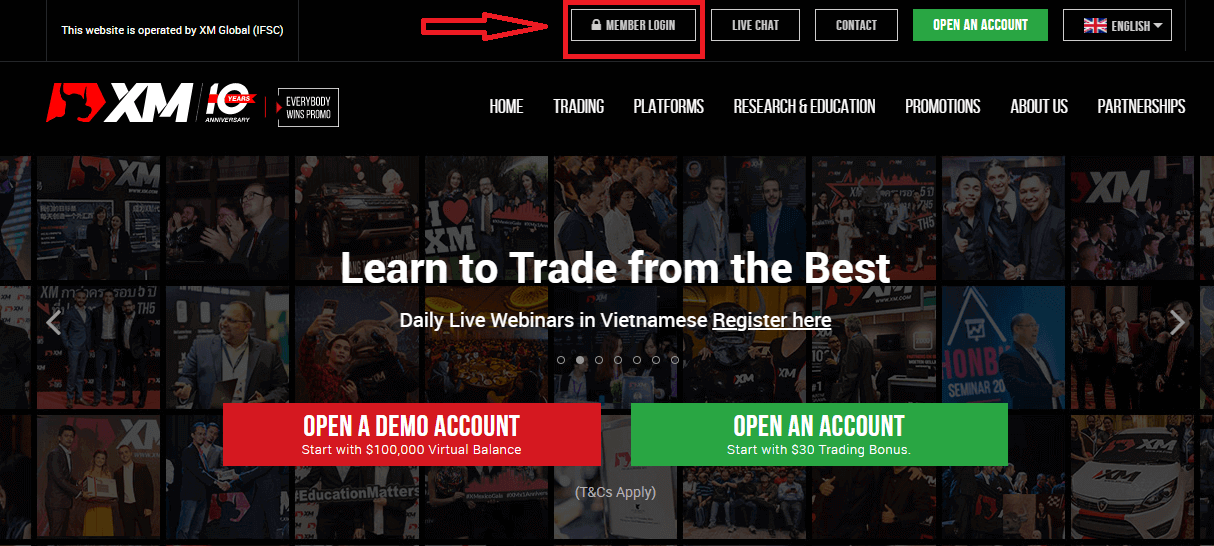

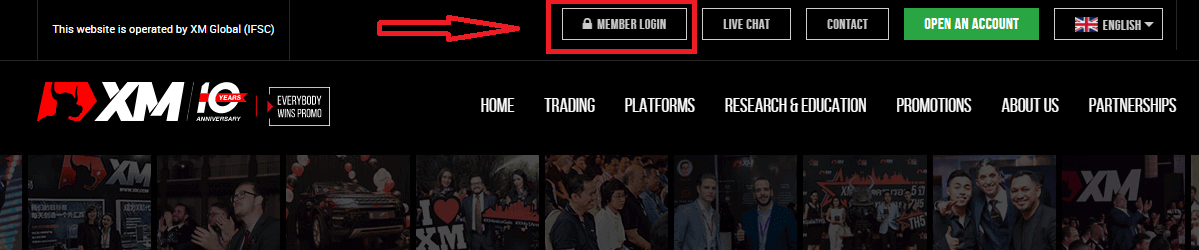

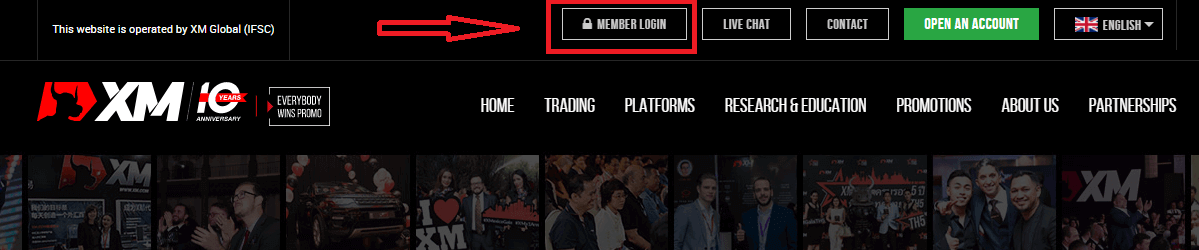

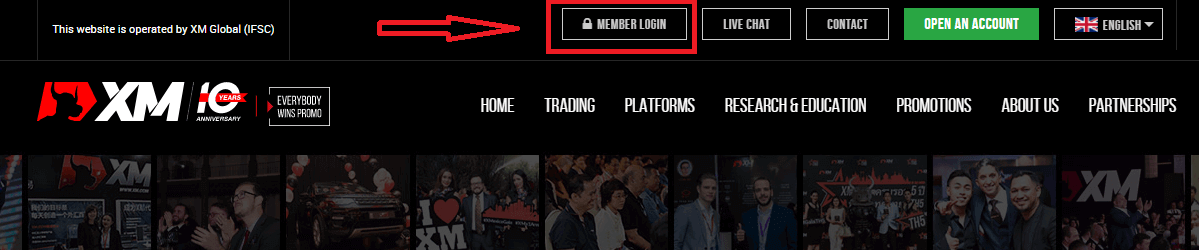

Go to XM Group’s website, Click on “Member Login” at the top of the screen.

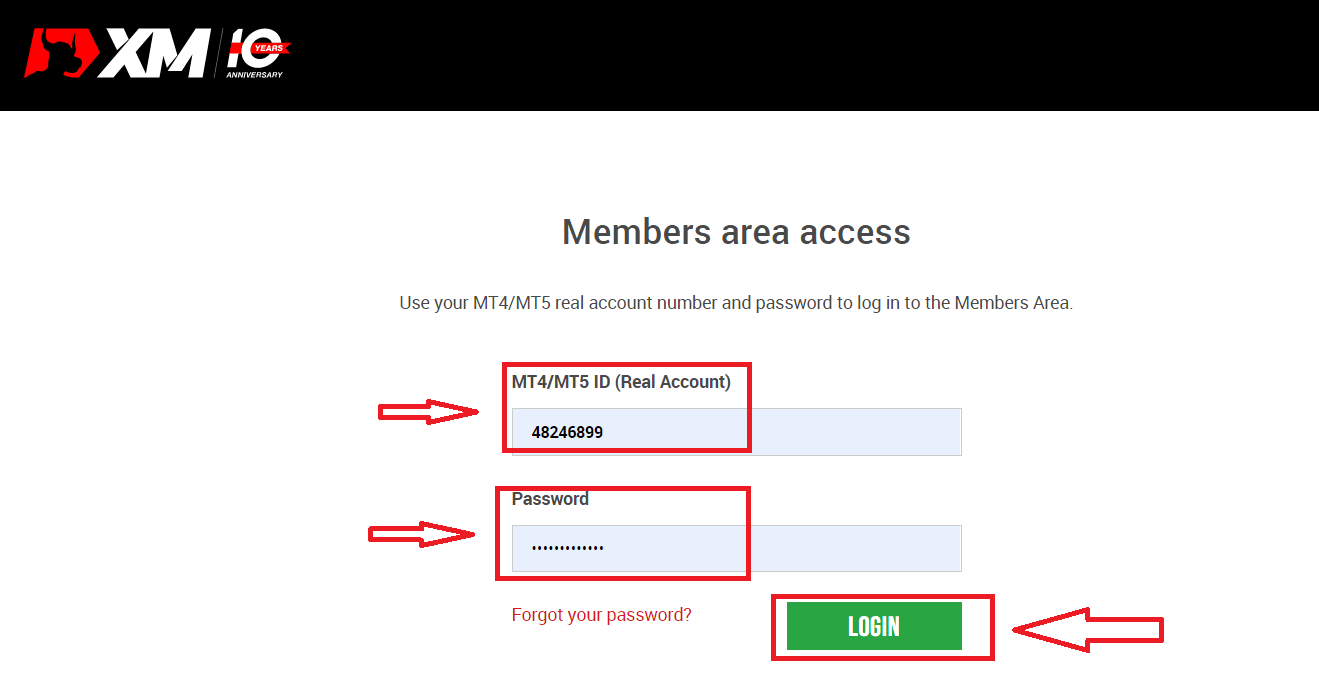

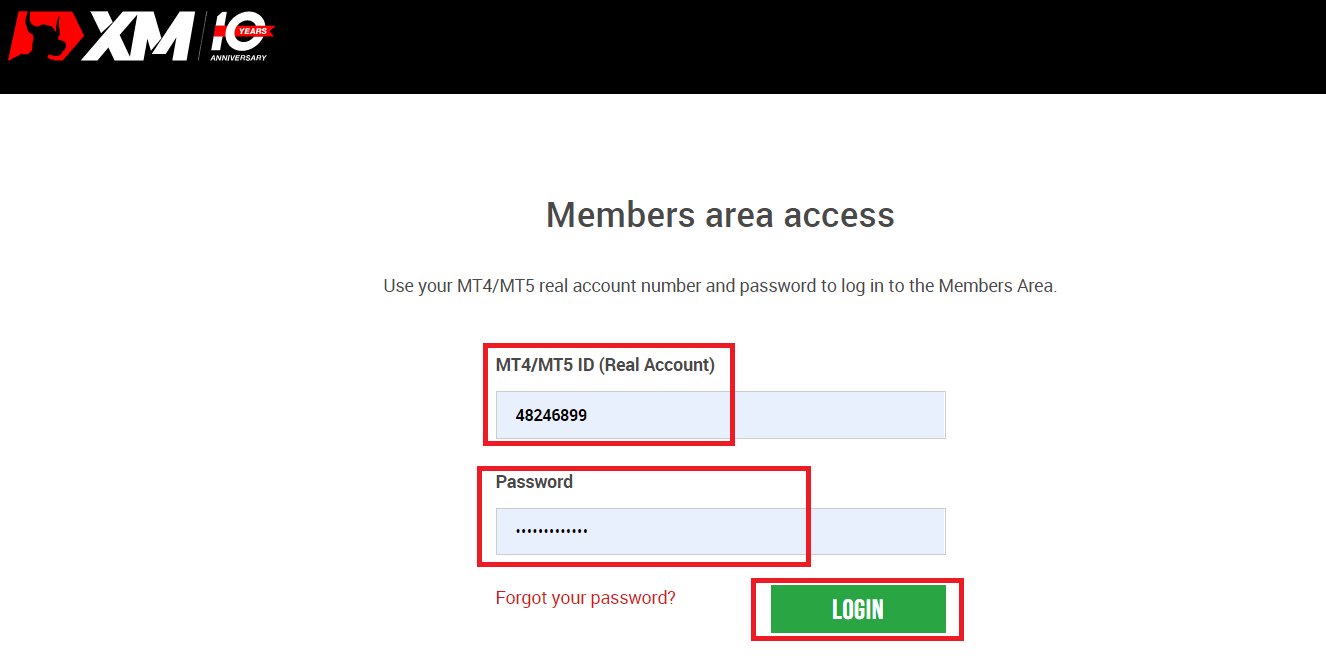

Enter your Account ID and Password.

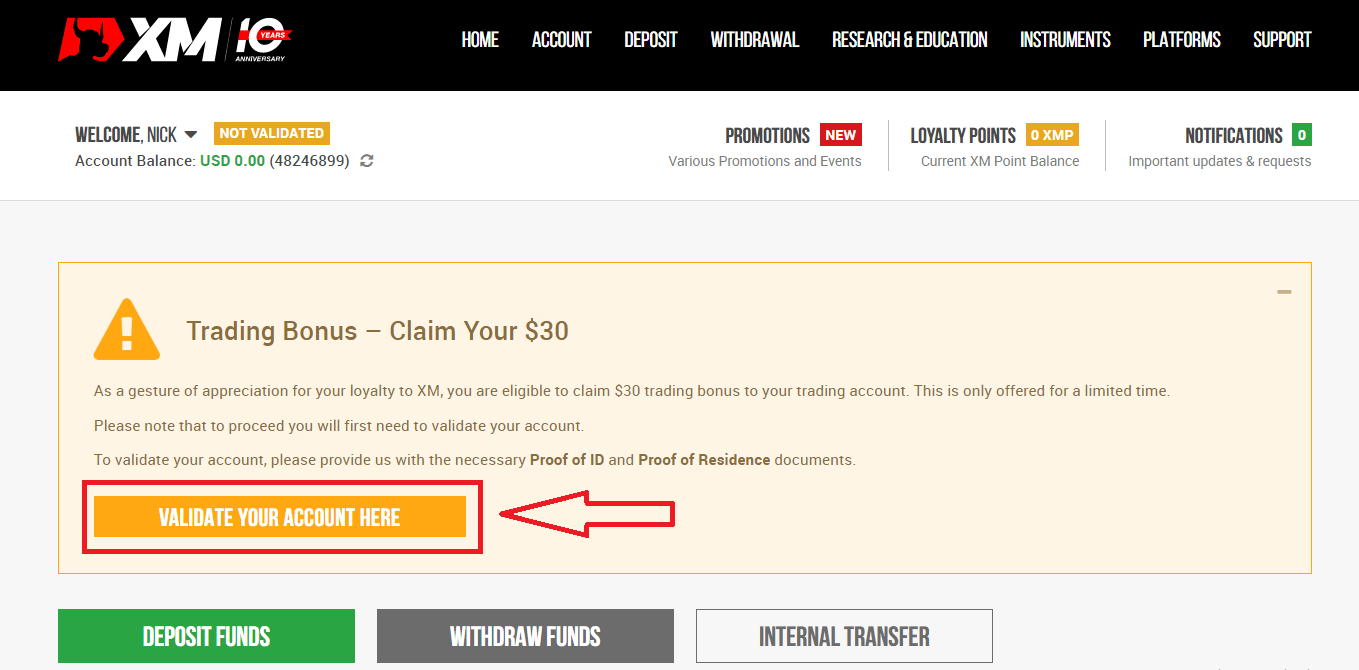

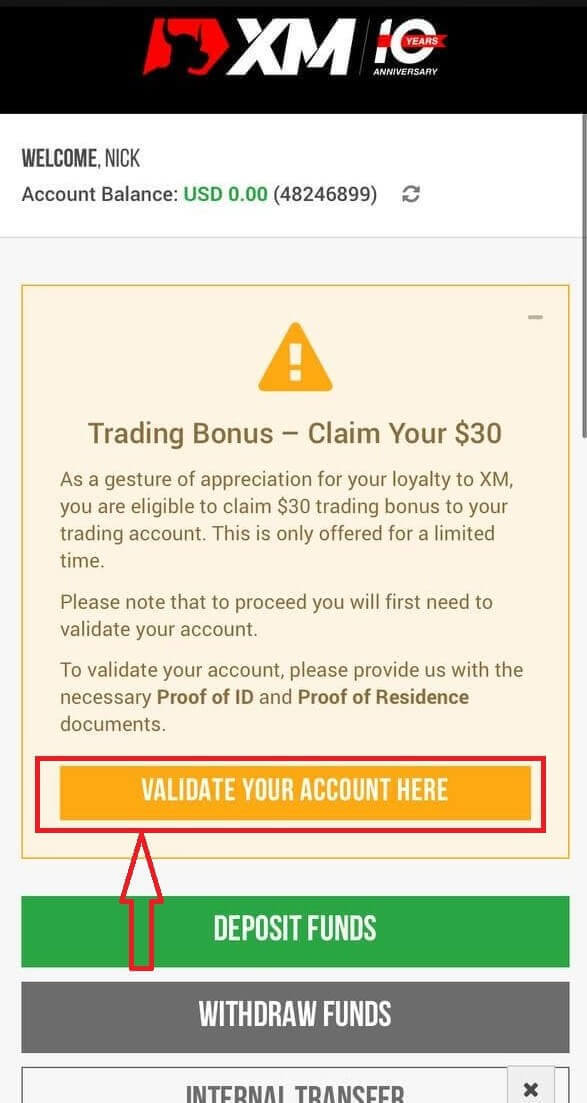

2/ Click the “VALIDATE YOUR ACCOUNT HERE" yellow button

At the main page, click the “VALIDATE YOUR ACCOUNT HERE" yellow button

Please upload the document(s) requested below:

- Please upload both sides of a clearly visible color copy of your valid identity card.

- Please ensure the uploaded image shows all four corners of the document

- The accepted file formats are GIF, JPG, PNG, PDF

- The maximum upload file size is 5MB.

- The app requires access to your camera and supports only the latest versions of mobile and web browsers.

3/ Upload 2 components of identification documents

Identification documents consist of 2 components.

- A color copy of a valid passport or other official identification document issued by authorities (e.g. driver’s license, identity card, etc). The identification document must contain the client’s full name, an issue or expiry date, the client’s place and date of birth or tax identification number, and the client’s signature.

- A recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection, bank account statement) dated within the last 6 months and confirming your registered address.

If you do not have a scanner, you can take a picture of the documents by camera on a mobile. It is OK to save it on your PC and upload it.

Please select the file you have saved on your computer by clicking “Browse".

After you have selected the documents, click “Upload your Documents" to finalize the submission.

Usually, your account will be validated within 1-2 working days (except Saturday, Sunday, and public holidays). If fast after a few hours. If you would like to trade with your account immediately after its activation, contact us in English to receive an early response.

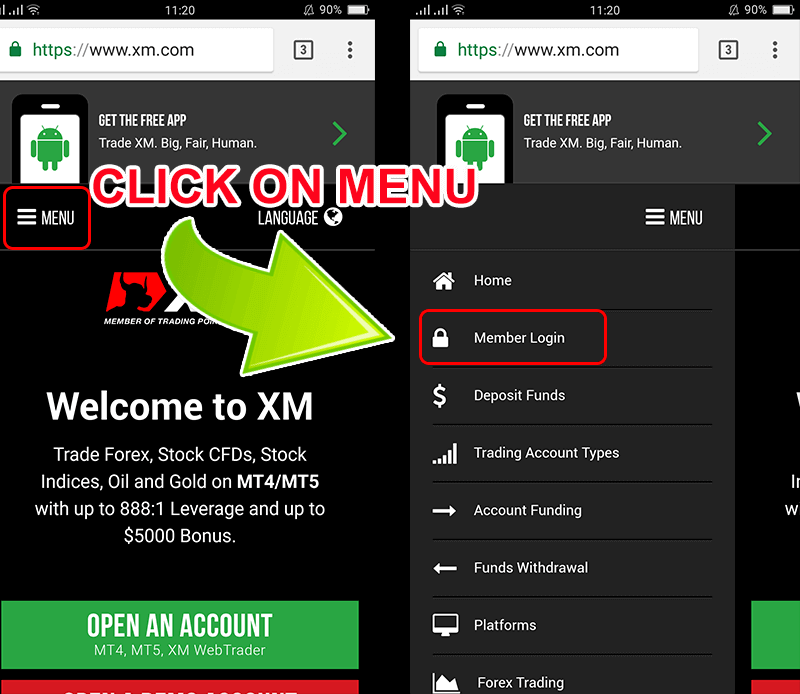

Verify Account on XM [App]

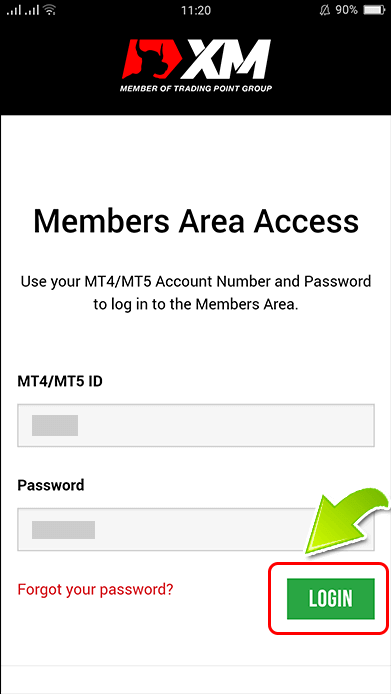

1/ Login to XM Account

Go to XM Group’s official website., Click on “Member Login” at the top of the screen.

Enter your Account ID and Password.

2/ Click the “VALIDATE YOUR ACCOUNT HERE" yellow button

At the main page, click the “VALIDATE YOUR ACCOUNT HERE" yellow button

Please upload the document(s) requested below:

- Please upload both sides of a clearly visible color copy of your valid identity card.

- Please ensure the uploaded image shows all four corners of the document

- The accepted file formats are GIF, JPG, PNG, PDF

- The maximum upload file size is 5MB.

- The app requires access to your camera and supports only the latest versions of mobile and web browsers.

3/ Upload 2 components of identification documents

Identification documents consist of 2 components.

- A color copy of a valid passport or other official identification document issued by authorities (e.g. driver’s license, identity card, etc). The identification document must contain the client’s full name, an issue or expiry date, the client’s place and date of birth or tax identification number, and the client’s signature.

- A recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection, bank account statement) dated within the last 6 months and confirming your registered address.

If you do not have a scanner, you can take a picture of the documents by camera on a mobile. It is OK to save it on your PC and upload it.

Please select the file you have saved on your computer by clicking “Browse".

After you have selected the documents, click “Upload your Documents" to finalize the submission.

Usually, your account will be validated within 1-2 working days (except Saturday, Sunday, and public holidays). If fast after a few hours. If you would like to trade with your account immediately after its activation, contact us in English to receive an early response.

How to Deposit Money into your XM Account

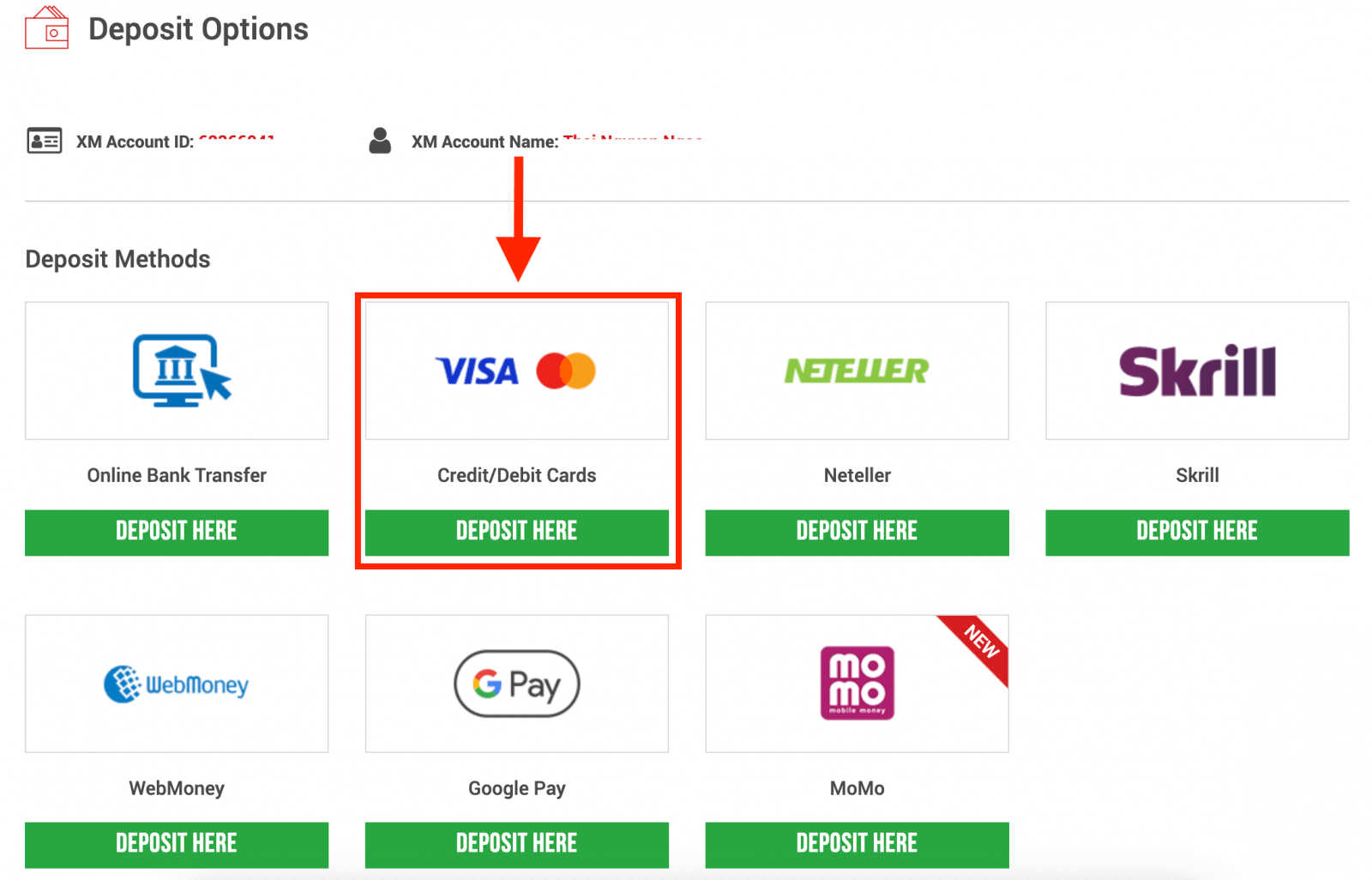

Deposit Money on XM using Credit/ Debit Cards

Deposit via Desktop

To make a deposit into XM’s trading account, please follow the instructions below.

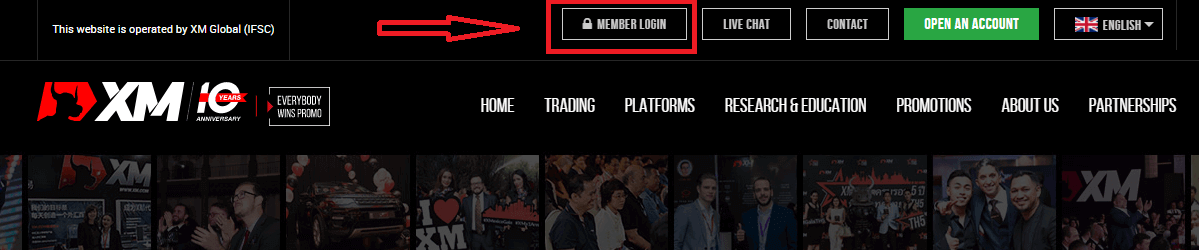

1. Login to the XM

Press “Member Login”.

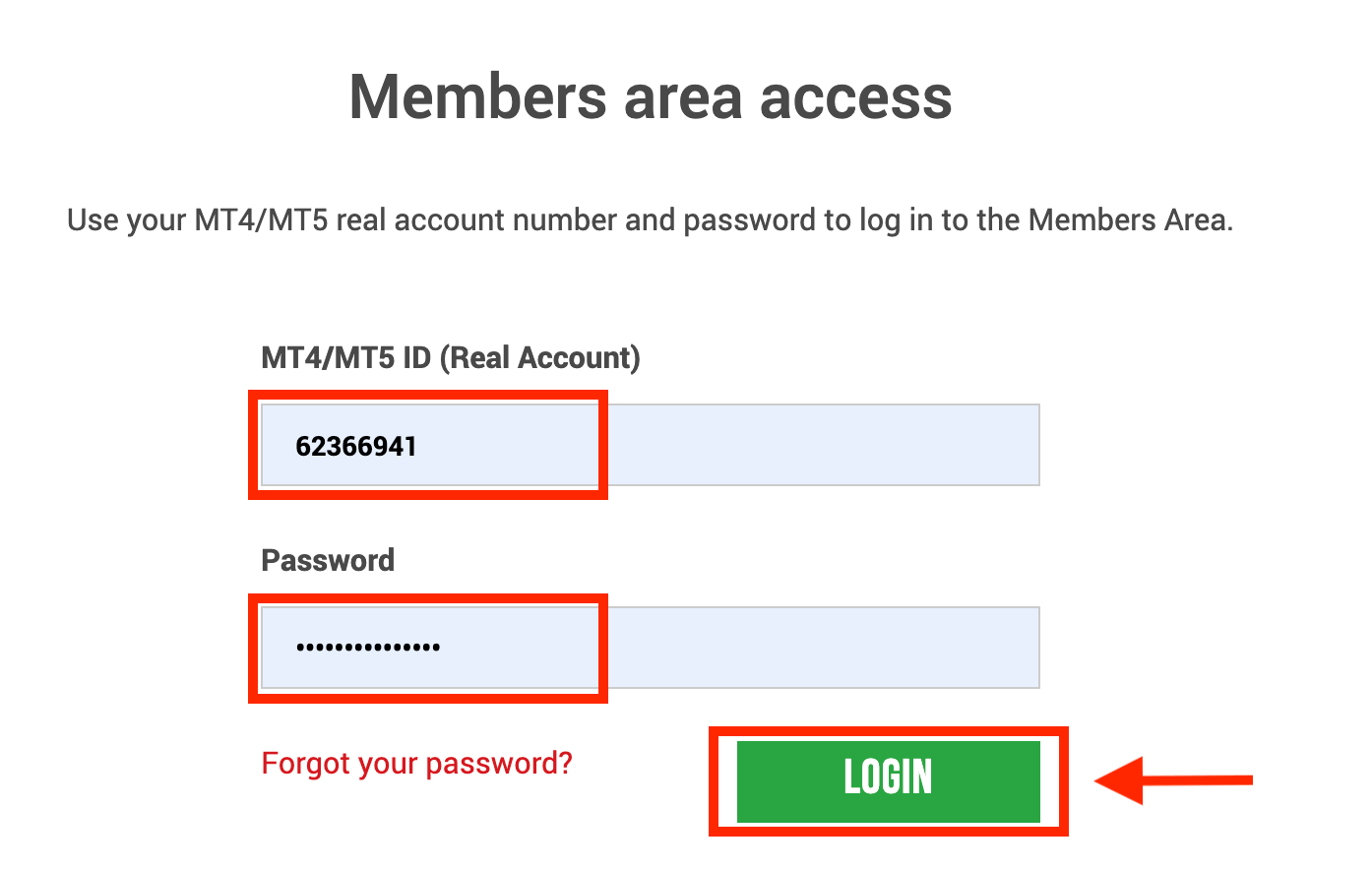

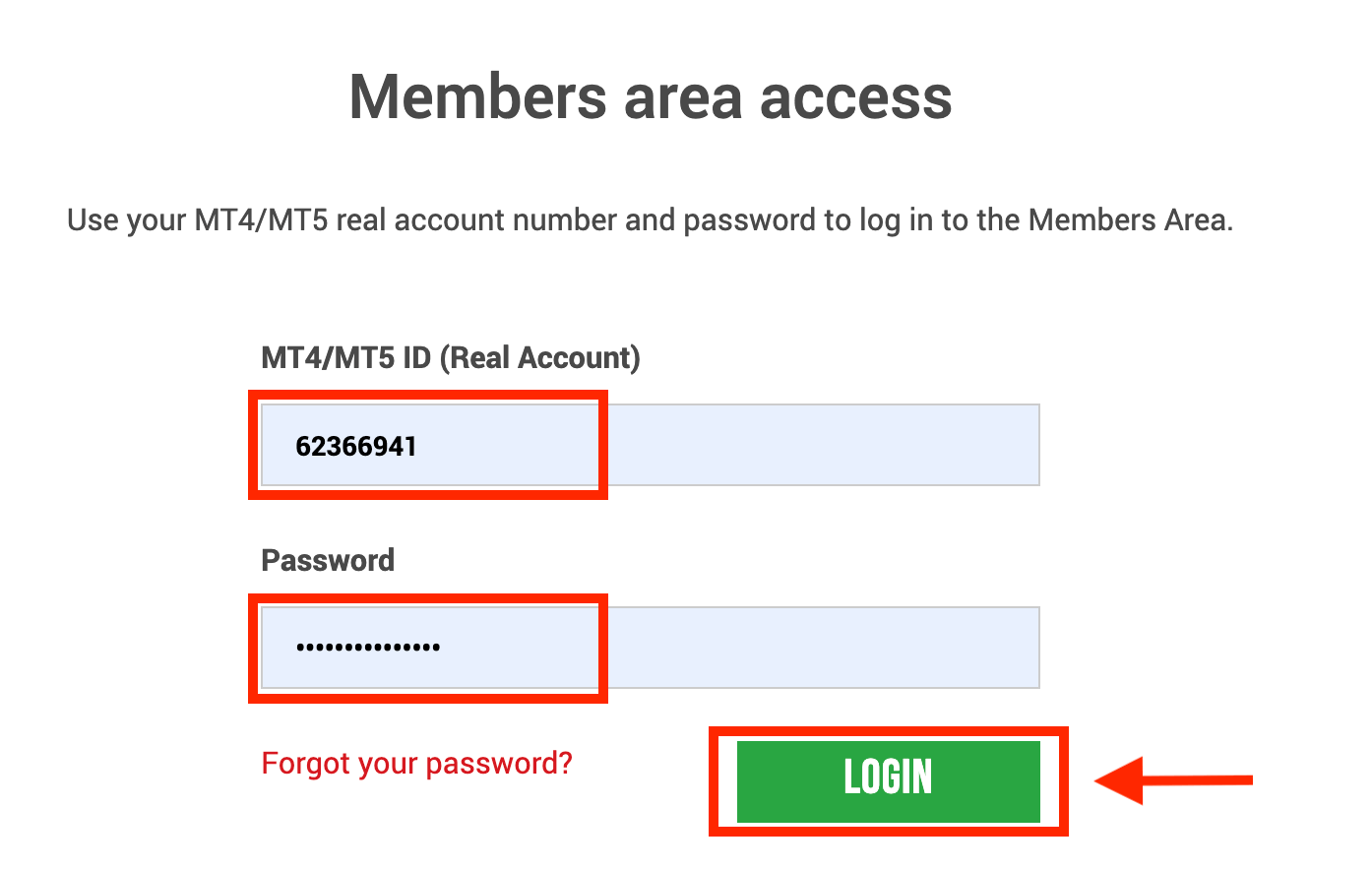

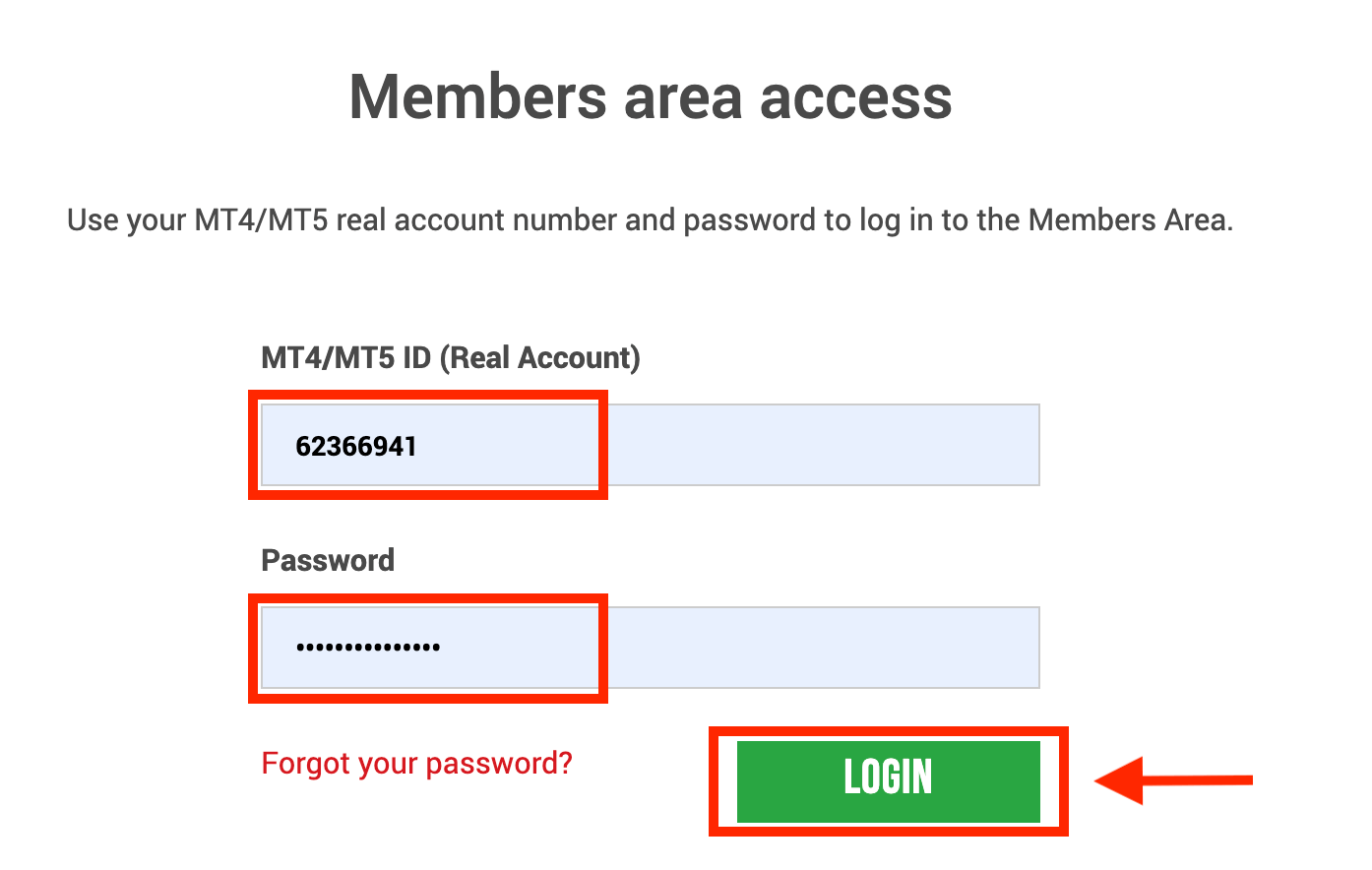

Enter your MT4/MT5 ID and Password, and Press "Login".

2. Select the deposit method “Credit/Debit Cards”

| Deposit methods | Processing time | Deposit fees |

|---|---|---|

| Credit/Debit Cards |

Immediately | Free |

NOTE: Before you proceed with a deposit via credit/debit card, please note the following:

- Please make sure that all payments are made from an account registered in the same name as your XM account.

- All withdrawals, excluding profits, can only be paid back to the credit/debit card that the deposit was initiated from, up to the deposited amount.

- XM does not charge any commissions or fees for deposits via credit/debit cards.

- By submitting a deposit request, you consent to your data being shared with third parties, including payment service providers, banks, card schemes, regulators, law enforcement, government agencies, credit reference bureaus and other parties we deem necessary to process your payment and/or verify your identity.

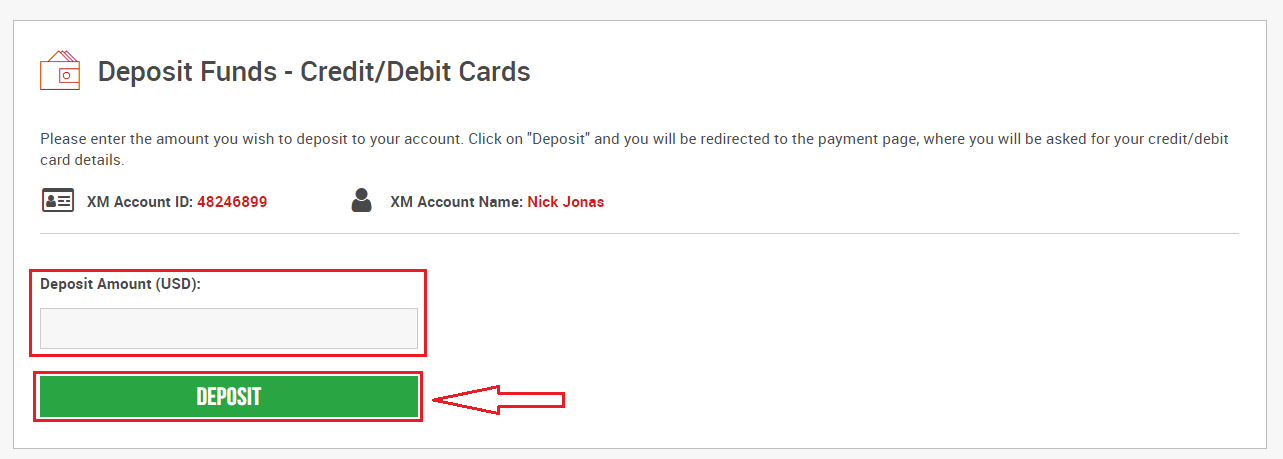

3. Enter the deposit amount and click "Deposit"

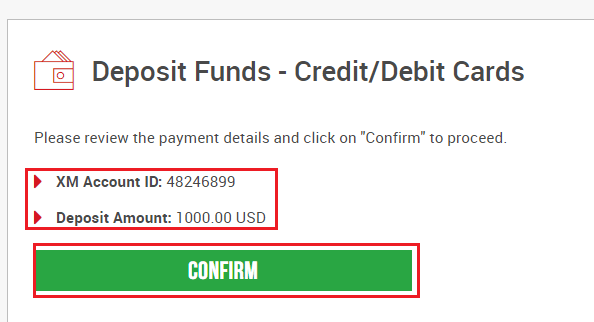

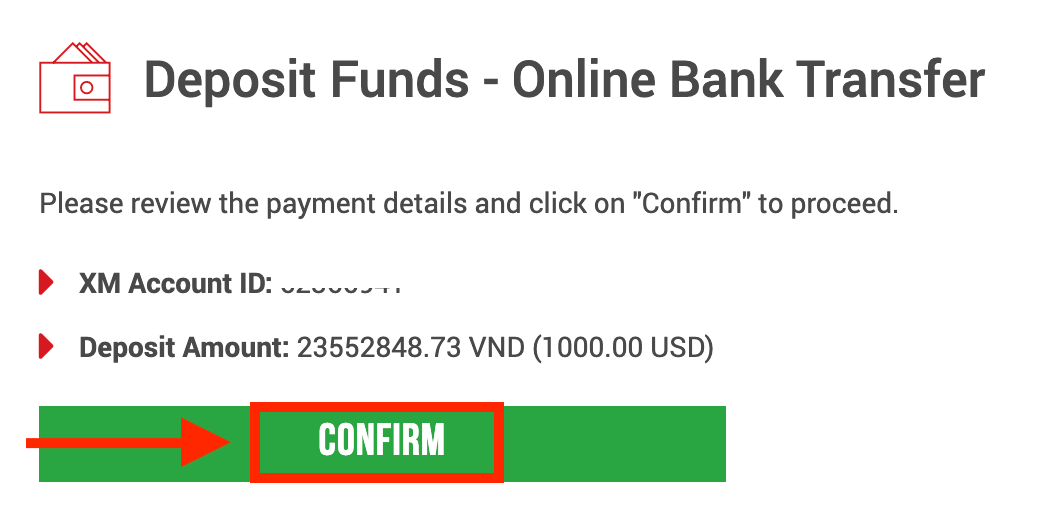

4. Confirm the account ID and deposit amount

Click on "Confirm" to proceed.

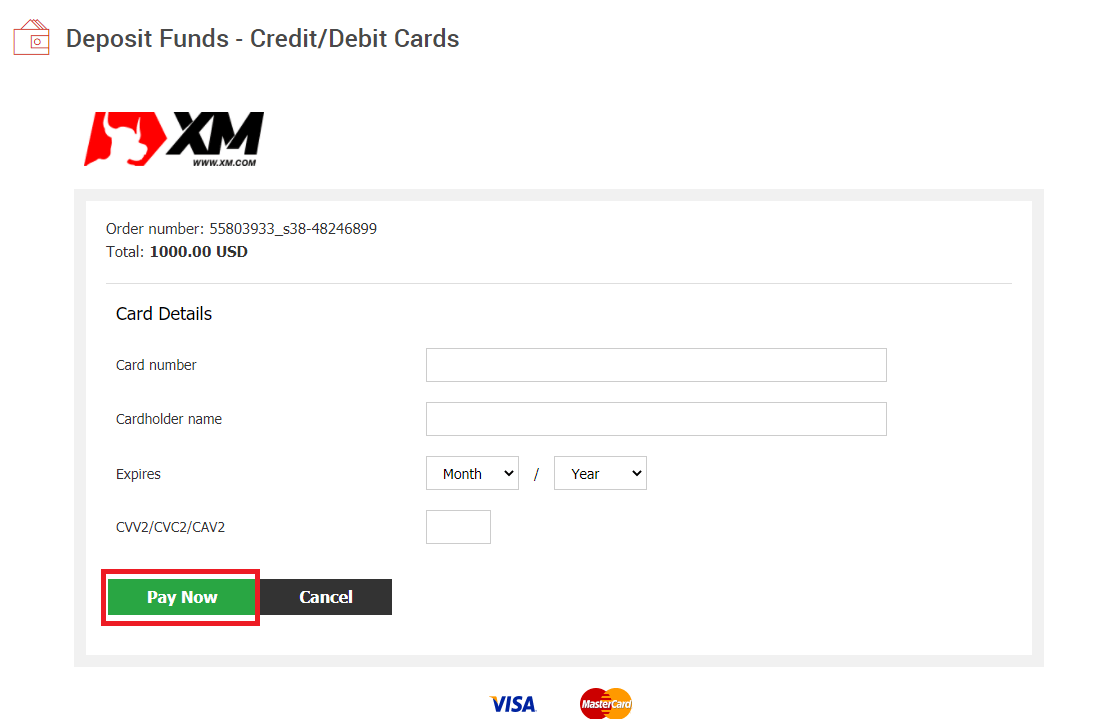

5. Enter all the required information to finish the Deposit

Click "Pay Now"

The deposit amount will be instantly reflected in your trading account.

Are you having trouble with the Deposit to XM MT4 or MT5?

Contact their support team on Live chat. They are available 24/7.

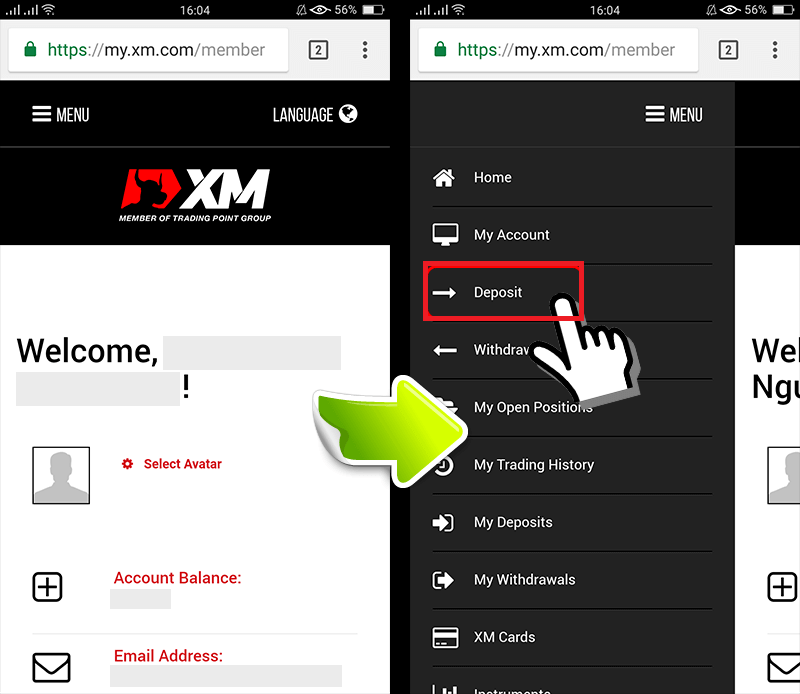

Deposit via Mobile Phone

1. Click the “Deposit" button from MenuAfter logging into My Account XM Group’s official account, click the “Deposit” button on the menu on the left side of the screen.

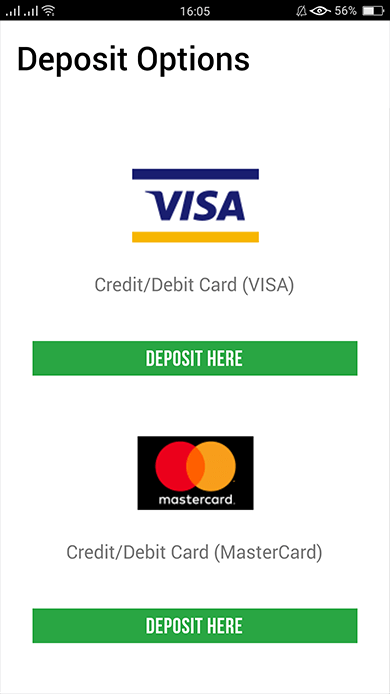

2. Select Deposit payment method

Credit/Debit cards are a recommended payment for deposit because it’s simple and allow fast deposits.

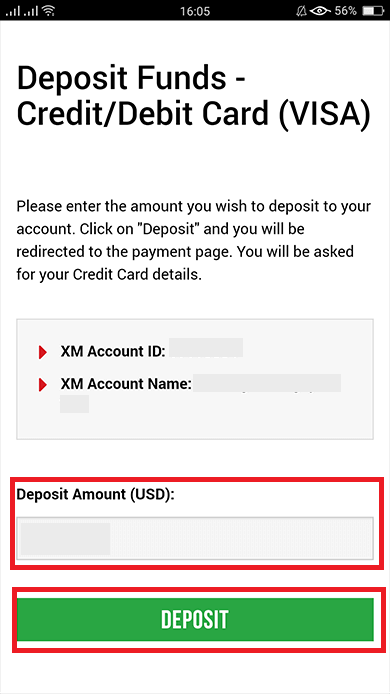

3. Enter the amount you want to deposit

Use your registered currency when opening an account. If you have selected trading currency as USD, then enter the deposit amount in USD.

After checking the XM Account ID and the amount of money needed to deposit, enter the amount you wish to deposit to your account, click “Deposit" and you will be redirected to the payment age.

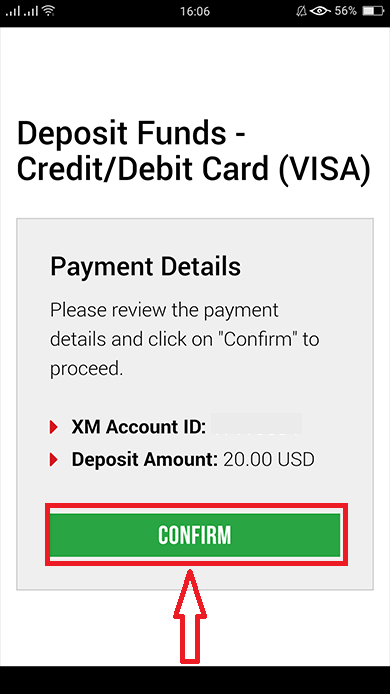

4. Confirm the account ID and deposit amount

If the information is correct then you click the “Confirm" button.

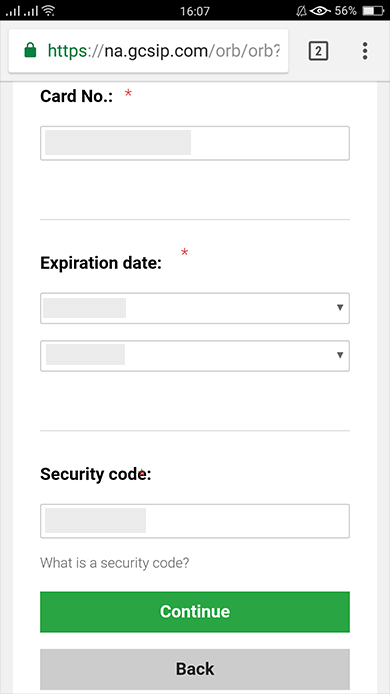

5. Enter Credit/Debit card information

Please enter your Credit/Debit card information because the system will automatically direct you to the card information input page.If your card was previously charged, some information should have been previously entered. Confirm the information such as the expiry date, …make sure all information is correct.

Once the information is filled in, Click the “Deposit” button a message will appear “Please wait while we process your payment”.

Please do not click the Go Back button on the browser while the payment is being processed.

Then the process is complete.

Deposit methods other than Credit/Debit cards payment will not be reflected immediately.

If the payment is not reflected in the account, please contact support team at XM Group if the payment is not reflected in the account.

In addition, if your account is deposited from a foreign country other than your registered permanent resident address, you will need to attach a Credit/Debit cards details sheet and a credit/Debit cards image to the support team for security reasons

Please note that the above provisions will apply in the case of Credit/Debit cards issued in foreign country or when traveling abroad.

Deposit Money on XM using Electronic Payments

To make a deposit into XM’s trading account, please follow the instructions below.

1. Login to the XM

Press “Member Login”.

Enter your MT4/MT5 ID and Password, and Press "Login".

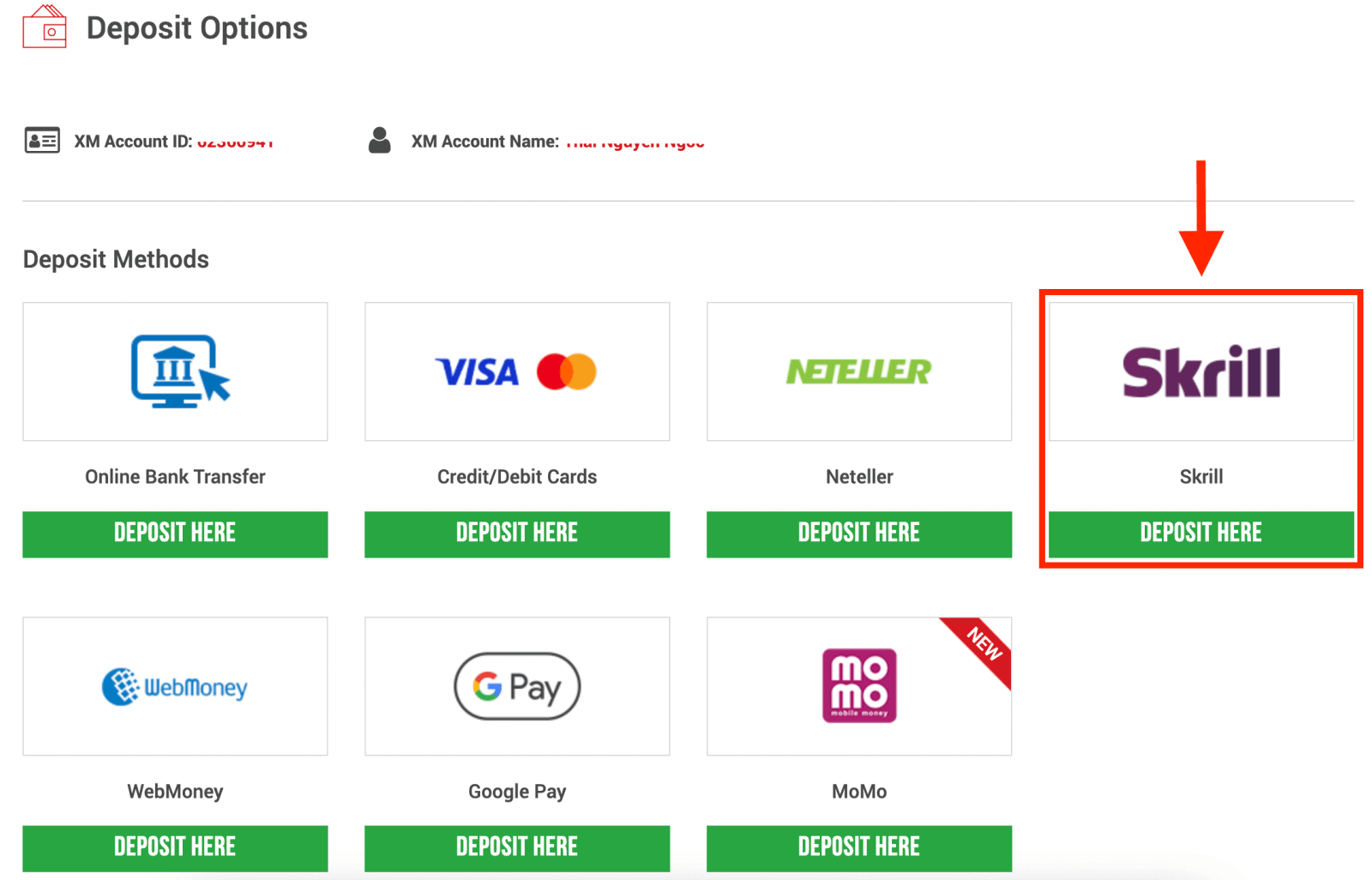

2. Select the deposit methods you want to deposit, for example: Skrill

| Deposit methods | Processing time | Deposit fees |

|---|---|---|

| Electronic Payments | Immediately ~ within 1 hour | XM will not receive the full amount you deposited because Skrill charges fees for processing your transaction. Nevertheless, XM will cover the balance of any fees charged by Skrill, crediting your account with the corresponding amount. |

NOTE: Before you proceed with a deposit via Skrill, please note the following:

- Please make sure that all payments are made from an account registered in the same name as your XM account.

- If you do not have an account with Skrill and want to register or learn more, please use this link www.skrill.com.

- By submitting a deposit request, you consent to your data being shared with third parties, including payment service providers, banks, card schemes, regulators, law enforcement, government agencies, credit reference bureaus and other parties we deem necessary to process your payment and/or verify your identity.

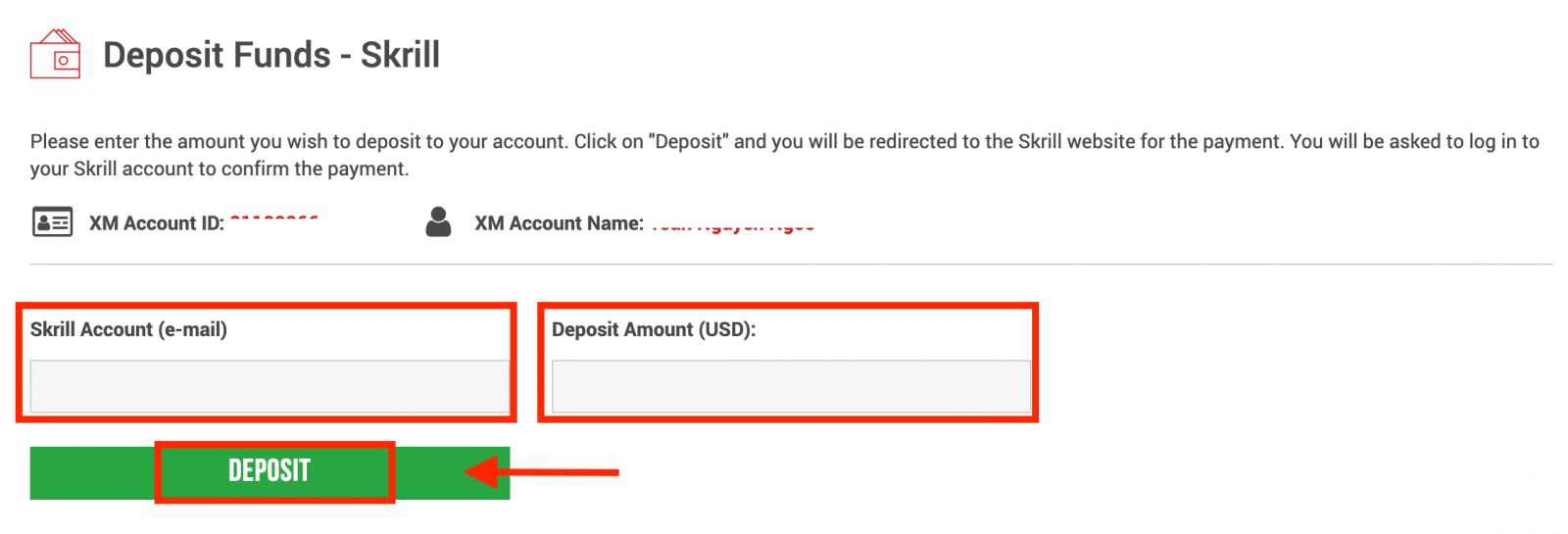

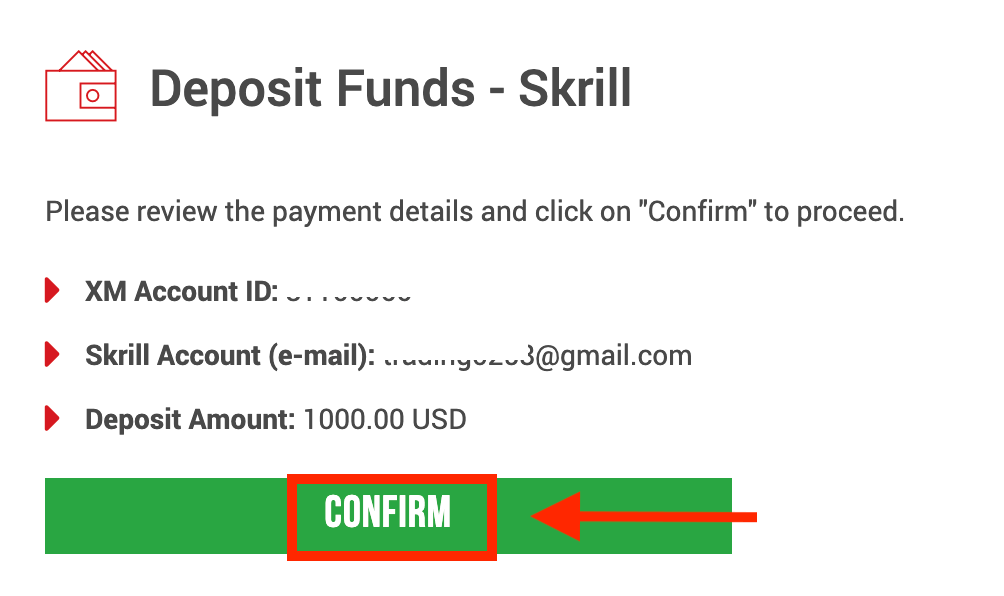

3. Enter the Skrill account, deposit the amount, and click "Deposit"

4. Confirm the account ID, Skrill account, and deposit amount

Click on "Confirm" to proceed.

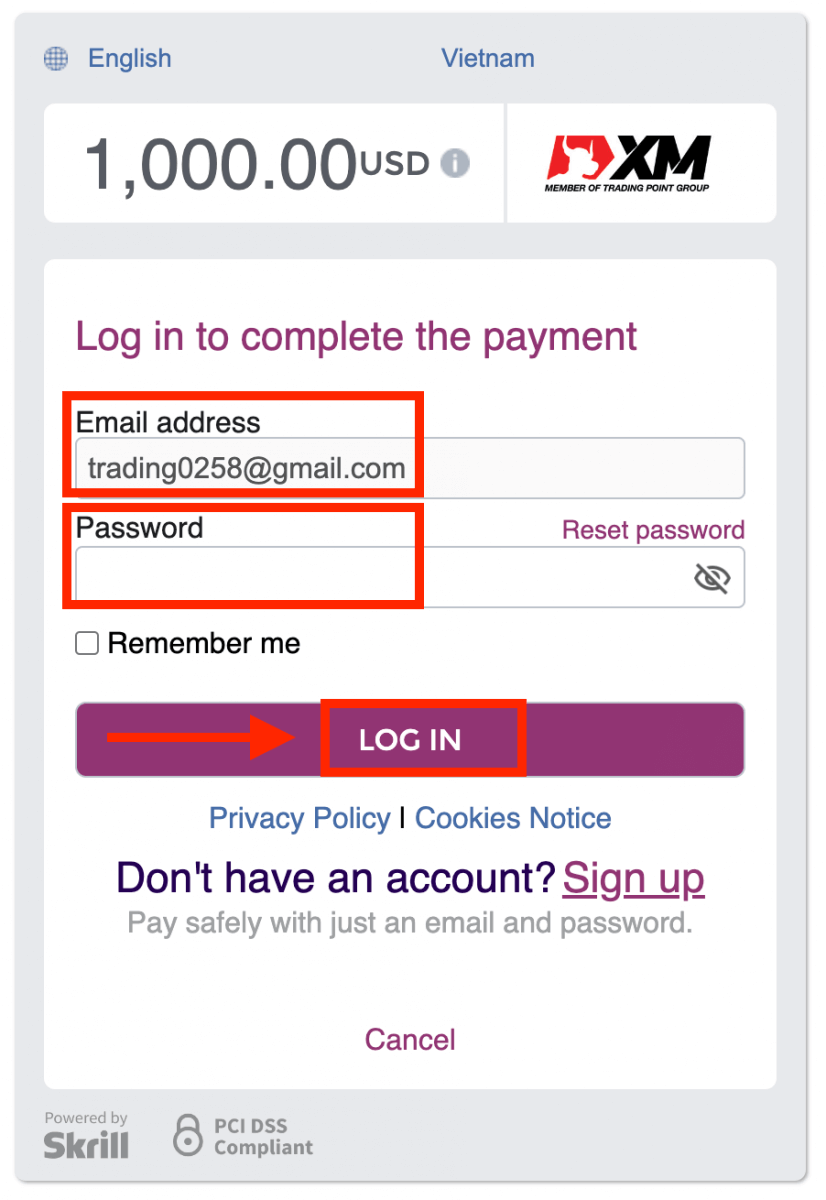

5. Enter all the required information to finish the Deposit

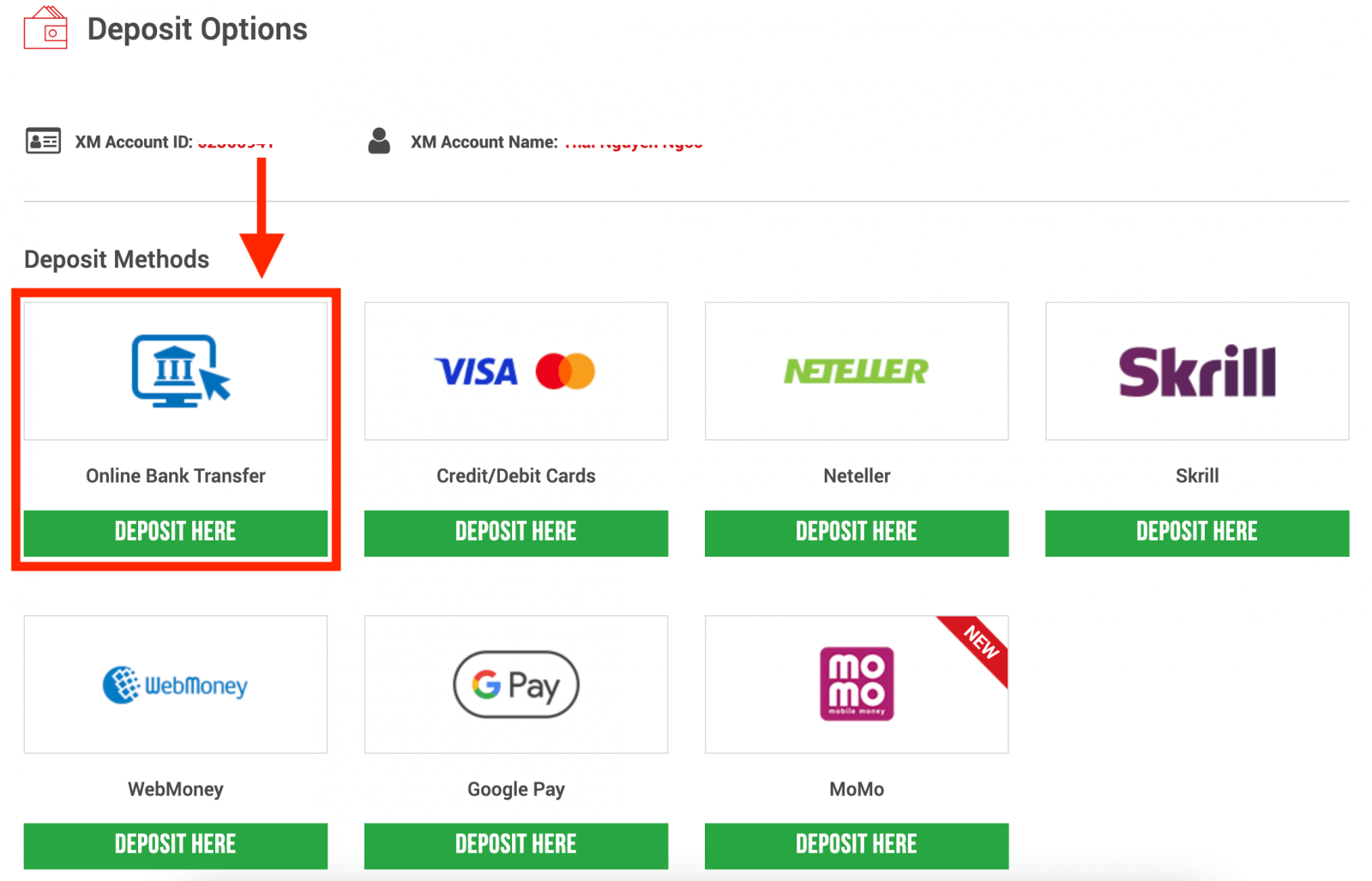

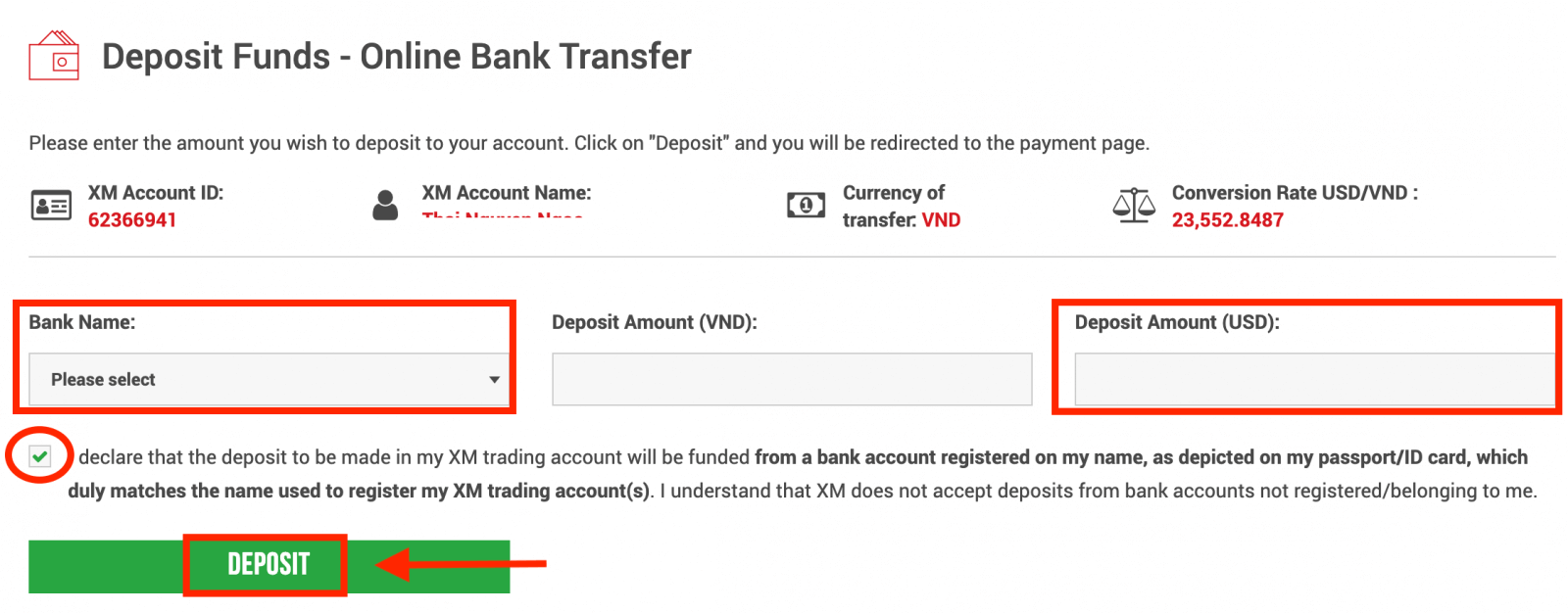

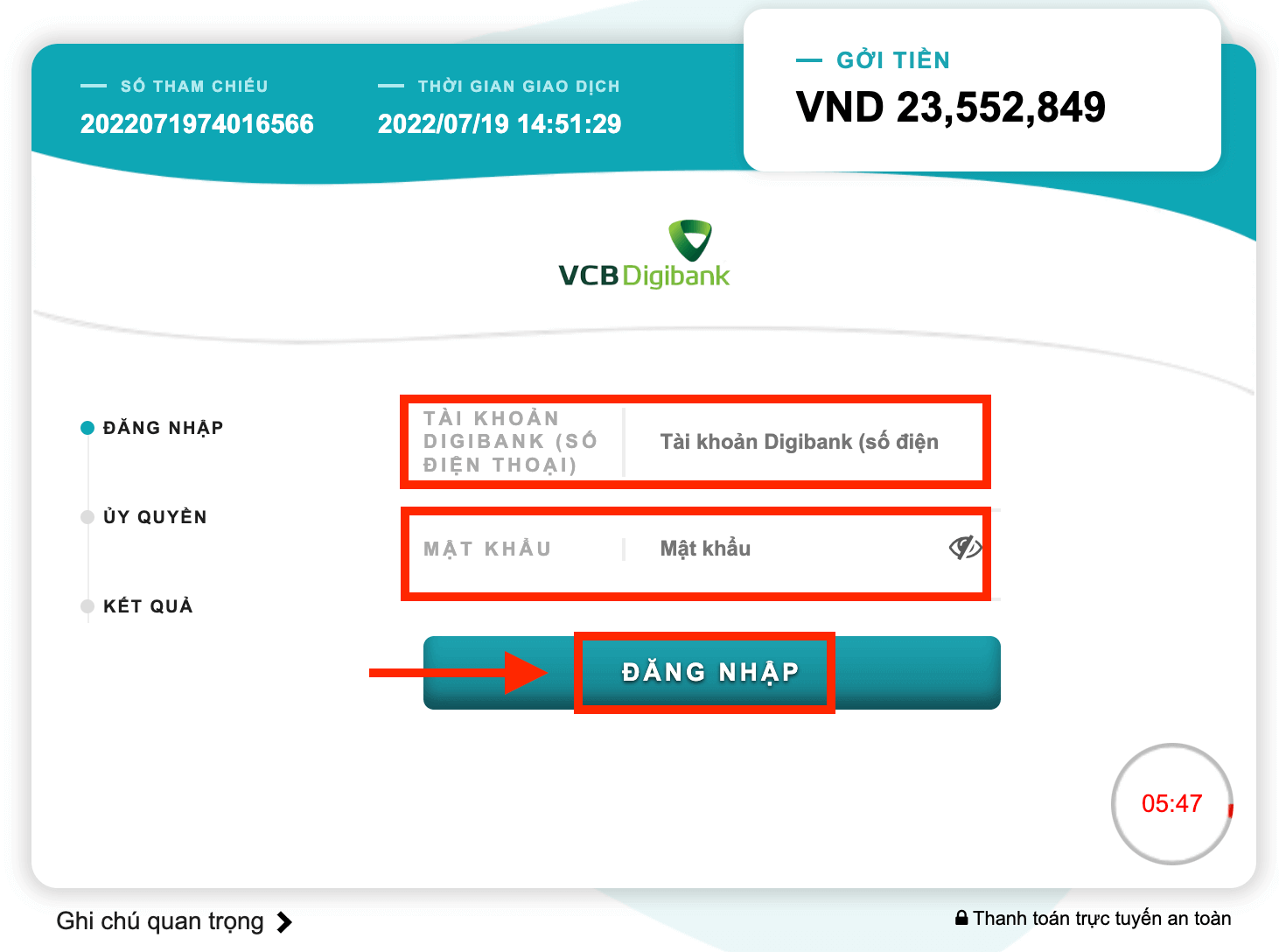

Deposit Money on XM using an Online Bank Transfer

To make a deposit into XM’s trading account, please follow the instructions below.

1. Login to the XM

Press “Member Login”.

Enter your MT4/MT5 ID and Password, and Press "Login".

2. Select the deposit method “Online Bank Transfer”

| Deposit methods | Processing time | Deposit fees |

|---|---|---|

| Online Bank transfer | 3-5 working days | Free |

NOTE: Before you proceed with a deposit via Online Bank Transfer, please note the following:

- Please make sure that all payments are made from an account registered in the same name as your XM account.

- XM does not charge any commissions or fees for deposits via online banking.

- By submitting a deposit request, you consent to your data being shared with third parties, including payment service providers, banks, card schemes, regulators, law enforcement, government agencies, credit reference bureaus and other parties we deem necessary to process your payment and/or verify your identity.

3. Choose the Bank Name, enter the deposit amount, and click "Deposit"

4. Confirm the account ID and deposit amount

Click on "Confirm" to proceed.

5. Enter all the required information to finish the Deposit

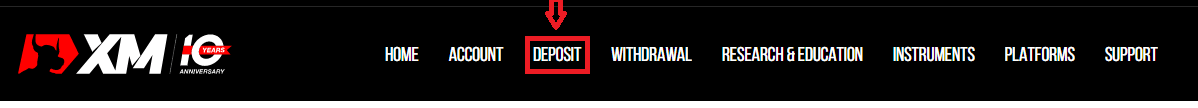

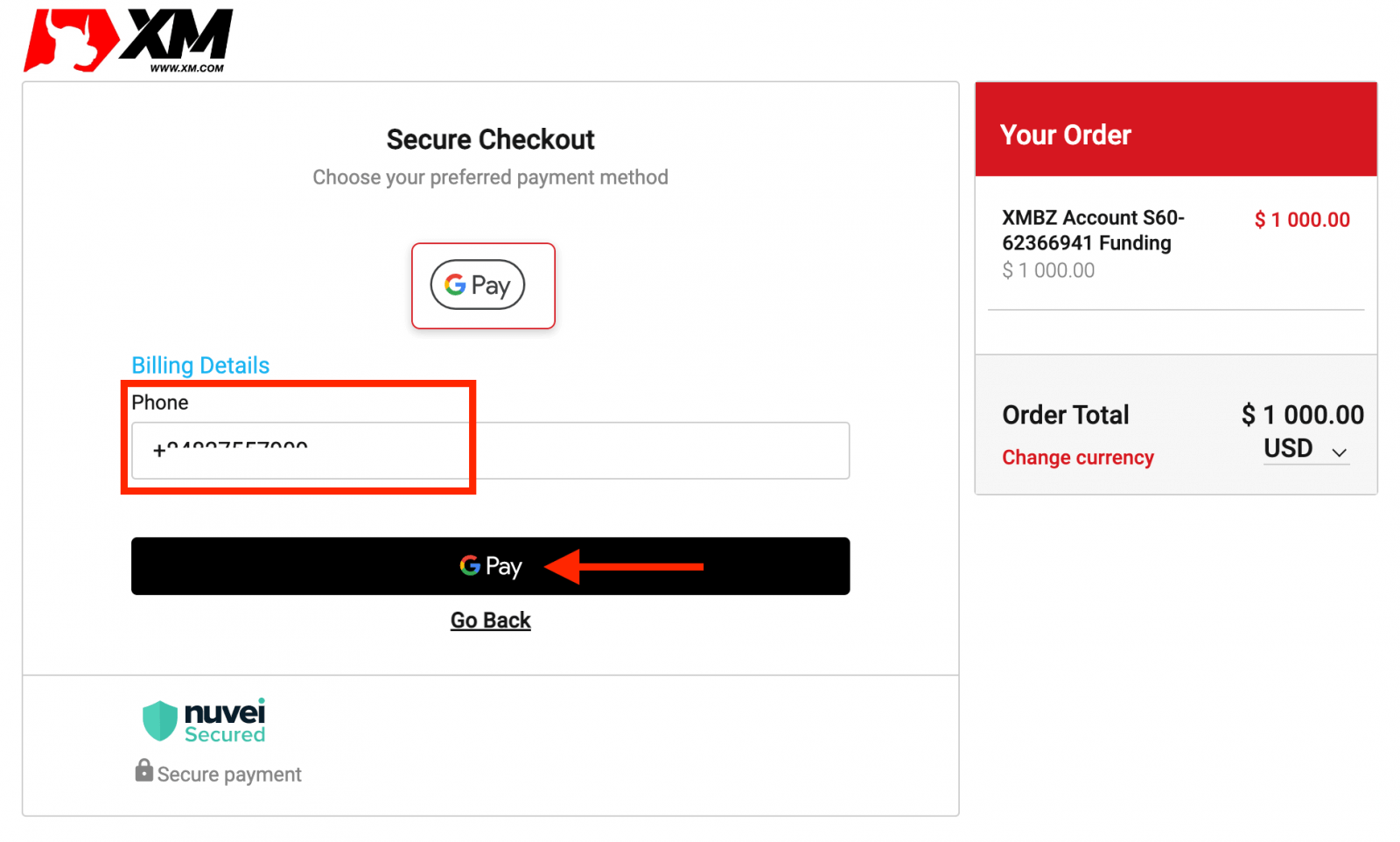

Deposit Money on XM using Google Pay

To make a deposit into XM’s trading account, please follow the instructions below.

1. Login to the XM

Press “Member Login”.

Enter your MT4/MT5 ID and Password, and Press "Login".

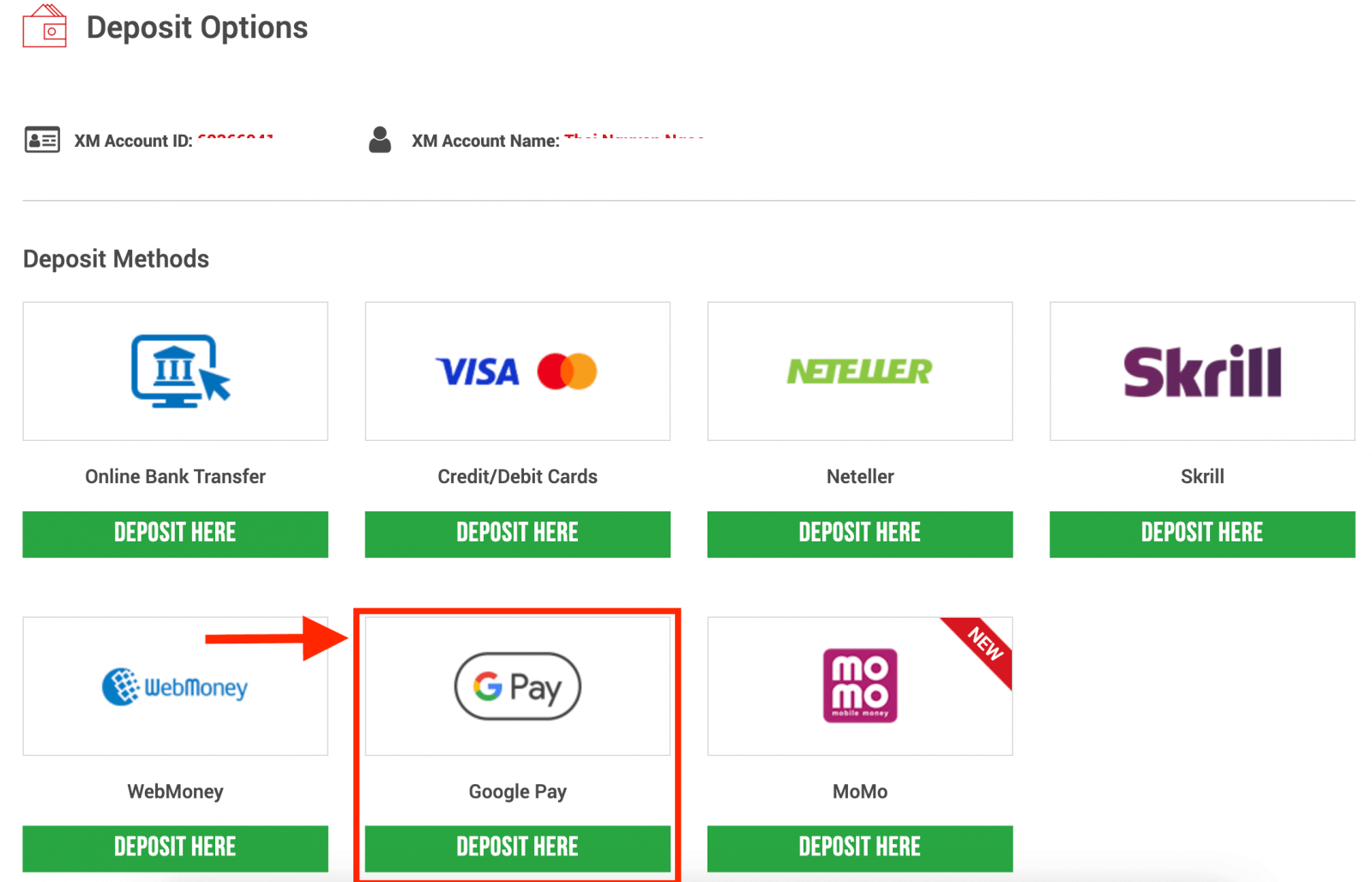

2. Select the deposit method “Google Pay”

NOTE: Before you proceed with a deposit via Google Pay, please note the following:

- Please make sure that all payments are made from an account registered in the same name as your XM account.

- Please note that Google Pay deposits are non-refundable.

- XM does not charge any commissions or fees for deposits via Google Pay.

- The maximum monthly limit is USD 10,000.

- By submitting a deposit request, you consent to your data being shared with third parties, including payment service providers, banks, card schemes, regulators, law enforcement, government agencies, credit reference bureaus and other parties we deem necessary to process your payment and/or verify your identity.

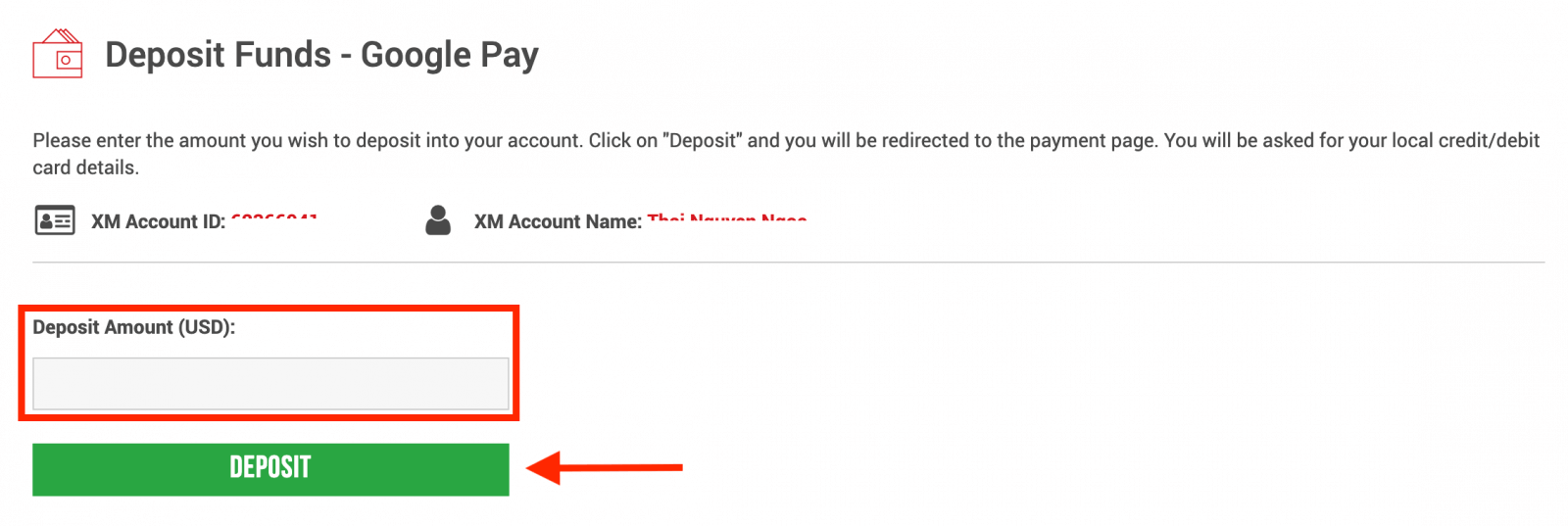

3. Enter the deposit amount and click "Deposit"

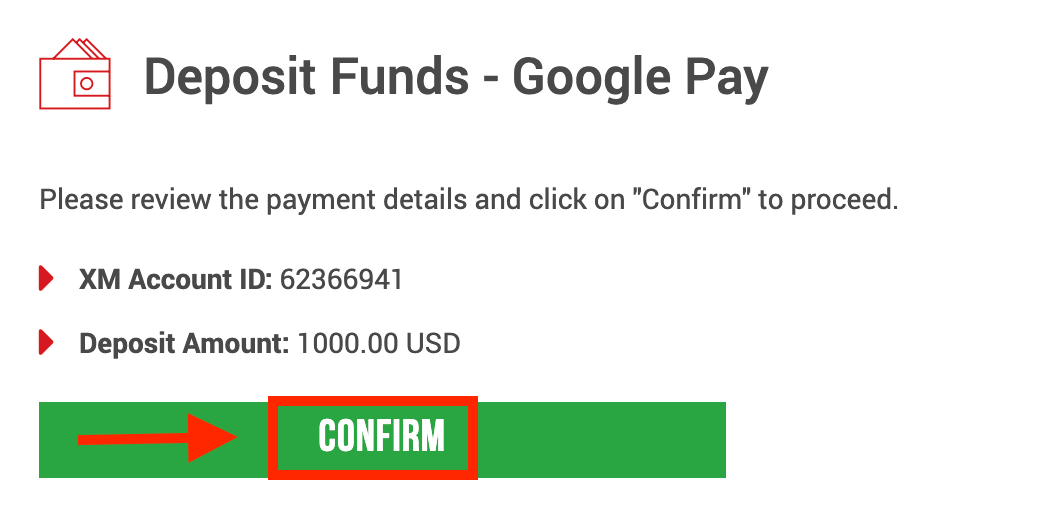

4. Confirm the account ID and deposit amount

Click on "Confirm" to proceed.

5. Enter all the required information to finish the Deposit

How to Trade Forex on XM

What is Forex Trading?

Forex trading, also known by the name of currency trading or FX trading, refers to buying a particular currency while selling another in exchange. Trading currencies always involves exchanging one currency for another.The ultimate aim can vary and can be any of the below but not limited to the below:

2. Exchanging currency A (e.g. USD) to currency B (e.g. EUR) for trading purposes;

3. Exchanging currency A (e.g. USD) to currency B (e.g. EUR) for speculative purposes, to make a profit.

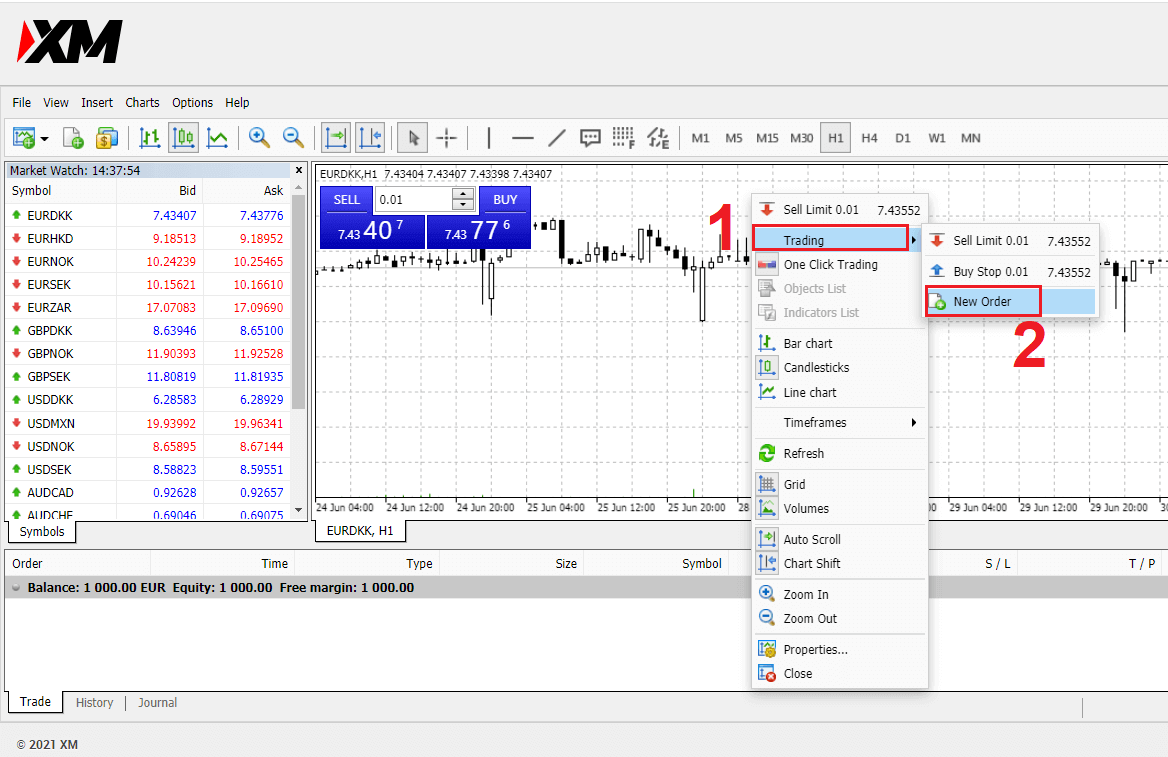

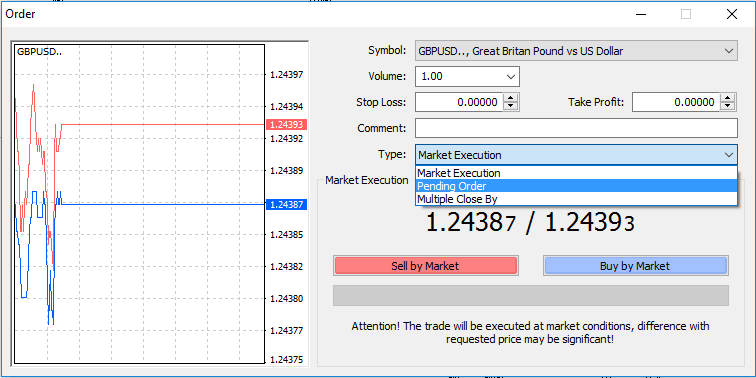

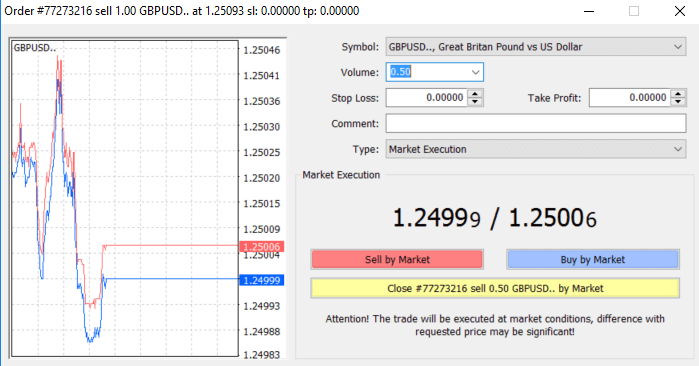

How to place a New Order in XM MT4

Right-click the chart, Then click “Trading" → select “New Order".Or

Double-click on the currency you want to place an order on MT4. The Order window will appear.

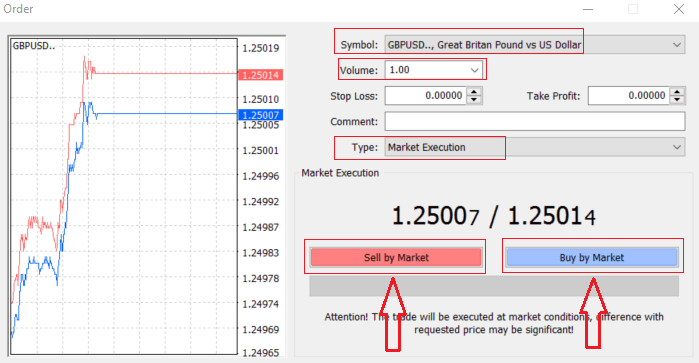

Symbol: check the Currency symbol you wish to trade is displayed in the symbol box

Volume: you must decide the size of your contract, you can click on the arrow and choose the volume from the listed options of the drop-down box or left-click in the volume box and type in the required value

- Micro Account: 1 Lot = 1,000 units

- Standard Account: 1 Lot = 100,000 units

- XM Ultra Account :

- Standard Ultra: 1 Lot = 100,000 units

- Micro Ultra: 1 Lot = 1,000 units

- Shares Account :1 share

- Micro Account: 0.1 Lots (MT4), 0.1 Lots (MT5)

- Standard Account: 0.01 Lots

- XM Ultra Account :

- Standard Ultra: 0.01 Lots

- Micro Ultra: 0.1 Lots

- Shares Account :1 Lot

Comment: this section is not obligatory but you can use it to identify your trades by adding comments

Type: which is set to market execution by default,

- Market Execution is the model of executing orders at the current market price

- A Pending Order is used to set a future price that you intend to open your trade.

Finally, you need to decide what order type to open, you can choose between a sell and a buy order.

Sell by Market is opened at the bid price and closed at the asking price, in this order type your trade may bring profit if the price goes down.

Buy by Market is opened at the ask price and closed at the bid price, in this order type your trade may bring profit It the price goes up.

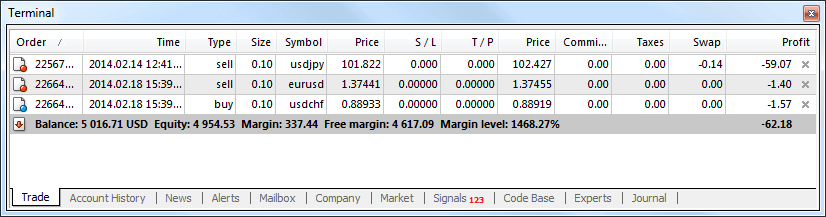

Once you click on either Buy or Sell, your order will be instantly processed, and you can check your order in the Trade Terminal.

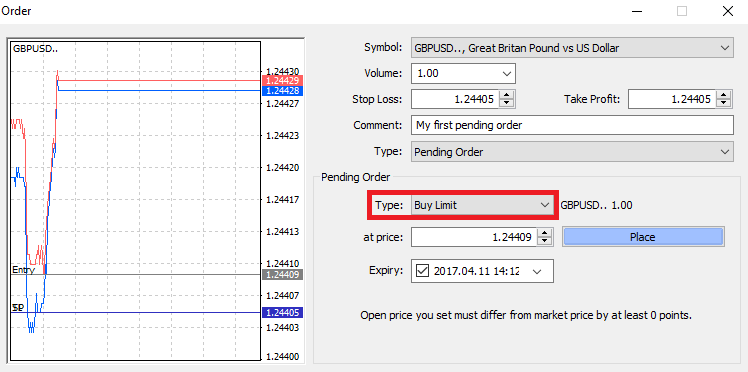

How to place a Pending Orders

How Many Pending Orders in XM MT4

Unlike instant execution orders, where a trade is placed at the current market price, pending orders allow you to set orders that are opened once the price reaches a relevant level, chosen by you. There are four types of pending orders available, but we can group them into just two main types:- Orders expecting to break a certain market level

- Orders are expected to bounce back from a certain market level

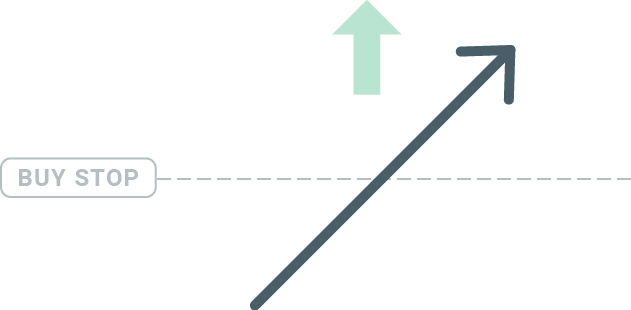

Buy Stop

The Buy Stop order allows you to set a buy order above the current market price. This means that if the current market price is $20 and your Buy Stop is $22, a buy or long position will be opened once the market reaches that price.

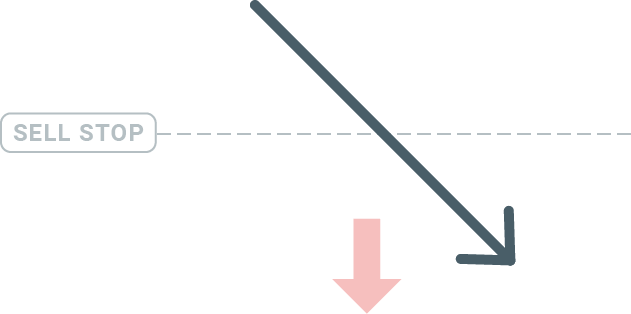

Sell Stop

The Sell Stop order allows you to set a sell order below the current market price. So if the current market price is $20 and your Sell Stop price is $18, a sell or ‘short’ position will be opened once the market reaches that price.

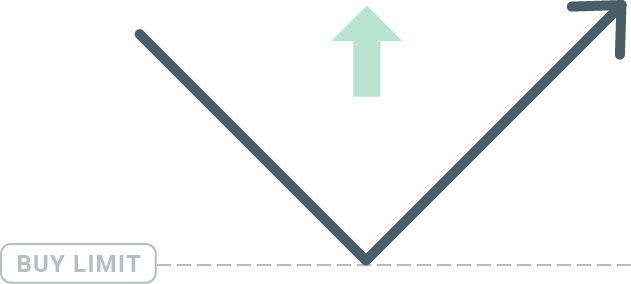

Buy Limit

The opposite of a buy stop, the Buy Limit order allows you to set a buy order below the current market price. This means that if the current market price is $20 and your Buy Limit price is $18, then once the market reaches the price level of $18, a buy position will be opened.

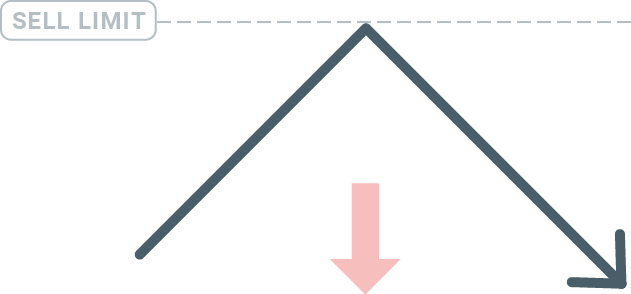

Sell Limit

Finally, the Sell Limit order allows you to set a sell order above the current market price. So if the current market price is $20 and the set Sell Limit price is $22, then once the market reaches the price level of $22, a sell position will be opened on this market.

Opening Pending Orders

You can open a new pending order simply by double-clicking on the name of the market on the Market Watch module. Once you do so, the new order window will open and you will be able to change the order type to Pending order.

Next, select the market level at which the pending order will be activated. You should also choose the size of the position based on the volume.

If necessary, you can set an expiration date (‘Expiry’). Once all these parameters are set, select a desirable order type depending on whether you would like to go long shortstop, or limit, and select the ‘Place’ button.

As you can see, pending orders are very powerful features of MT4. They are most useful when you’re not able to constantly watch the market for your entry point, or if the price of an instrument changes quickly, and you don’t want to miss the opportunity.

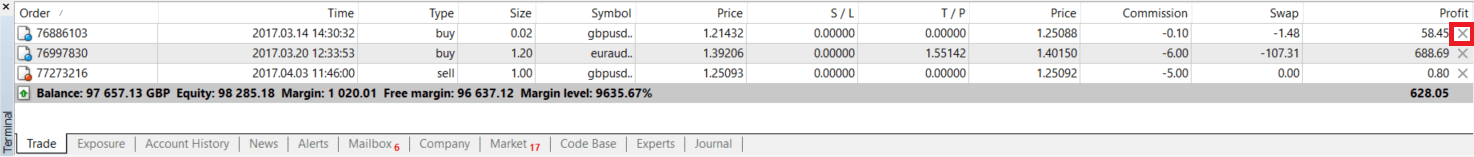

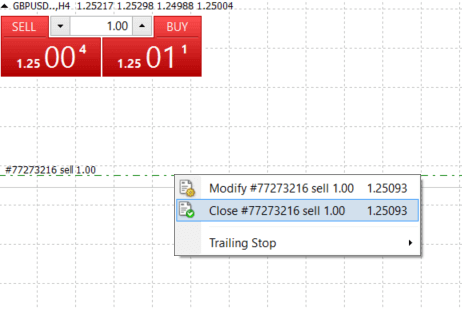

How to close Orders in XM MT4

To close an open position, click the ‘x’ in the Trade tab in the Terminal window.

Or right-click the line order on the chart and select ‘close’.

If you’d like to close only a part of the position, click right-click on the open order and select ‘Modify’. Then, in the Type field, select instant execution and choose what part of the position you want to close.

As you can see, opening and closing your trades on MT4 is very intuitive, and it literally takes just one click.

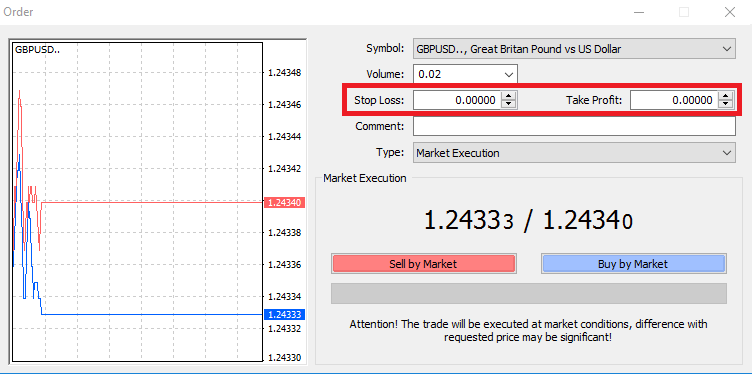

Using Stop Loss, Take Profit, and Trailing Stop in XM MT4

One of the keys to achieving success in financial markets over the long term is prudent risk management. That’s why stopping losses and taking profits should be an integral part of your trading.So let’s have a look at how to use them on our MT4 platform to ensure you know how to limit your risk and maximize your trading potential.

Setting Stop Loss and Take Profit

The first and the easiest way to add Stop Loss or Take Profit to your trade is by doing it right away when placing new orders.

To do this, simply enter your particular price level in the Stop Loss or Take Profit fields. Remember that Stop Loss will be executed automatically when the market moves against your position (hence the name: stop losses), and Take Profit levels will be executed automatically when the price reaches your specified profit target. This means that you’re able to set your Stop Loss level below the current market price and Take Profit level above the current market price.

It’s important to remember that a Stop Loss (SL) or a Take Profit (TP) is always connected to an open position or a pending order. You can adjust both once your trade has been opened and you’re monitoring the market. It’s a protective order to your market position, but of course, they are not necessary to open a new position. You always can add them later, but we highly recommend always protecting your positions*.

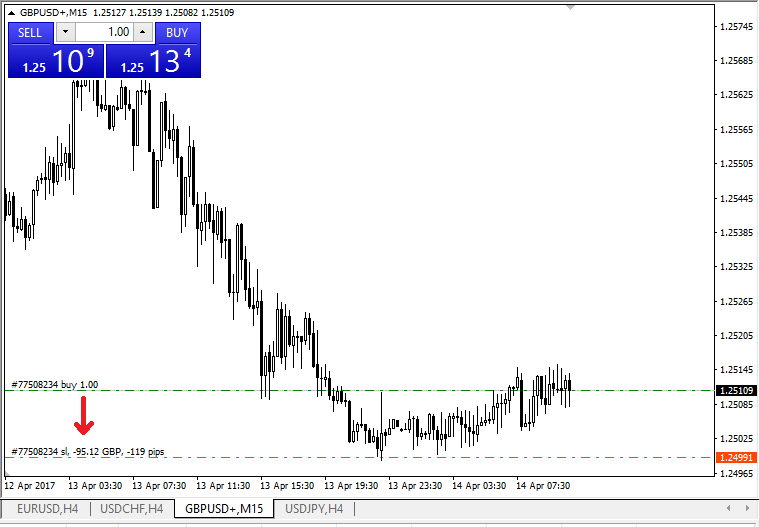

Adding Stop Loss and Take Profit Levels

The easiest way to add SL/TP levels to your already opened position is by a using trade line on the chart. To do so, simply drag and drop the trade line up or down to a specific level.

Once you’ve entered SL/TP levels, the SL/TP lines will appear on the chart. This way you can also modify SL/TP levels simply and quickly.

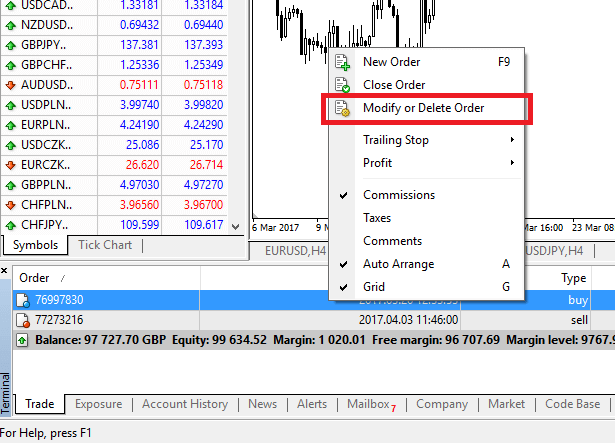

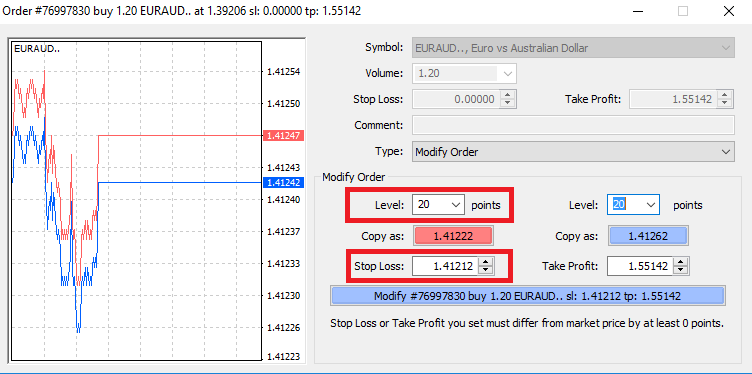

You can also do this from the bottom ‘Terminal’ module as well. To add or modify SL/TP levels, simply right-click on your open position or pending order, and choose ‘Modify or delete order’.

The order modification window will appear and now you’re able to enter/modify SL/TP by the exact market level, or by defining the points range from the current market price.

Trailing Stop

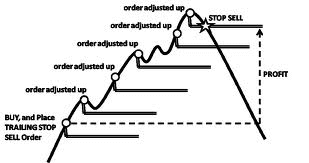

Stop Losses are intended for reducing losses when the market moves against your position, but they can help you lock in your profits as well.While that may sound a bit counterintuitive at first, it’s actually very easy to understand and master.

Let’s say you’ve opened a long position and the market moves in the right direction, making your trade a profitable one at present. Your original Stop Loss, which was placed at a level below your open price, can now be moved to your open price (so you can break even) or above the open price (so you are guaranteed a profit).

To make this process automatic, you can use a Trailing Stop. This can be a really useful tool for your risk management, particularly when price changes are rapid or when you’re unable to constantly monitor the market.

As soon as the position turns profitable, your Trailing Stop will follow the price automatically, maintaining the previously established distance.

Following the example above, please bear in mind, however, that your trade needs to be running a profit large enough for the Trailing Stop to move above your open price before your profit can be guaranteed.

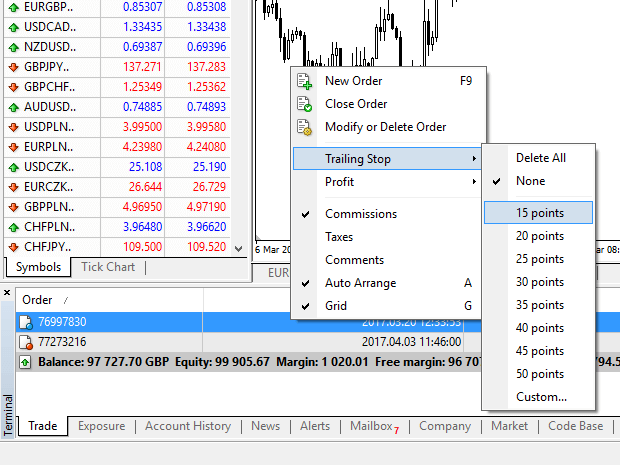

Trailing Stops (TS) are attached to your opened positions, but it’s important to remember that if you have a trailing stop on MT4, you need to have the platform open for it to be successfully executed.

To set a Trailing Stop, right-click the open position in the ‘Terminal’ window and specify your desired pip value of the distance between the TP level and the current price in the Trailing Stop menu.

Your Trailing Stop is now active. This means that if prices change to the profitable market side, TS will ensure the stop loss level follows the price automatically.

Your Trailing Stop can easily be disabled by setting ‘None’ in the Trailing Stop menu. If you want to quickly deactivate it in all opened positions, just select ‘Delete All’.

As you can see, MT4 provides you with plenty of ways to protect your positions in just a few moments.

*Whilst Stop Loss orders are one of the best ways to ensure your risk is managed and potential losses are kept to acceptable levels, they don’t provide 100% security.

Stop losses are free to use and they protect your account against adverse market moves, but please be aware that they cannot guarantee your position every time. If the market becomes suddenly volatile and gaps beyond your stop level (jumps from one price to the next without trading at the levels in between), it’s possible your position could be closed at a worse level than requested. This is known as price slippage.

Guaranteed stop losses, which have no risk of slippage and ensure the position is closed out at the Stop Loss level you requested even if a market moves against you, are available for free with a basic account.

How to Withdraw Money from XM

Withdraw Money from XM

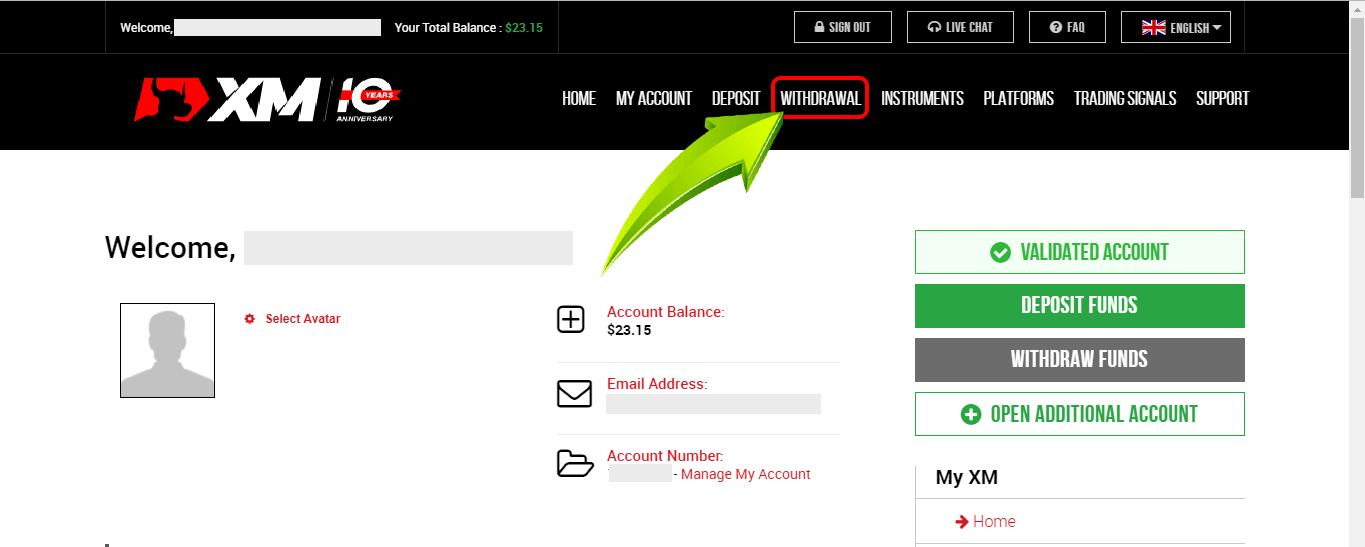

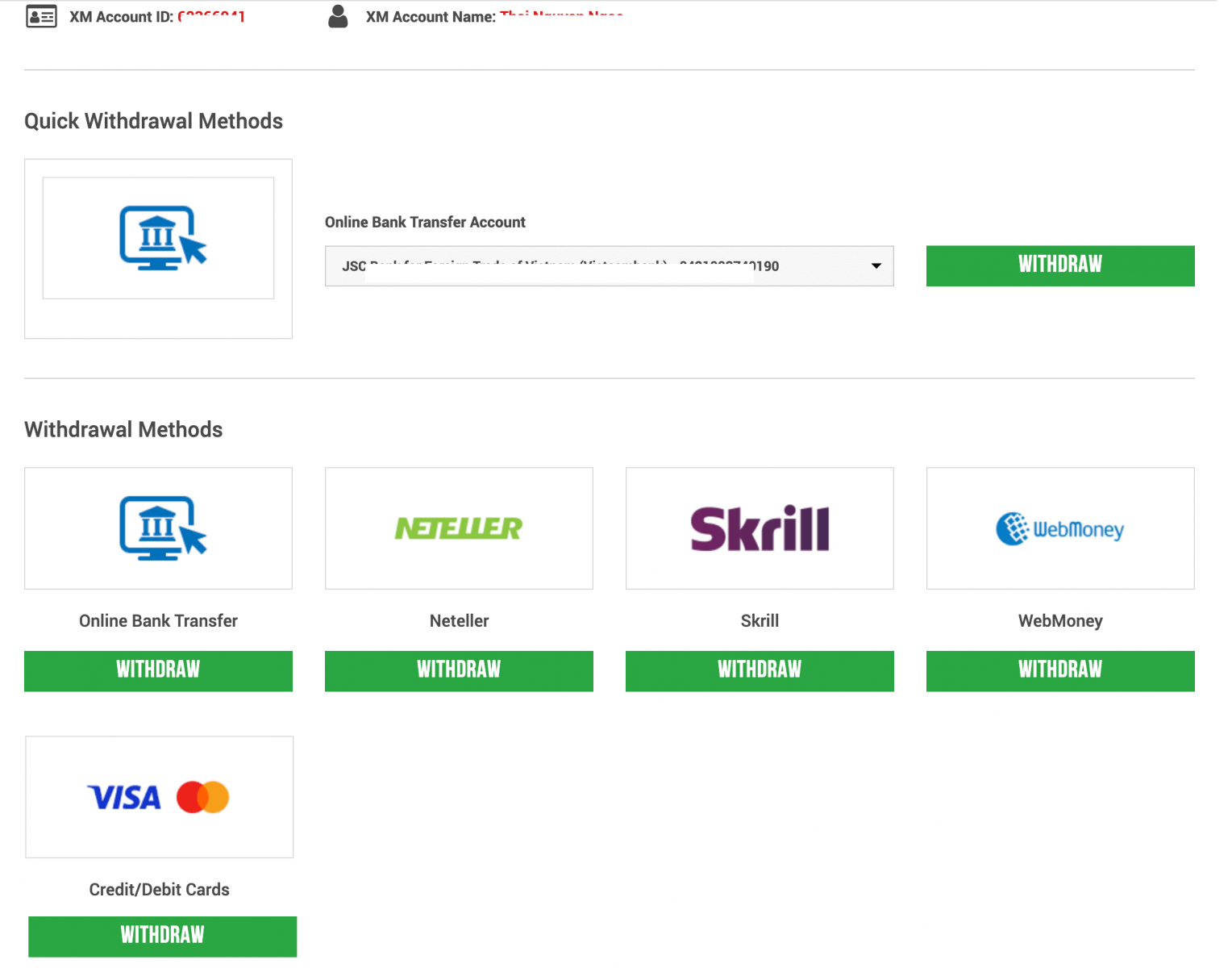

1/ Click the “Withdrawal” button on the My Account pageAfter logging in to My XM Group account, click “Withdrawal” on the menu.

2/ Select Withdrawal options

Please note the following:

- We strongly suggest that you submit withdrawal requests after closing your positions.

- Please note that XM does accept withdrawal requests for trading accounts with open positions; however, to ensure the safety of our clients’ trades the following restrictions apply:

a) Requests which would cause the margin level to drop below 150% will not be accepted from Monday 01:00 to Friday 23:50 GMT+2 (DST applies).

b) Requests which could cause the margin level to drop below 400% will not be accepted during weekends, from Friday 23:50 to Monday 01:00 GMT+2 (DST applies).

- Please note that any withdrawal of funds from your trading account will result in the proportional removal of your trading bonus.

Credit/Debit cards can be withdrawn up to the deposit amount.

After withdrawing up to the amount deposited, you can choose to withdraw the remaining amount using whichever method you like.

For example: You deposit 1000 USD into your credit card, and you make a profit of 1000 USD after trading. If you want to withdraw money, you have to withdraw 1000 USD or the amount deposited using a credit card, the remaining 1000 USD you can withdraw by other methods.

| Deposit methods | Possible withdrawal methods |

|---|---|

| Credit/ Debit Card | Withdrawals will be processed up to the amount deposited by credit/ debit card. The remaining amount can be withdrawn via other methods |

| NETELLER/ Skrill/ WebMoney | Choose your withdrawal method other than credit or debit card. |

| Bank Transfer | Choose your withdrawal method other than credit or debit card. |

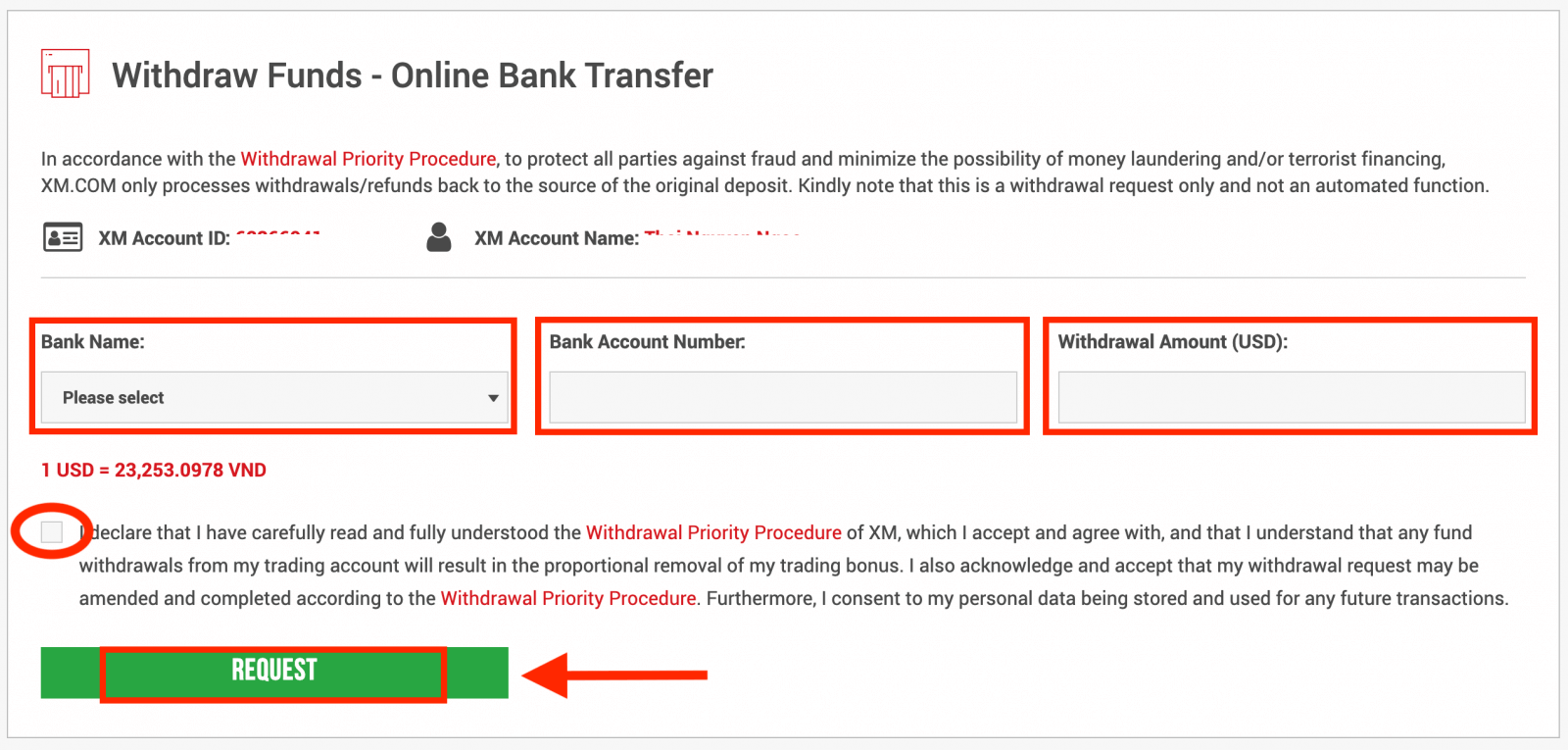

3/ Enter the amount you wish to withdraw and submit the request

For example: you choose "Bank Transfer", then select the Bank Name, enter Bank Account Number and the amount you wish to withdraw.

Click “Yes” to agree to the preferred withdrawal procedure, then click “Request”.

Thus, the withdrawal request has been submitted.

The withdrawal amount will be automatically deducted from your trading account. Withdrawal requests from XM Group will be processed within 24 hours (except Saturday, Sunday, and public holidays)

| Withdrawal methods | Withdrawal fees | Minimum withdrawal amount | Processing time |

|---|---|---|---|

| Credit/ Debit Card | Free | 5 USD ~ | 2-5 working days |

| NETELLER/ Skrill/ WebMoney | Free | 5 USD ~ | 24 working hours |

| Bank Transfer | XM covers all transfer fees | 200 USD ~ | 2-5 working days |

Disclaimers

XMP (bonus) that has been redeemed will be removed entirely even if you only withdraw 1 USD

At XM, a client can open up to 8 accounts.

Therefore, it is possible to prevent the removal of the entire XMP (bonus) by opening another account, transferring the investment amount to this account, and using it to withdraw money.

What payment options do I have to withdraw money?

We offer a wide range of payment options for deposits/withdrawals: by multiple credit cards, multiple electronic payment methods, bank wire transfer, local bank transfer, and other payment methods.As soon as you open a trading account, you can log in to our Members Area, select a payment method of your preference on the Deposits/Withdrawal pages, and follow the instructions given.

What is the minimum and maximum amount that I can withdraw?

The minimum withdrawal amount is 5 USD (or equivalent denomination) for multiple payment methods supported in all countries. However, the amount varies according to the payment method you choose and your trading account validation status. You can read more details about the deposit and withdrawal process in the Members Area.Frequently Asked Questions (FAQs)

Verification

Why do I need to submit my documents for account validation?

As a regulated company, we operate by several compliance-related issues and procedures imposed by our main regulatory authority, IFSC. These procedures involve the collection of adequate documentation from our clients with regards to KYC (Know Your Client), including the collection of a valid ID card and a recent (within 6 months) utility bill or bank account statement that confirms the address the client has registered with.

Do I need to upload my documents again if I open a new trading account and my first account has already been validated?

No, your new account will be validated automatically, as long as you will use the same personal contact details as for your previous account.

Can I update my personal information?

If you wish to update your email address, please send an email to [email protected] from your registered email address.

If you wish to update your residential address, please send an email to [email protected] from your registered email address and upload the POR (not older than 6 months) confirming that address in the Members Area.

Deposit

What paymffent options do I have for depositing/withdrawing money?

We offer a wide range of payment options for deposits/withdrawals: by multiple credit cards, multiple electronic payment methods, bank wire transfer, local bank transfer, and other payment methods.As soon as you open a trading account, you can log in to our Members Area, select a payment method of your preference on the Deposits/Withdrawal pages, and follow the instructions given.

In which currencies can I deposit money into my trading account?

You can deposit money in any currency and it will be automatically converted into the base currency of your account, by XM’s prevailing inter-bank price.

What is the minimum and maximum amount that I can deposit/withdraw?

The minimum deposit/withdrawal amount is 5 USD (or equivalent denomination) for multiple payment methods supported in all countries. However, the amount varies according to the payment method you choose and your trading account validation status. You can read more details about the deposit and withdrawal process in the Members Area.

How long does it take for funds to reach my bank account?

It depends on the country the money is sent to. Standard bank wire within the EU takes 3 working days. Bank wires to some countries may take up to 5 working days.

How long does the deposit/withdrawal take by credit card, e-wallet, or any other payment method?

All deposits are instant, except for the bank wire transfer. All withdrawals are processed by our back office within 24 hours on business days.

Are there any deposit/withdrawal fees?

We do not charge any fees for our deposit/withdrawal options. For instance, if you deposit USD 100 by Skrill and then withdraw USD 100, you will see the full amount of USD 100 in your Skrill account as we cover all transaction fees both ways for you.This also applies to all credit/debit card deposits. For deposits/withdrawals via international bank wire transfer, XM covers all transfer fees imposed by our banks, except deposits amounting to less than 200 USD (or equivalent denomination).

If I deposit funds by e-wallet, can I withdraw money to my credit card?

To protect all parties against fraud and in compliance with the applicable laws and regulations for the prevention and suppression of money laundering, our company’s policy is to return the client’s funds to the origin of these funds, and as such the withdrawal will be returned to your e-wallet account. This applies to all withdrawal methods, and the withdrawal has to go back to the source of the funds deposit.Trading

How Does Forex Trading Work?

Forex trading is in essence trading currencies for one another. As such, an XM client sells one currency against another at a current market rate.To be able to trade, it is required to open an account and hold currency A and then exchange currency A for currency B either for a long-term or a short-term trade, with the ultimate goal varying accordingly.

Since FX trading is performed on currency pairs (i.e., the quotation of the relative value of one currency unit against another currency unit), the first currency is the so-called base currency, while the second currency is called the quote currency.

For example, the quotation EUR/USD 1.2345 is the price of the euro expressed in US dollars, which means that 1 euro equals 1.2345 US dollars.

Currency trading can be carried out 24 hours a day, from 22.00 GMT on Sunday until 22.00 GMT on Friday, with currencies traded among the major financial centers of London, New York, Tokyo, Zürich, Frankfurt, Paris, Sydney, Singapore and Hong Kong.

What Influences Prices in Forex Trading?

There is an endless number of factors that all contribute to and influence the prices in forex trading (i.e. currency rates) daily, but it could be safe to say that there are 6 major factors that contribute the most and are more or less the main driving forces for forex trading price fluctuation:

2. Differentials in interest rates

3. Current account deficits

4. Public debt

5. Terms of trade

6. Political and economic stability

To best comprehend the above 6 factors, you will have to keep in mind that currencies are traded against one another. So when one falls, another one rises as the price denomination of any currency is always stated against another currency.

What is Forex Trading Software?

Forex trading software is an online trading platform provided to each XM client, which allows them to view, analyze, and trade currencies, or other asset classesIn simple terms, each XM client is provided access to a trading platform (i.e. software) that is directly connected to the global market price feed and allows them to perform transactions without the help of a third party.

Who are Forex Trading Market Participants?

Forex trading market participants can fall in any of the following categories:

1. Travellers or overseas consumers who exchange money to travel overseas or purchase goods from overseas.

2. Businesses that purchase raw materials or goods from overseas and need to exchange their local currency for the currency of the country of the seller.

3. Investors or speculators who exchange currencies, which either require a foreign currency, to perform trading in equities or other asset classes from overseas or are trading currencies to make a profit from market changes.

4. Banking institutions that exchange money to service their clients or to lend money to overseas clients.

5. Governments or central banks that either buy or sell currencies and try to adjust financial imbalances, or adjust economic conditions.

What is Important in Forex Trading?

As a retail foreign exchange trader, the most important factors that affect your trading are trade execution quality, speed,d, and spreads. One affects the other.A spread is the difference between the bid and the ask price of a currency pair (buy or sell price), and so to make it even easier it is the price at which your broker or bank is willing to sell or buy your requested trade order. Spreads, however, only matter with the correct execution.

In the forex trading marketplace, when we refer to execution we mean the speed at which a foreign exchange trader can actually buy or sell what they see on their screen or what they are quoted as bid/ask price over the phone. A good price makes no sense if your bank or broker cannot fill your order fast enough to get that bid/ask price.

What are Majors in Forex Trading?

In forex trading, some currency pairs are nicknamed majors (major pairs). This category includes the most traded currency pairs and they always include the USD on one side.Major pairs include: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, NZD/USD

What are Minors in Forex Trading?

In forex trading, minor currency pairs or crosses are all currency pairs that do not include the USD on one side.

What are Exotics in Forex Trading?

In forex trading, exotic pairs include the less traded currency pairs that include a major currency paired with the currency of a smaller or emerging economy. These pairs usually have less volatility, and less liquidity and do not present the dynamic behavior of major pairs and crosses.

Advantages of Forex Trading with XM

- 55+ currency pairs - majors, crosses, and exotics

- 24 hours a day, 5 days a week

- Leverage up to 888:1

- Tight spreads and NO re-quotes

- Trade the most liquid market in the world

- Trade with NO hidden charges

Withdrawal

What is the withdrawal priority procedure?

To protect all parties against fraud and minimize the possibility of money laundering and/or terrorist financing, XM will only process withdrawals/refunds back to the source of the original deposit according to the Withdrawal Priority Procedure below:- Credit/debit card withdrawals. Withdrawal requests submitted, regardless of the withdrawal method chosen, will be processed via this channel up to the total amount deposited by this method.

- E-wallet withdrawals. E-wallet refunds/withdrawals will be processed once all Credit/Debit card deposits have been completely refunded.

- Other Methods. All other methods such as bank wire withdrawals shall be used once deposits made with the above two methods have been completely exhausted.

All withdrawal requests will be completed within 24 working hours; however, all withdrawal requests submitted will be instantly reflected in the clients’s trading accounts as pending withdrawals. In case a client selects an incorrect withdrawal method, the client’s request will be processed according to the Withdrawal Priority Procedure described above.

All client withdrawal requests shall be processed in the currency in which the deposit was originally made. Should the deposit currency differ from the transfer currency, the transfer amount will be converted by XM into the transfer currency at the prevailing exchange rate.

How can I withdraw if my withdrawal amount exceeds the amount I deposited via credit/debit card?

Since we can only transfer the same amount back to your card as the amount you have deposited, profits can be transferred to your bank account via wire transfer. If you have also made deposits via E-wallet, you also have the option to withdraw profits to that same E-wallet.

How long does it take to receive my money after I make a withdrawal request?

Your withdrawal request is processed by our back office within 24 hours. You will receive your money on the same day for payments made via e-wallet, while for payments by bank wire or credit/debit card, it usually takes 2 - 5 business days.

Can I withdraw my money whenever I want?

To withdraw funds, your trading account must be validated. This means that first, you need to upload your documents in our Members Area: Proof of Identity (ID, passport, driving license) and Proof of Residency (utility bill, telephone/Internet/TV bill, or bank statement), which include your address and your name and can’t be older than 6 months.Once you receive confirmation from our Validation Department that your account has been validated, you can request the fund’s withdrawal by logging in to the Members Area, selecting the Withdrawal tab, and sending us a withdrawal request. It is only possible to send your withdrawal back to the original source of deposit. All withdrawals are processed by our Back Office within 24 hours on business days.

Are there any withdrawal fees?

We do not charge any fees for our deposit/withdrawal options. For instance, if you deposit USD 100 by Skrill and then withdraw USD 100, you will see the full amount of USD 100 in your Skrill account as we cover all transaction fees both ways for you.

This also applies to all credit/debit card deposits. For deposits/withdrawals via international bank wire transfer, XM covers all transfer fees imposed by our banks, except for deposits amounting to less than 200 USD (or equivalent denomination).

If I deposit funds by e-wallet, can I withdraw money to my credit card?

To protect all parties against fraud and in compliance with the applicable laws and regulations for the prevention and suppression of money laundering, our company’s policy is to return clients’s funds to the origin of these funds, and as such the withdrawal will be returned to your e-wallet account. This applies to all withdrawal methods, and the withdrawal has to go back to the source of the funds deposit.

What is MyWallet?

It is a digital wallet, in other words, a central location where all the funds clients earn from various XM programs are stored.From MyWallet, you can manage and withdraw funds to the trading account of your choice and view your transaction history.

When transferring funds to an XM trading account, MyWallet is treated as any other payment method. You will still be eligible to receive deposit bonuses under the terms of the XM Bonus Program. For more information, click here.

Can I withdraw funds directly from MyWallet?

No. You must first send funds to one of your trading accounts before you can withdraw them.I am looking for a specific transaction in MyWallet, how can I find it?

You can filter your transaction history by ‘Transaction Type’, ‘Trading Account’, and ‘Affiliate ID’ using the dropdowns in your dashboard. You can also sort transactions by ‘Date’ or ‘Amount’, in ascending or descending order, by clicking on their respective column headers.

Can I deposit to/withdraw from my friend’s/relative’s account?

As we are a regulated company, we do not accept deposits/withdrawals made by third parties. Your deposit can only be made from your own account, and the withdrawal has to go back to the source where the deposit was made.

If I withdraw money from my account, can I also withdraw the profit made with the bonus? Can I withdraw the bonus at any stage?

The bonus is for trading purposes only, and cannot be withdrawn. We offer you the bonus amount to help you open larger positions and allow you to hold your positions open for a longer period. All profits made with the bonus can be withdrawn at any time.

Is it possible to transfer money from one trading account to another trading account?

Yes, this is possible. You can request an internal transfer between two trading accounts, but only if both accounts have been opened under your name and if both trading accounts have been validated. If the base currency is different, the amount will be converted. Internal transfer can be requested in the Members Area, and it is instantly processed.

What will happen to the bonus if I use internal transfer?

In this case, the bonus will be credited proportionally.

I used more than one deposit option, how can I withdraw now?

If one of your deposit methods has been a credit/debit card, you always need to request a withdrawal up to the deposit amount, as before any other withdrawal method. Only in case that amount deposited via credit/debit card is fully refunded back to the source, you may select another withdrawal method, according to your other deposits.

Are there any extra fees and commissions?

At XM we do not charge any fees or commissions. We cover all transaction fees (with bank wire transfers for amounts over 200 USD).

Conclusion: Embark on Your XM Trading Journey with Confidence

Starting your XM trading journey requires careful planning and continuous learning. By following this step-by-step guide, beginners can build a strong foundation and navigate the financial markets with confidence.

Remember, successful trading involves patience, discipline, and a willingness to learn.